From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Headwinds: Swiss Climate Vote Failure & Mixed Plant Activity Signal Uncertainty

Europe’s steel market faces a challenging outlook influenced by recent political developments in Switzerland and mixed signals from observed steel plant activity. The failure of the Swiss “Initiative for a Future,” as reported in “30.11.2025: Abstimmung Erbschaftssteuer-Initiative – die Resultate” which proposed funding climate protection through inheritance taxes, may dampen investment in green steel initiatives, indirectly impacting long-term demand for sustainably produced steel. However, no immediate connection to observed plant activity can be established.

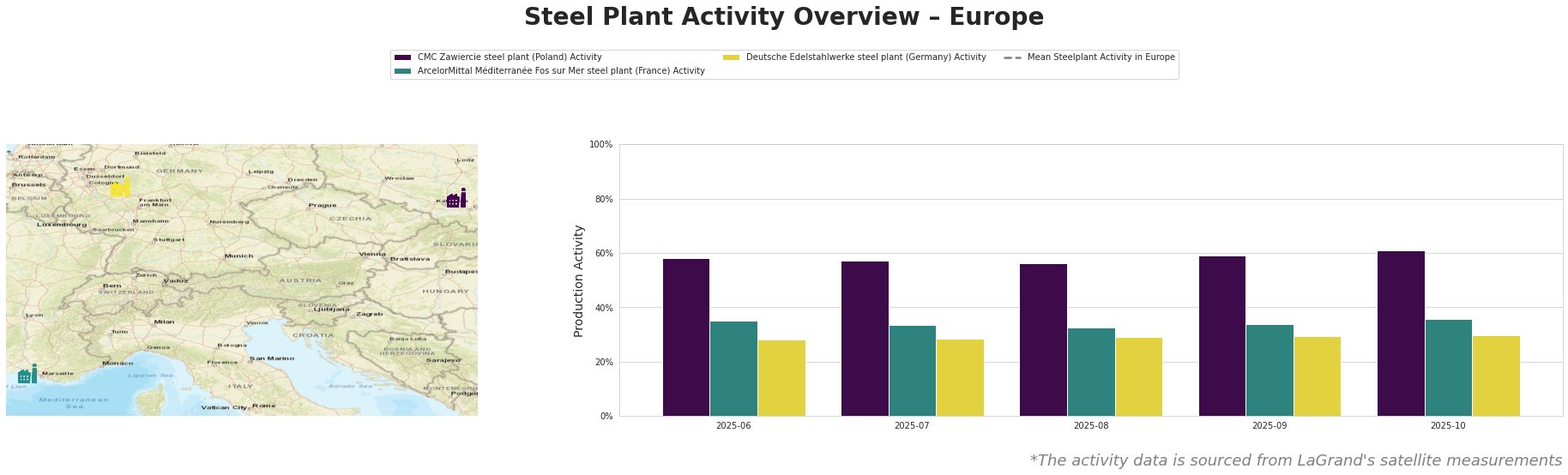

The average European steel plant activity shows a volatile trend over the observed period, peaking in July/August 2025 and declining significantly by October 2025.

CMC Zawiercie steel plant: This Polish plant, with a 1.7 million tonne EAF-based crude steel capacity, shows a gradual increase in activity, from 58% in June to 61% in October. This trend does not appear to be directly linked to the Swiss news articles.

ArcelorMittal Méditerranée Fos sur Mer steel plant: This integrated BF/BOF plant in France, with a 4 million tonne crude steel capacity, exhibits relatively stable activity, fluctuating between 33% and 36%. No direct link can be established between these stable operations and the Swiss vote results. The plant is scheduled to shut down it’s BOF by 2030.

Deutsche Edelstahlwerke steel plant: This German EAF-based plant, with a 0.6 million tonne crude steel capacity, shows stable activity at around 28-30% during the observed months. This stability cannot be directly linked to the Swiss news articles.

Evaluated Market Implications:

Given the mixed activity levels and the uncertainty surrounding climate investment following the Swiss vote against the “Initiative for a Future,” steel buyers should:

- Closely monitor price volatility: The decreasing average activity levels across Europe coupled with political uncertainty suggests potential for price fluctuations.

- Strengthen supplier relationships: Secure supply by reinforcing relationships with existing suppliers, particularly those demonstrating consistent production like CMC Zawiercie.

- Evaluate alternative sourcing options: Explore sourcing from regions with stable or increasing production to mitigate risks associated with potential European supply constraints.

- Factor in long-term decarbonization challenges: The rejection of the Swiss inheritance tax initiative may slow down the transition towards green steel in some regions, influencing future procurement strategies.