From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Sentiment in Europe Remains Neutral Amid Thyssenkrupp Production Cuts

Recent developments in the European steel market reflect a neutral sentiment characterized by significant production cuts announced by Thyssenkrupp Electrical Steel. These measures arise in response to a surge in low-priced imports, as reported in “Thyssenkrupp to cut GOES production in Germany and France amid import surge in EU“. Activity data observed via satellite corroborate these changes, signaling notable shifts across various plants.

Production cuts starting mid-December will affect the Gelsenkirchen and Isbergues plants, with the latter operating at only 50% capacity for an extended period. This operational scale-back has escalated concerns about job security for approximately 1,200 employees. The article notes a troubling triple increase in GOES imports into the EU since 2022, exacerbating challenges for local production capabilities.

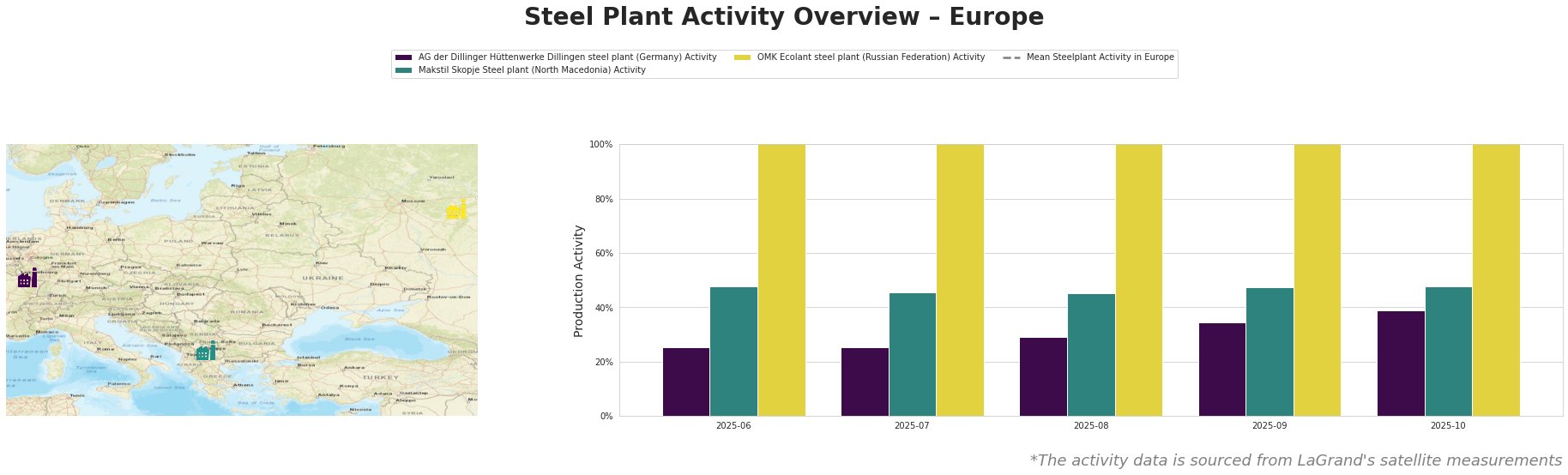

The overall mean activity across the observed European steel plants declined from 40.78% in June to 27.18% by October. Specifically, AG der Dillinger Hüttenwerke Dillingen exhibited stable but low activity levels, maintaining around 25-39%. In contrast, the Makstil Skopje plant displayed the highest activities ranging from 45.0% to 48.0% during this period. However, these levels remain critically low compared to historical benchmarks, indicating significant market distress and underutilization, though no explicit link to Thyssenkrupp’s cuts could be established.

AG der Dillinger Hüttenwerke operates through an integrated steel process, utilizing a blast furnace for its predominantly non-alloy structural steel products. This plant has seen variations in activity corresponding to broader market trends, though it significantly lags behind in activity despite the production interruptions at Thyssenkrupp. Conversely, Makstil Skopje, employing an electric arc furnace, continues to maintain relatively higher percentages but faces potential risks due to downstream fluctuations in demand exacerbated by competitive imports.

Evaluating prospective supply disruptions, Thyssenkrupp’s anticipated production decline could create ripple effects across local markets and increase supply-chain uncertainties for buyers dependent on GOES products. Steel procurement professionals should consider diversifying suppliers, including nations outside the EU, given the reduced output capability of European producers. Immediate procurement actions could involve evaluating contract terms with existing suppliers to build flexibility against continuing market volatility and repetition of recent trends in import competition.