From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America Steel Market: Tariffs Loom, Nucor Plants Maintain High Activity Despite Trade Tensions

North America’s steel market faces potential disruptions due to ongoing trade negotiations between the U.S. and EU, as highlighted in “EU Warns the United States Against Expanding Steel Tariffs” and “U.S. to EU: Balance Digital Rules in Exchange for Reduced Steel, Aluminum Tariffs.” While these trade tensions develop, satellite data reveals consistent high activity at several Nucor steel plants. No direct relationship between the news articles and the plant activity data could be established.

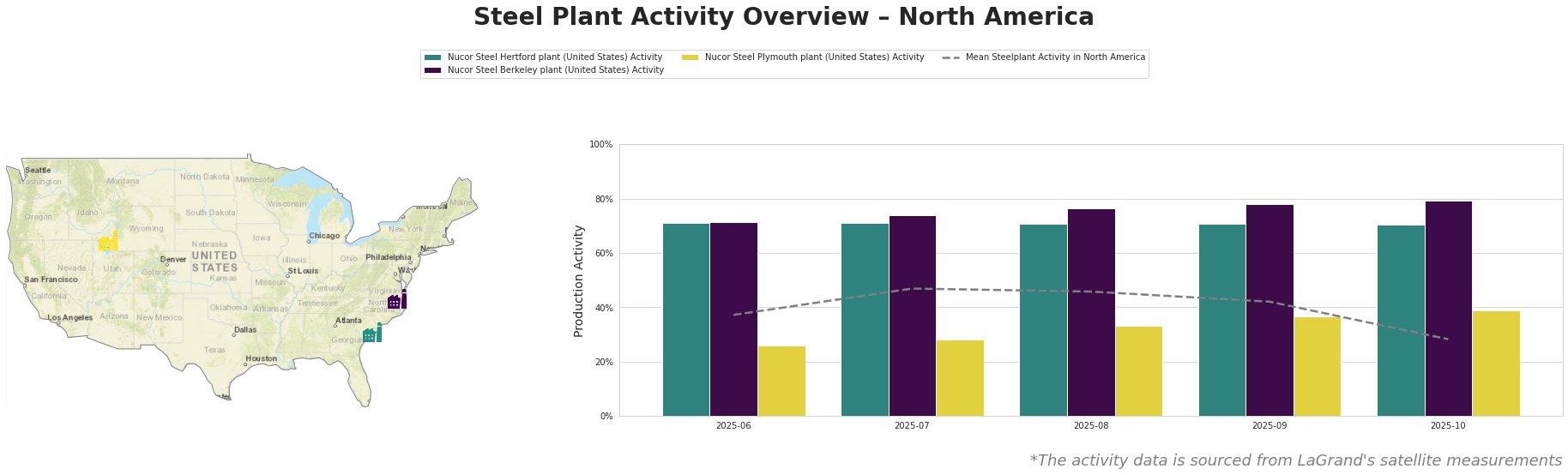

The mean steel plant activity in North America exhibited volatility, declining to 28% in October after peaking at 47% in July. Conversely, Nucor Steel Hertford consistently showed very high activity at 71%. Nucor Steel Berkeley steadily increased activity from 71% in June to 79% in October. Nucor Steel Plymouth showed a gradual increase, starting at 26% in June and rising to 39% in October.

Nucor Steel Hertford, located in North Carolina, specializes in plate production using EAF technology with a capacity of 1542 ttpa of crude steel. The plant maintained a consistently high activity level of 71% from June to October. No direct link between this plant’s high activity and the named trade negotiation news could be established.

Nucor Steel Berkeley, situated in South Carolina, focuses on finished rolled products like beams and sheets, utilizing EAF technology with a larger capacity of 2956 ttpa of crude steel. Its activity steadily increased from 71% in June to 79% in October, outpacing the mean North American activity. No direct link between this plant’s increased activity and the named trade negotiation news could be established.

Nucor Steel Plymouth, based in Utah, produces finished rolled bar products via EAF technology with a 908 ttpa crude steel capacity. The plant demonstrated a continuous, though gradual, climb in activity from 26% in June to 39% in October. No direct link between this plant’s increased activity and the named trade negotiation news could be established.

The potential expansion of U.S. tariffs, as indicated in “EU Warns the United States Against Expanding Steel Tariffs” and “U.S. to EU: Balance Digital Rules in Exchange for Reduced Steel, Aluminum Tariffs,” presents a risk of supply disruption and price increases, particularly for steel products imported from the EU. Given the stable high activity levels at the Nucor Steel Hertford and the increasing activity at Nucor Steel Berkeley and Plymouth, procurement professionals should:

- Prioritize securing contracts with domestic suppliers, like Nucor, to mitigate potential disruptions caused by tariff uncertainties. The consistently high activity at Nucor Steel Hertford suggests a reliable supply of plate products.

- Evaluate current EU-based supply chains and quantify potential tariff impacts based on the steel product type and country of origin.

- Monitor trade negotiation developments closely, especially regarding specific steel product categories that may be subject to expanded tariffs. As “U.S. to EU: Balance Digital Rules in Exchange for Reduced Steel, Aluminum Tariffs” suggests, the outcome of these negotiations will directly influence tariff levels and supply availability.