From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Energy Subsidies Threaten EU Steel Market: Czech and Italian Producers at Risk

Europe’s steel market faces potential disruption due to diverging energy policies. The “German power cap disadvantages Czechia, unbalances EU,” with “Czech steelmakers concerned about German industrial electricity prices,” fearing competitive disadvantages. Italian associations share similar concerns, as highlighted in “Italian associations concerned about German industrial electricity prices.” These concerns are amplified by the “German Steel Federation warns industrial electricity price plan excludes steelmakers under CISAF,” suggesting uneven support even within Germany. While no direct correlation can be definitively established from the provided data, these policies raise concerns about potential distortions in regional steel production.

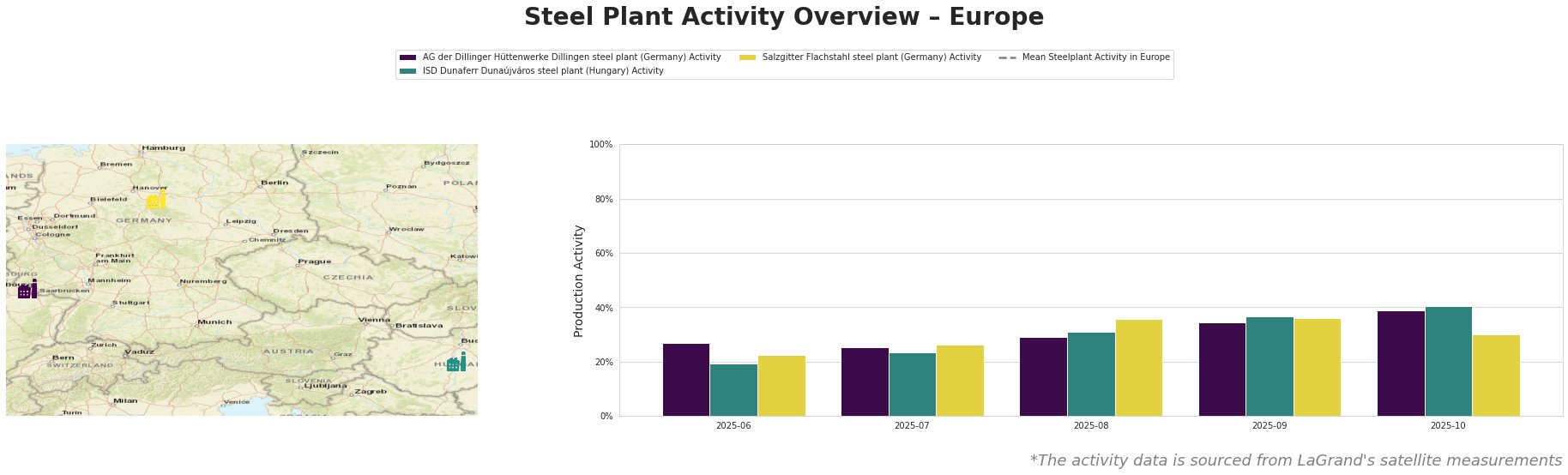

Observed plant activity levels show fluctuations across Europe:

The mean steel plant activity in Europe fluctuated significantly, ranging from approximately 271 million to 407 million units.

AG der Dillinger Hüttenwerke Dillingen steel plant (Germany): This integrated BF/BOF plant, with a crude steel capacity of 2.76 million tonnes, produces a range of heavy-plate products for sectors including automotive, energy, and infrastructure. Activity levels rose steadily from 27% in June to 39% in October. The observed increase does not directly correlate with the news articles, as they primarily discuss future energy policies rather than current production boosts.

ISD Dunaferr Dunaújváros steel plant (Hungary): This integrated BF/BOF plant, with a crude steel capacity of 1.6 million tonnes, focuses on semi-finished and finished rolled products. Activity increased consistently from 19% in June to 40% in October. No direct connection can be established between the plant’s increased activity and the news articles concerning German energy subsidies.

Salzgitter Flachstahl steel plant (Germany): A major integrated BF/BOF producer with a 5.2 million tonne crude steel capacity, Salzgitter produces flat steel products for automotive and construction. Activity increased from 22% in June to 36% in August and September, before dropping to 30% in October. While Salzgitter is planning a transition to DRI and hydrogen-based steelmaking under its Salcos Green Steel project, no explicit connection can be established with the mentioned articles.

Evaluated Market Implications

The “German power cap disadvantages Czechia, unbalances EU” and other articles suggest potential disadvantages for steel producers in Czechia and Italy. Coupled with the “German Steel Federation warns industrial electricity price plan excludes steelmakers under CISAF,” the German plan will generate market asymmetries and uncertainty.

Recommended Procurement Actions:

- Diversify Sourcing: Steel buyers should actively diversify their supply base, increasing reliance on producers outside of Czechia and potentially Italy, to mitigate risks associated with potential production cuts in those regions.

- Monitor German Policy: Closely monitor developments regarding the German electricity price cap and its implementation, particularly any revisions to CISAF that might include or exclude specific steelmakers. Understanding which German producers benefit most will be crucial.

- Assess Contractual Risk: Evaluate existing steel supply contracts with Czech and Italian producers for clauses related to force majeure or price adjustments linked to energy costs. Be prepared to renegotiate or seek alternative supply arrangements if necessary.