From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Buoyant Amidst Green Transition and Geopolitical Shifts: Plant Activity Rises

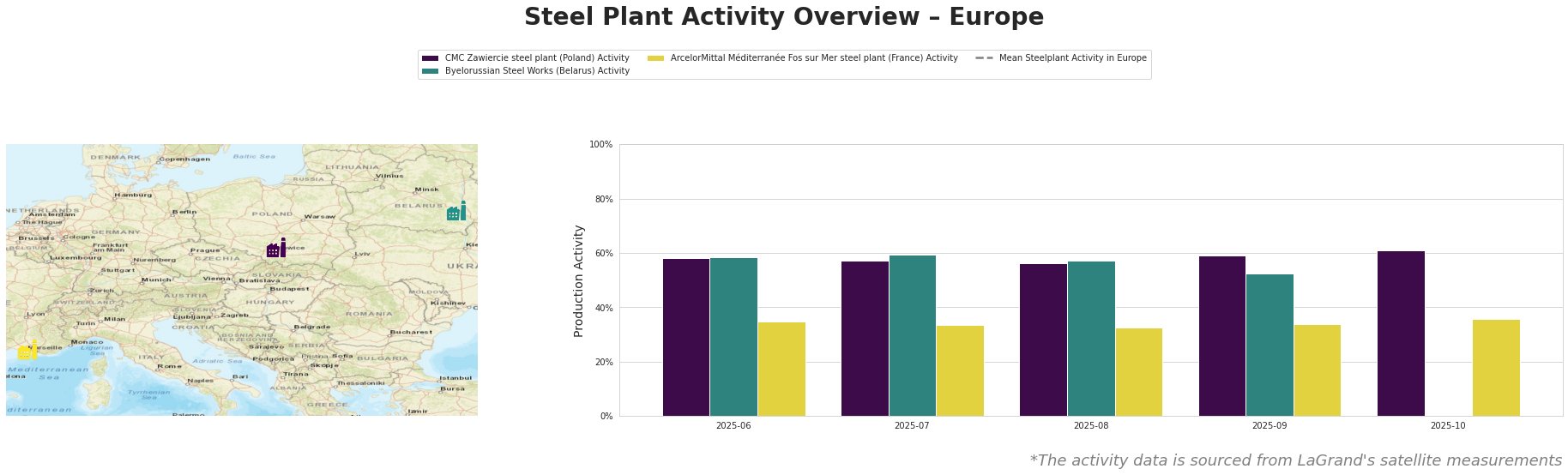

Europe’s steel market demonstrates resilience, with increased plant activity coinciding with ongoing debates about climate policy and trade. Specifically, changes in activity were observed in the given timeframe, however, no direct relationship between the “Stehen Umwelt- und Klimaschutz im Abseits“, “Handelsverträge brauchen Anreize zum Klimaschutz“, “Parteitag: Grüne wollen sozial gerechteren Klimaschutz” and the activity levels could be established.

The data indicates fluctuating activity levels across the observed steel plants and the European average. The European mean activity peaked in July and August at 407779666.0, then declined in the following months.

CMC Zawiercie, a Polish steel plant with an EAF capacity of 1700 ttpa, showed a fluctuating activity level. The plant started at 58.0% in June, dropped to 56.0% in August, but has increased to 61% in October, exceeding its starting value. As of its reliance on EAF, it should be more resilient to new climate policy (given the shift away from coal based production described in “Handelsverträge brauchen Anreize zum Klimaschutz”), but no direct connection could be established based on activity data alone.

Byelorussian Steel Works, featuring a 3000 ttpa EAF capacity, saw its activity dip to 52.0% in September after a peak of 60.0% in July. Data for October is missing. Due to the lack of further information, a direct relationship between the article “Stehen Umwelt- und Klimaschutz im Abseits” and this activity pattern can not be established.

ArcelorMittal Méditerranée Fos sur Mer, with its 4000 ttpa BOF capacity, displays the lowest activity levels of the observed plants, with slight fluctuations between 33% and 36%. As an integrated BF-BOF plant, it may face future challenges related to the implementation of stricter climate policies as proposed in “Handelsverträge brauchen Anreize zum Klimaschutz”, although no immediate impact is evident in the observed data.

Evaluated Market Implications

Despite the ongoing discussions surrounding environmental regulations and geopolitical tensions, the European steel market appears stable, with generally consistent plant activity. As “Handelsverträge brauchen Anreize zum Klimaschutz” suggests, the future competitiveness of BOF-based steel production (like at ArcelorMittal Méditerranée Fos sur Mer) might be at risk.

Given the EAF based production and consistent activity, procurement professionals can regard CMC Zawiercie as a reliable supplier for building and infrastructure. Due to the missing data for Byelorussian Steel Works, buyers should monitor the steel plant in order to ensure reliable supply chains.