From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market Remains Strong Despite Fossil Fuel Transition Uncertainty, LPG Demand Surges

Brazil’s steel market exhibits overall strength, driven by increased LPG consumption and government subsidies, despite unresolved fossil fuel transition plans post-COP 30. Steel plant activity remains robust, with some volatility. The news article “Brazil boosts payouts for new LPG scheme by 2.6pc” signals increased demand for LPG cylinders, which may indirectly impact steel demand for cylinder manufacturing. However, a direct link between this news and specific satellite-observed activity changes at steel plants cannot be definitively established based on the provided information alone. The “Fossil fuels shift talks to continue outside Cop” news article highlights uncertainty regarding future fossil fuel phase-out plans, which could affect long-term steel demand, especially for energy-related infrastructure.

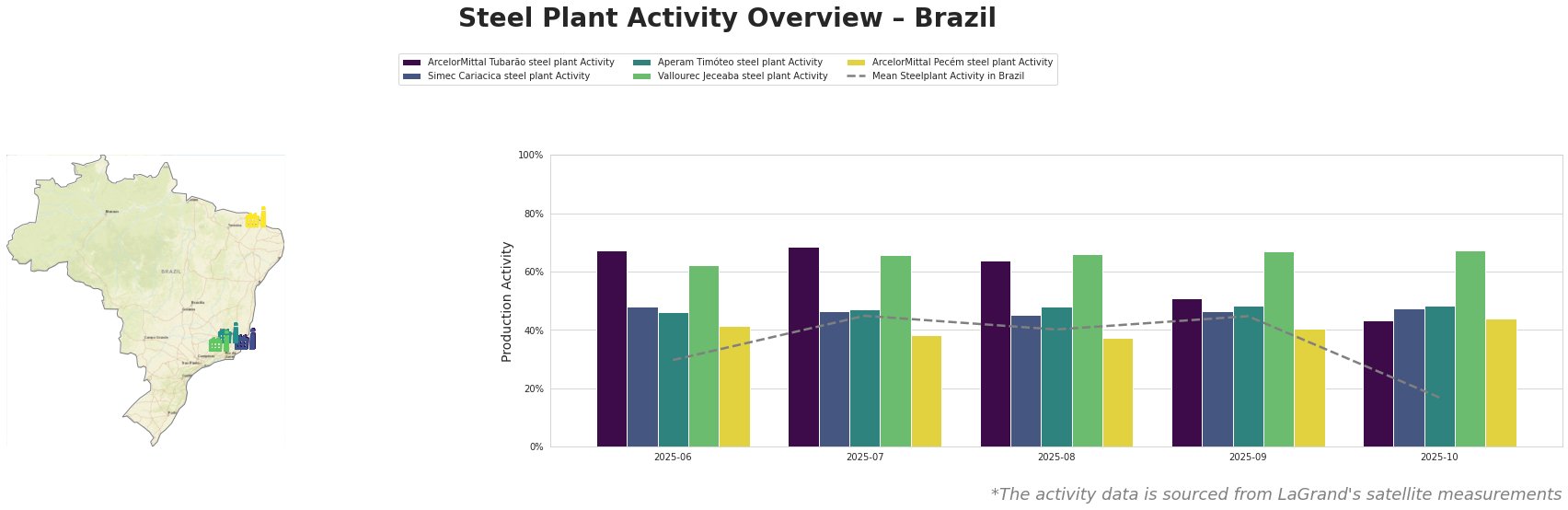

Overall, average steel plant activity in Brazil fluctuated, peaking at 45.0% in July and September before dropping significantly to 17.0% in October. ArcelorMittal Tubarão consistently operated above the mean, with a significant drop from 51.0% in September to 43.0% in October. Simec Cariacica showed relatively stable activity. Aperam Timóteo maintained steady activity levels. Vallourec Jeceaba consistently showed high activity. ArcelorMittal Pecém showed more stable activity.

ArcelorMittal Tubarão, located in Espírito Santo, operates with a 7500 ttpa crude steel capacity using BF/BOF technology. It produces slabs, hot-rolled coils, and cold-rolled/galvanized steel for various sectors. The plant’s activity decreased significantly from 51.0% in September to 43.0% in October. However, no direct link can be established between this activity drop and the provided news articles.

Simec Cariacica, also in Espírito Santo, produces 600 ttpa of crude steel using EAF technology, focusing on rebar and profiles for construction. The plant’s activity remained relatively stable. No direct connection can be established between its stable activity and the provided news articles.

Aperam Timóteo, located in Minas Gerais, has a 900 ttpa crude steel capacity, utilizing both BF/BOF and EAF processes to produce stainless, electrical, and special carbon steels. The plant’s activity remained relatively stable. No direct connection can be established between its stable activity and the provided news articles. Notably, Aperam utilizes charcoal from cultivated eucalyptus forests as a substitute for coke, which could provide a competitive advantage, especially in light of ongoing discussions on reducing reliance on fossil fuels.

Vallourec Jeceaba, in Minas Gerais, has a 1000 ttpa crude steel capacity via BF/EAF and specializes in seamless steel pipes, primarily for the energy sector. The plant demonstrated consistently high activity levels throughout the observed period. No direct connection can be established between its high activity and the provided news articles.

ArcelorMittal Pecém, located in Ceará, produces 3000 ttpa of crude steel using BF/BOF technology, manufacturing slabs, plates, and rolled steel. The plant’s activity remained relatively stable. No direct connection can be established between its stable activity and the provided news articles.

The drop in mean steel plant activity in Brazil in October, particularly the reduction at ArcelorMittal Tubarão, warrants monitoring. The “Fossil fuels shift talks to continue outside Cop” article indicates potential long-term uncertainty around demand, but the increased LPG subsidies discussed in “Brazil boosts payouts for new LPG scheme by 2.6pc” may provide offsetting demand, particularly for manufacturers supplying the LPG cylinder market.

Procurement Actions:

- Steel Buyers: Given the observed volatility and the “Brazil boosts payouts for new LPG scheme by 2.6pc” article, prioritize securing supply contracts, particularly for flat steel products potentially used in LPG cylinder manufacturing. Monitor the activity of ArcelorMittal Tubarão and ArcelorMittal Pecém, both producers of flat steel products, for potential supply disruptions.

- Market Analysts: Closely track LPG cylinder production and sales data to assess the actual impact of the increased subsidies on steel demand. Monitor policy developments related to the fossil fuel transition to understand their potential long-term impact on different steel end-user sectors.