From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces CBAM Uncertainty Amidst Weak Demand; Plant Activity Declines

European steel markets are facing increasing uncertainty due to the Carbon Border Adjustment Mechanism (CBAM) and persistent weak demand. The news article “Stable EU HRC offers contrast with weak imports and rising CBAM confusion” highlights the confusion surrounding CBAM implementation. This coincides with a recent downtrend in European steel plant activity observed via satellite.

The impact of CBAM is further emphasized in “Domestic steel HRC prices in Europe firm as CBAM, trade defenses curb appetite for imports,” indicating that while domestic HRC prices remain firm, buyers are cautious due to sufficient inventory and CBAM-related concerns. Further, uncertainty toward 2026 is fueled by the expectation that CBAM may reduce imports and could lead to price increases despite weak current demand as per the news “Europe and the UK steel markets face 2026 concerns: Demand weak, prices being tested“. News articles “European steel HRC prices steady; buyers doubt durability of rebound” and “EU HRC market, demand visibility remain weak” also highlight low near-term buying interest and skepticism about the durability of any price rebounds. A direct relationship between these news articles and observed plant activity cannot be explicitly established but is strongly implied.

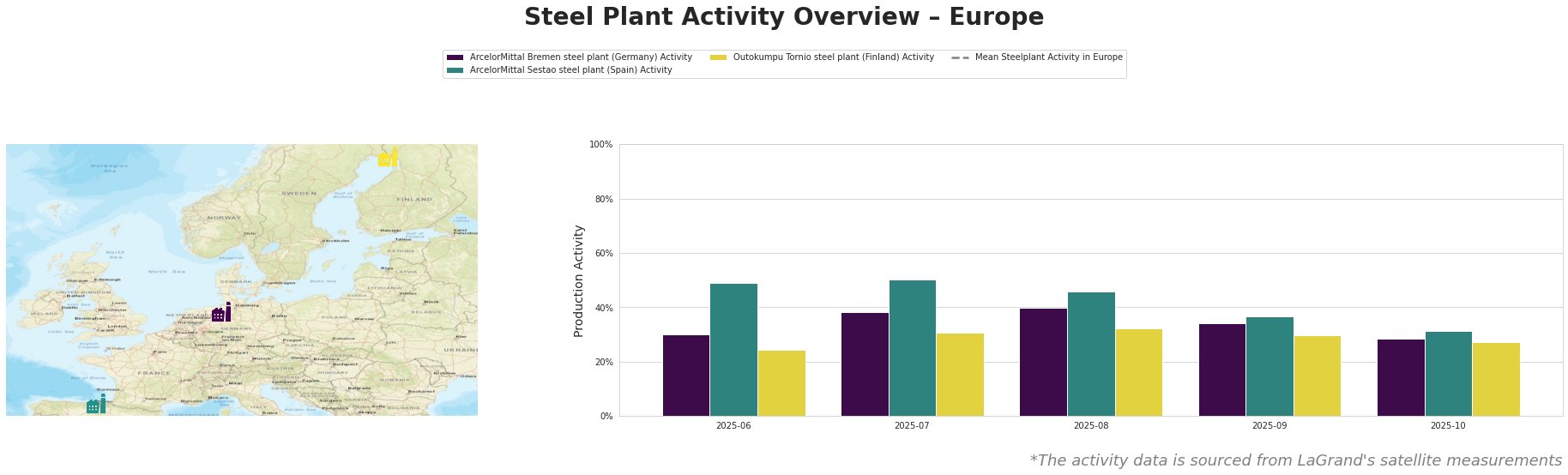

Observed mean steel plant activity in Europe shows a downtrend from July/August to October. ArcelorMittal Bremen showed a peak in August (40%) followed by a decrease to 29% in October. ArcelorMittal Sestao activity was highest in July (50%), also declining to 31% in October. Outokumpu Tornio follows a similar pattern, peaking in August (32%) and decreasing to 27% in October. All three plants showed below-average activity compared to their individual peaks in October.

ArcelorMittal Bremen, an integrated BF/BOF steel plant with a capacity of 3.8 million tonnes of crude steel, experienced a decline in activity from 40% in August to 29% in October. This reduction, alongside similar trends observed at other European plants, may be linked to the weak demand and CBAM uncertainty reported in “Europe and the UK steel markets face 2026 concerns: Demand weak, prices being tested,” though a direct link is not definitively established.

ArcelorMittal Sestao, an EAF-based plant with a 2 million tonne capacity, also saw activity decrease from 50% in July to 31% in October. As per its plant information details it is expected to receive DRI from ArcelorMittal Asturias Gijon plant by 2025. This drop in activity may also be linked to the general market uncertainty and import dynamics affected by CBAM, detailed in “Domestic steel HRC prices in Europe firm as CBAM, trade defenses curb appetite for imports“, however, there is no explicitly verifiable relationship.

Outokumpu Tornio, an EAF-based stainless steel producer with a 1.2 million tonne capacity, displayed a reduction in activity from 32% in August to 27% in October. The news article “Europe and the UK steel markets face 2026 concerns: Demand weak, prices being tested” speaks to challenges for buyers regarding costs for green steel which may be a factor in this plant’s lowered activity but no direct correlation can be established.

Given the weak demand and uncertainty surrounding CBAM implementation, as evidenced in “Stable EU HRC offers contrast with weak imports and rising CBAM confusion,” “EU HRC market, demand visibility remain weak,” and “Domestic steel HRC prices in Europe firm as CBAM, trade defenses curb appetite for imports” procurement actions are:

- Steel Buyers: Delay new HRC bookings where possible. The news “European steel HRC prices steady; buyers doubt durability of rebound” indicates buyers doubt the durability of the increase, so holding back and following news closely may be of benefit.

- Market Analysts: Closely monitor CBAM implementation details. The news “Stable EU HRC offers contrast with weak imports and rising CBAM confusion” directly mentions market confusion and this may be cause for greater price volatility in future.