From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Report: Activity Decline as Volkswagen Restructures Production

Amidst the evolving landscape of the European automotive and steel industries, significant restructuring actions by Volkswagen are influencing market dynamics. The core issue lies in Volkswagen’s manufacturing adjustments, specifically highlighted in the articles “Volkswagen shuts down factory in Germany for the first time in 88 years“ and “VW closes plant in Germany for first time“. These closures are leading to reduced demand for steel products, visible in satellite activity data from key European steel plants.

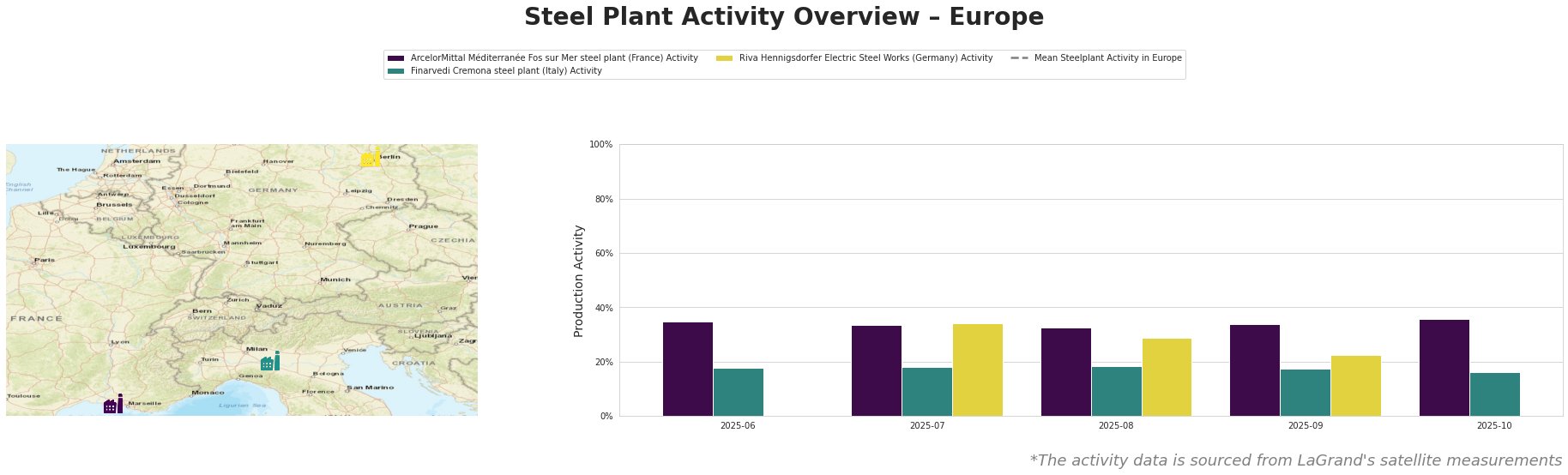

The satellite data reflects that the ArcelorMittal Méditerranée Fos sur Mer steel plant has maintained stable activity levels around 36.0% in October, with a notable activity rise in the previous months, aligning with existing demand. However, Finarvedi Cremona shows a decline, dropping to 16.0% by October following ongoing restructuring in the automotive sector. The Riva Hennigsdorfer facility exhibited fluctuations, peaking at 34.0% in July but then decreasing to 22.0% in September. These trends suggest responses to the falling demand exacerbated by Volkswagen’s production shutdown decisions.

The ArcelorMittal plant, with its integrated production processes, is more insulated from drastic activity drops compared to Finarvedi Cremona, which relies heavily on electric arc furnace technology. While restructuring at VW and declining demand for vehicles signal potential supply disruptions for steel products in sectors like automotive, Finarvedi’s reliance on fluctuating automotive demand means it may face tighter supply chain pressures.

As a procurement action, steel buyers should consider securing contracts with ArcelorMittal given its steadier output. In contrast, they should reevaluate partnerships with Finarvedi, where lower activity could result in longer lead times and sourcing challenges. Buyers are advised to closely monitor developments in the automotive space as adjustments from manufacturers could further influence steel procurement strategies. The outlook remains neutral; however, preparations for potential disruptions are prudent.