From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Faces Uncertainty: German Subsidies, Scrap Restrictions, and Import Safeguards Impacting Production

The European steel market faces increasing uncertainty driven by energy subsidies, scrap metal export restrictions, and evolving import safeguards. The Czech and Slovak steel industries are concerned about Germany’s subsidized electricity tariff, as highlighted in “Czech steel sector urges government action as Germany introduces subsidized electricity tariff,” which could disadvantage them, potentially impacting production at plants like AG der Dillinger Hüttenwerke. While the article details the looming disadvantage, no immediate impact on AG der Dillinger Hüttenwerke Dillingen steel plant (Germany) Activity levels can be directly linked based on provided satellite data; activity has been trending upwards over the observed period. Ukraine’s new scrap export policies, as described in “Export duties and zero quotas on scrap will preserve strategic raw materials – Kalenkov,” and the upcoming EU safeguards, as detailed in “Leaked European Parliament draft on safeguards backs 50% steel over-quota duty, adds Russia/Belarus ban, quota carryover,” add further complexity to the market.

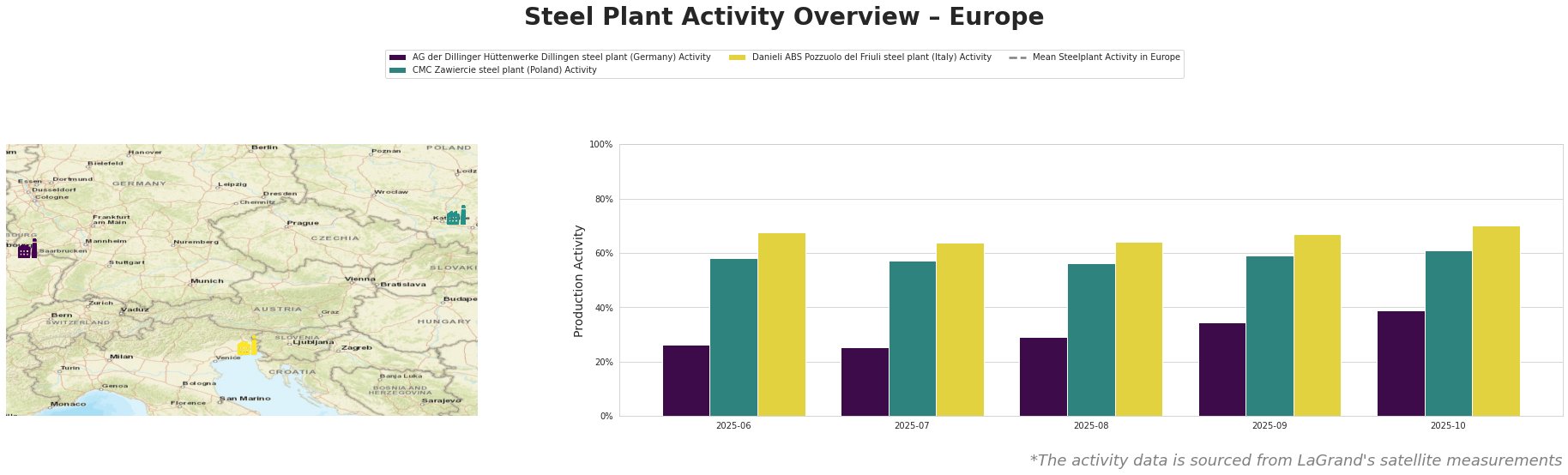

The mean steel plant activity in Europe shows significant fluctuations over the observed months, peaking in July and August. Activity then declined in September and further in October.

AG der Dillinger Hüttenwerke, a German integrated steel plant (BF/BOF), shows a consistently increasing activity level from June (26%) to October (39%). This upward trend contrasts with concerns raised in “Czech steel sector urges government action as Germany introduces subsidized electricity tariff,” which details that the subsidized electricity tariff may cause production decline. At this time, satellite data does not reflect this.

CMC Zawiercie, a Polish electric arc furnace (EAF) steel plant, exhibits relatively stable activity levels, ranging from 56% to 61% during the observed period. There is no obvious connection with the news article entitled “Czech steel sector urges government action as Germany introduces subsidized electricity tariff“, since they are an EAF producer which is less energy-intensive. It’s worth noting that “Export duties and zero quotas on scrap will preserve strategic raw materials – Kalenkov” might indirectly impact CMC Zawiercie if scrap availability becomes constrained due to Ukraine’s export restrictions, but no direct correlation can be established at this time, although Poland is the primary transit country for Ukranian scrap exports.

Danieli ABS Pozzuolo del Friuli, an Italian EAF steel plant, shows a stable upward trend in activity, increasing from 68% in June to 70% in October. As an EAF producer, there is no direct connection between its activity and the “Czech steel sector urges government action as Germany introduces subsidized electricity tariff“.

Based on the potential market disruptions arising from German energy subsidies, scrap restrictions, and import safeguards, steel buyers should:

- Prioritize long-term contracts with German suppliers like AG der Dillinger Hüttenwerke to secure supply before potential cost advantages from subsidized electricity fully materialize, potentially impacting pricing strategies in 2026. Closely monitor German government policy decisions regarding the tariff.

- Diversify scrap sourcing for EAF producers like CMC Zawiercie and Danieli ABS Pozzuolo del Friuli to mitigate risks associated with Ukraine’s export restrictions. Consider alternative sources within the EU.

- Evaluate potential impact of import safeguards by analyzing import volumes from countries outside the EU and their potential impact on steel prices. Prepare for potential supply chain adjustments and price volatility as the safeguard measures come into effect as discussed in “Leaked European Parliament draft on safeguards backs 50% steel over-quota duty, adds Russia/Belarus ban, quota carryover.”