From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends Drive European Steel Market Confidence Amid Regulatory Changes

Recent shifts in Europe’s steel market indicate a positive sentiment, with satellite-observed data showing enhancements in plant activity levels following notable regulatory developments. The article titled As EU waters down 2035 EV goals, electric startups express concern aligns with observed plant activities, as the revised energy policies prompted varying responses within the sector.

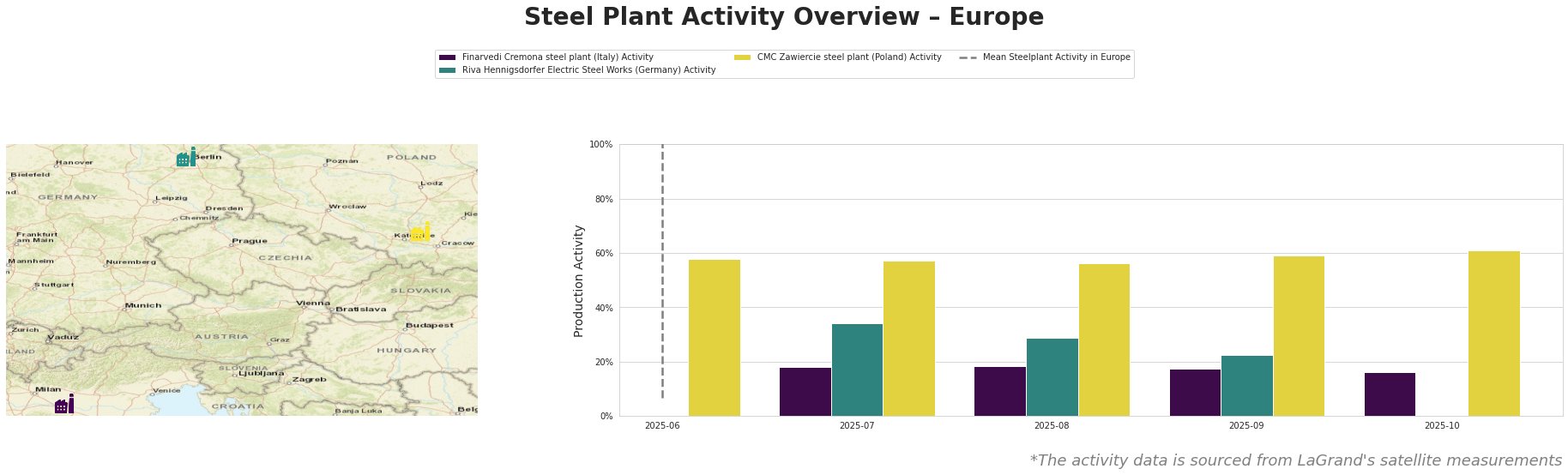

The Finarvedi Cremona plant, focused on electric arc furnace (EAF) technology, has maintained low activity levels, averaging 18% in July and August, reflecting a gradual decline to 16% by October. These dips could be linked to uncertainties stemming from the EU’s regulatory atmosphere but do not directly correlate to any specific article.

Riva Hennigsdorfer Electric Steel Works exhibited higher activity, peaking at 34% in July before tapering off. Such fluctuations may partially relate to the anticipated demand shifts indicated in the Viewpoint: EU crop biodiesel demand set to rise in 2026, as increased biodiesel requirements could indirectly boost steel production for automotive applications.

Meanwhile, CMC Zawiercie has shown consistent activity improvements, advancing from 57% in July to 61% in October, indicative of robust market demand, possibly enhanced by the EU’s positive signalling around energy production resilience and local sourcing incentives.

The manufacturing outlook seems buoyed by EV policy adaptations and biomass regulations, potentially favoring a rebound in steel demand driven by automotive revitalizations. However, market players should remain alert to localized disruptions, especially from the Finarvedi Cremona plant, which could lag due to policy-induced uncertainties and sectoral pressures.

Potential procurement actions for buyers include:

– Monitor CMC Zawiercie closely, as rising activity levels suggest a growing supply capability stepping into 2026, potentially assuring timely deliveries amidst fluctuating demand.

– Engage with Riva Hennigsdorfer for steel supplies, as its established capacity aligns well with automotive manufacturing, supported by legislative shifts towards increased biodiesel usage that could uplift overall production.

For long-term strategies, it’s advisable to diversify suppliers based on each plant’s activity trends and responsiveness to regulatory changes, ensuring procurement resilience in the face of evolving market dynamics.