From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Sector Surges: JFE Investment & VISL Revival Fuel Optimism

India’s steel market is poised for significant growth, spurred by major investments and revitalization efforts. “JFE Steel to establish joint venture with India’s JSW worth $3.4 billion” directly correlates with expected increases in steel production capacity in Odisha. Separately, “India’s steel ministry prepares $448 million DPRs to revive defunct VISL steel mill” signals potential long-term supply increases catering to railway and defense sectors; however, current satellite data shows no immediate effect.

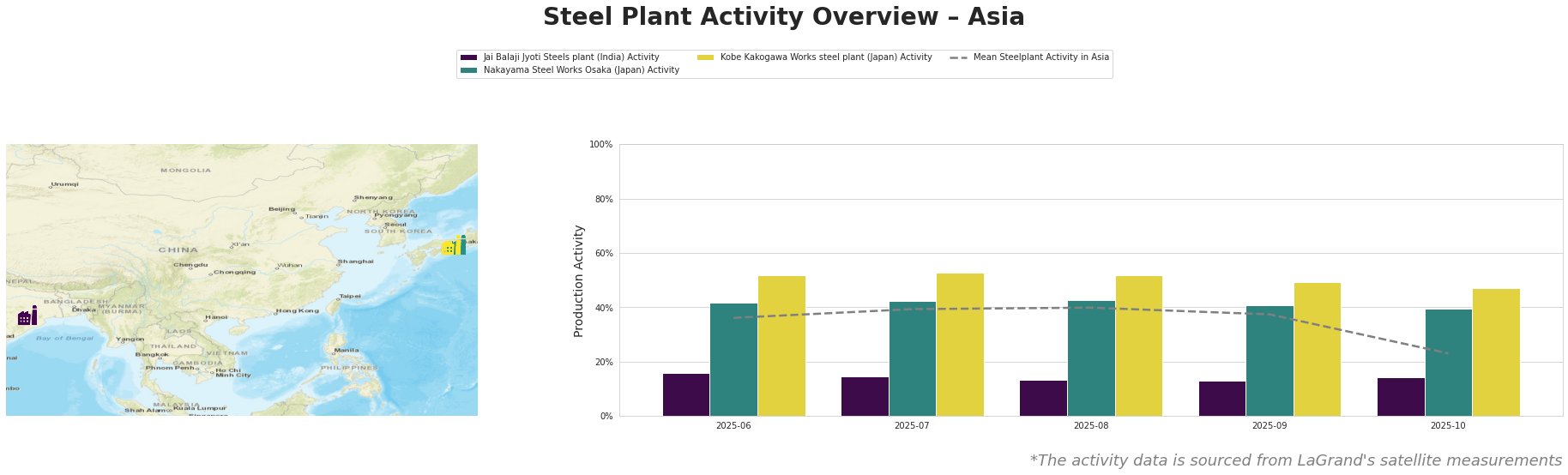

Recent monthly activity trends show some volatility:

The mean steel plant activity in Asia experienced a significant drop in October, falling to 23.0 from a high of 40.0 in August. Jai Balaji Jyoti Steels plant has remained consistently below the Asian mean, showing a slight increase to 14.0 in October after hitting a low of 13.0 in August and September. Nakayama Steel Works Osaka has remained above the mean, with activity hovering between 40.0 and 43.0. Kobe Kakogawa Works steel plant consistently shows the highest activity levels among the observed plants, peaking at 53.0 in July and dropping to 47.0 in October, which is still significantly above the Asian mean.

Jai Balaji Jyoti Steels plant in Odisha, India, operates with DRI and EAF technologies, focusing on crude, semi-finished, and finished rolled products, including DRI, billets, bars, wire rods, and iron ore, with a crude steel capacity of 92 ttpa. Despite its Responsible Steel Certification, the observed activity levels have been consistently low and below the Asian average, with a slight increase to 14.0% in October, after being at 13.0% for months. Currently, no direct connection can be established between these observed activity levels and the news articles provided.

Nakayama Steel Works Osaka in Kansai, Japan, focuses on electric steel production using EAF technology, producing coil, plate, bars, and wire rods for building, energy, and transport sectors, with a crude steel capacity of 660 ttpa. The plant has maintained a relatively stable activity level, fluctuating between 40.0% and 43.0%. This stability doesn’t appear directly linked to any of the provided news articles.

Kobe Kakogawa Works steel plant, also in Kansai, Japan, operates as an integrated BF-BOF plant with a large crude steel capacity of 6,000 ttpa, producing plates, sheets, and wire rods for automotive, building, machinery, and transport sectors. Its activity has been the highest among the observed plants, but declined to 47.0% in October. No direct connection can be established between this decline and the provided news articles.

Evaluated Market Implications:

The “JFE Steel to establish joint venture with India’s JSW worth $3.4 billion” and “Japan’s JFE Steel to invest $1.75 billion in JV with JSW Steel to run BPSL mill” articles clearly signal a significant expansion of steel production in the Odisha region of India, specifically through JSW Kalinga Steel Limited (formerly BPSL). Given the planned increase in crude steel production capacity from 4.5 million mt per year to 10 million mt per year by 2030, steel buyers should anticipate increased availability of steel coils, sheets, bars, and wire rods from this region in the medium to long term.

Recommended Procurement Actions:

- Steel Buyers focused on India: Given the JFE/JSW investment targeted for completion by June, buyers should begin building relationships with JSW Kalinga Steel Limited, as emphasized in the “Integrated Steel Plant Joint Venture with JSW Steel in India” news article. Negotiate supply contracts to secure favorable pricing and volumes in anticipation of increased production.

- Steel Analysts: Closely monitor the progress of the JFE/JSW joint venture, particularly regulatory approvals from the Competition Commission of India. Track production output from JSW Kalinga Steel Limited against the stated target of 10 million mt per year by 2030.