From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Optimistic Despite Select Production Dips: Tata Green Transition & Zawiercie’s Resilient Output

Europe’s steel market exhibits a very positive sentiment, underscored by strategic shifts towards green steel production, even amidst fluctuations in plant activity. Tata Steel’s commitment to decarbonization, evidenced by the acquisition of Vattenfall power plants as reported in “Tata Steel Nederland to acquire Wattenfall power plants to support transition to green metallurgy” and “Tata Steel Nederland to acquire Vattenfall power plants to support green steel transition“, signals a long-term investment in sustainable steelmaking. However, the satellite data doesn’t reveal an immediate correlation with the Vattenfall acquisition, since the mentioned acquisition date is January 1, 2026, which lies outside the observation window.

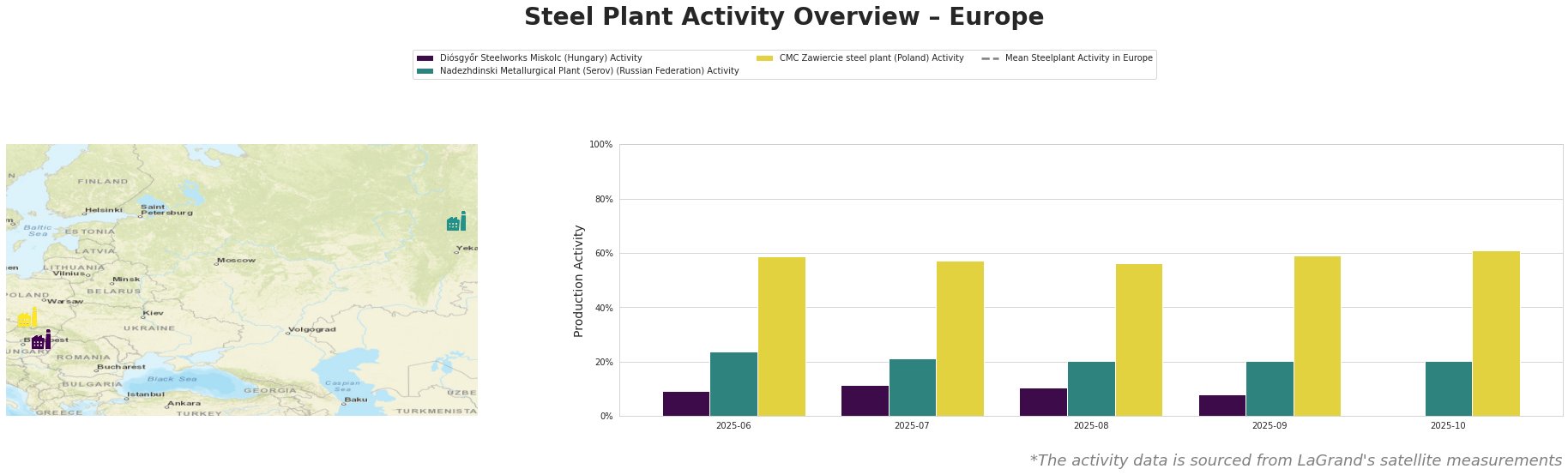

Across Europe, the mean steel plant activity shows volatility over the observed period, reaching highs in July and August and lows in October. Diósgyőr Steelworks Miskolc shows a consistently low level of activity, peaking at 12% in July 2025, before dropping to 8% in September. Nadezhdinski Metallurgical Plant activity remains relatively stable at around 20% throughout the observed period. CMC Zawiercie consistently operates at a higher activity level, ranging between 56% and 61%. It is noteworthy that during October 2025, when the overall European average fell, CMC Zawiercie’s activity reached its highest point, indicating strong regional demand or operational resilience.

Diósgyőr Steelworks Miskolc, a Hungarian steel plant with a 550ktpa EAF-based capacity, focuses on producing special bar quality steels for automotive and construction. The plant’s observed activity remained consistently below 12% throughout the entire period, with a noticeable drop to 8% in September. This suggests potential production adjustments or maintenance activities. No direct link to the provided news articles can be established.

Nadezhdinski Metallurgical Plant (Serov), located in the Sverdlovsk region and boasting a 756ktpa capacity primarily utilizing EAF technology, manufactures a range of long products. Satellite data indicates a steady activity level around 20%, which is well below potential capacity. The plant holds both ISO 14001 and ISO 50001 certifications and is producing for automotive, energy, transport, tools and machinery sectors. There is no apparent impact from the news.

CMC Zawiercie steel plant, a significant Polish steel producer with a 1.7 million tonnes per year EAF-based capacity, displays robust activity throughout the monitored months. This steel plant produces for automotive, building and infrastructure, energy, steel packaging, tools and machinery, and transport sectors. Despite fluctuations in the European average, Zawiercie maintained strong output. Notably, activity peaked at 61% in October, contrasting with the overall European downward trend. No direct link to the provided news articles can be established.

Given Tata Steel’s strategic shift toward green steel production as highlighted in “Tata Steel Nederland to acquire Vattenfall power plants to support green steel transition” and “Tata Steel Nederland to acquire Wattenfall power plants to support transition to green metallurgy“, steel buyers should monitor the long-term implications for supply chains and explore opportunities to procure sustainably produced steel. The Zawiercie steel plant’s consistently high production rates could offer a reliable source, however, buyers should closely monitor the environmental impact and carbon footprint related to the plant’s high production and energy sourcing. Buyers should also be prepared for potential price adjustments reflecting the costs associated with Tata Steel’s green transition.