From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Activity Resilient Despite Geopolitical Uncertainty

Ukraine’s steel sector demonstrates surprising resilience amid regional tensions, with satellite data showing stable to increasing activity at key plants, even as German political discussions reflect anxieties about the broader conflict as highlighted in “Liveblog Bundespolitik: Bundeswehr verlegt Eurofighter nach Polen | FAZ” and “Rückschlag für BSW: Ausschuss gegen Neuauszählung der Bundestagswahl | FAZ“. However, a direct relationship between these political discussions and steel plant activity cannot be definitively established. The upcoming vote on a pension package in the Bundestag, as discussed in “Bas hält Zustimmung zu Rentenpaket für sicher | FAZ,” does not appear to have any direct bearing on current steel production levels in Ukraine.

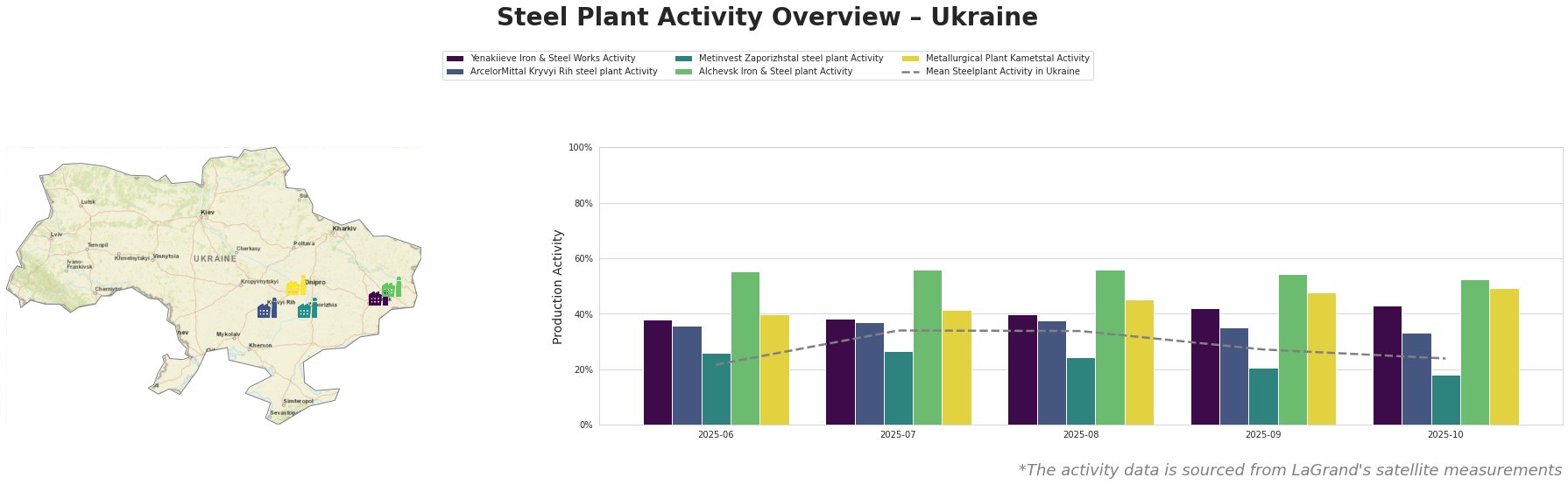

Across all observed plants, activity peaked in July and August at 34%, then declined to 24% by October. Yenakiieve Iron & Steel Works consistently operates above the mean, reaching 43% activity in October. ArcelorMittal Kryvyi Rih shows a similar trend but declines to 33% in October. Metinvest Zaporizhstal shows the lowest relative activity, dropping to just 18% in October. Alchevsk Iron & Steel plant maintains high activity, starting at 55% and then receding to 52%. Metallurgical Plant Kametstal shows consistent growth from 40% to 49% activity. There is no indication that the political discussions reported in “Liveblog Bundespolitik: Bundeswehr verlegt Eurofighter nach Polen | FAZ“, “Rückschlag für BSW: Ausschuss gegen Neuauszählung der Bundestagswahl | FAZ“, and “Bas hält Zustimmung zu Rentenpaket für sicher | FAZ” had any immediate impact on the observed production activity trends.

Yenakiieve Iron & Steel Works (Donetsk Oblast), with a capacity of 3.3 million tonnes of crude steel using BOF technology, showed consistently high activity, reaching 43% in October. The observed increase is not directly linked to any of the provided news articles.

ArcelorMittal Kryvyi Rih (Dnipropetrovsk Oblast), a major integrated plant with 8 million tonnes of crude steel capacity utilizing BF, BOF, and OHF processes, experienced a slight activity decrease to 33% in October. The observed decline is not directly linked to any of the provided news articles.

Metinvest Zaporizhstal (Zaporizhzhia Oblast), producing 4.1 million tonnes of crude steel via OHF, demonstrated a decline in activity to 18% in October, significantly below the average. The company is planning a new 3.2 million tonne BOF, however, this development is not mentioned in any of the provided news articles.

Alchevsk Iron & Steel plant (Luhansk Oblast), with 5.472 million tonnes capacity focused on BOF steelmaking, exhibited relatively stable and high activity, remaining above 50% throughout the period. The sustained activity, despite its location, isn’t directly explainable by the news articles provided.

Metallurgical Plant Kametstal (Dnipropetrovsk Oblast), a 4.2 million tonne BOF-based producer of semi-finished and finished rolled products, showed a consistent increase in activity, reaching 49% in October. This growth is not explicitly linked to any of the provided news articles.

Given the continued operation of key Ukrainian steel plants, despite the ongoing geopolitical situation, and based on the observed increase in activity at Metallurgical Plant Kametstal, steel buyers should:

1. Prioritize securing supply contracts with Kametstal to capitalize on their increasing output.

2. Closely monitor the activity of Metinvest Zaporizhstal which is showing the lowest activity in the observed range and explore alternative sourcing if their output continues to decline.

3. Continuously monitor German political discourse, particularly concerning military support for Ukraine, as negative developments could indirectly impact steel production and supply chains in the long term. While the provided news articles do not directly relate to the steel market, sustained political anxiety could affect investor confidence and economic stability.