From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustrian Steel Production Surges Amidst Voestalpine Uncertainty: Procurement Strategy Adjustments Needed

Austria’s steel sector shows a complex picture of overall production increase coupled with company-specific cutbacks. As reported in “Austria increased steel production by 35.8% y/y in October” and “Austria ramps up crude steel production in October,” the nation saw a significant year-over-year production increase, yet Voestalpine AG, a major player, faces potential capacity cuts. Satellite data reveals varied activity levels across Voestalpine’s plants, demanding a nuanced approach to procurement.

The Austrian steel market experienced strong growth in October, with crude steel production reaching 704,581 tons, as highlighted in “Austria increased crude steel production in October“. This represents an 11.2% increase from the previous month and a substantial 45.7% increase year-over-year. This positive trend contrasts with overall EU output, which decreased by 3.5% year-over-year in October, according to the article “Austria increased crude steel production in October.” While these production figures are encouraging, “Austria increased steel production by 35.8% y/y in October” also notes that Voestalpine AG is considering production capacity cuts due to factors like US tariffs and weaker demand. The impact of Voestalpine’s potential cutbacks may offset Austria’s reported growth.

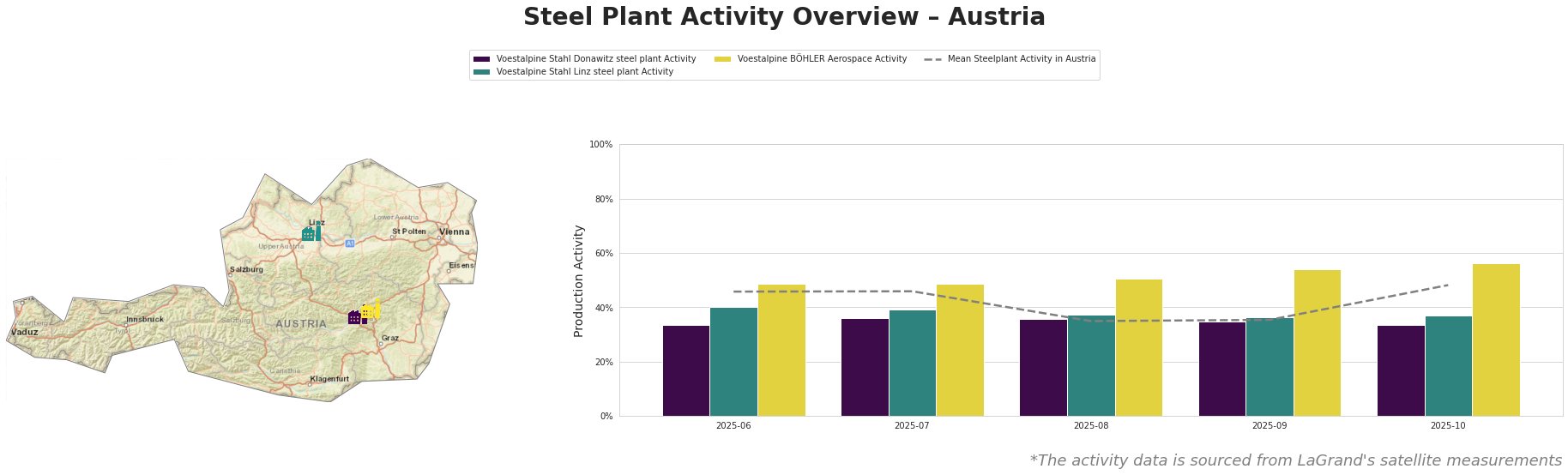

The mean activity across Austrian steel plants fluctuated. It remained consistent at 46% in June and July, then dropped to 35% in August and September, before increasing to 48% in October. Voestalpine Stahl Donawitz steel plant showed consistently lower activity than the mean. Voestalpine Stahl Linz steel plant demonstrated activity levels generally below the Austrian mean activity. Voestalpine BÖHLER Aerospace, however, exhibited consistently higher activity levels than the mean. No direct connection between overall plant activity and the named news articles can be explicitly established based on the provided information.

Voestalpine Stahl Donawitz steel plant, located in Styria, possesses a crude steel capacity of 1,570,000 tonnes, primarily through its integrated (BF) process. The plant’s activity remained consistently below the Austrian mean activity, reaching its lowest point of 33% in June 2025 and ending the observation period at 34% in October. As the “Austria increased steel production by 35.8% y/y in October” article mentions cost and competitiveness issues as a possible justification for the cuts, reduced operational activity at the Donawitz plant could be a sign of this. However, based on the provided data, no direct connection can be explicitly established.

Voestalpine Stahl Linz steel plant, situated in Upper Austria, is a major integrated steel producer with a crude steel capacity of 6,000,000 tonnes. The plant’s activity also remained below the mean, fluctuating slightly. The fluctuations are relatively small, starting at 40% activity in June and ending at 37% in October. It is difficult to link this directly to the production cutbacks mentioned in “Austria increased steel production by 35.8% y/y in October,” as the satellite data doesn’t show a sharp decline. No direct link can be explicitly confirmed.

Voestalpine BÖHLER Aerospace in Kapfenberg relies on the electric process (EAF) for its steel production. Unlike the other two plants, BÖHLER Aerospace consistently operated above the Austrian mean activity, showing a steady increase from 49% in June to 56% in October. Given Voestalpine’s supply of steel to BYD’s Hungarian plant, as mentioned in “Austria ramps up crude steel production in October” and “Austria increased crude steel production in October,” the sustained high activity may reflect increased demand for specialized steel products like those produced by Voestalpine BÖHLER Aerospace, but no explicit evidence for such a connection is available.

While overall Austrian steel production is increasing, the potential cutbacks at Voestalpine, especially if concentrated at plants like Donawitz with consistently lower observed activity, could create localized supply constraints. Given the news from the articles titled “Austria increased steel production by 35.8% y/y in October“, “Austria ramps up crude steel production in October” and “Austria increased crude steel production in October” of possible production decrease, and the observation of varying activity levels at individual plants, steel buyers should:

- Diversify Procurement Sources: Reduce reliance on Voestalpine, exploring alternative suppliers within Austria and the EU, especially for products potentially affected by capacity reductions at specific Voestalpine plants.

- Monitor Voestalpine’s Production Decisions: Closely track Voestalpine’s announcements regarding plant closures or capacity adjustments to proactively anticipate and mitigate supply disruptions.

- Negotiate Contractual Protections: Secure contractual clauses with suppliers that address potential supply shortages and price fluctuations, providing greater certainty in a dynamic market.

- Focus on specialty steel products: As Voestalpine BÖHLER Aerospace is a steel plant that relies on the electric process (EAF) for its steel production and the plant’s activity consistently operated above the Austrian mean activity, procurement strategies should give priority to the product category [unknown] for a successful procurement.