From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Faces Continued Downturn: Plant Activity Declines Amidst EU Demand Slump

Ukraine’s steel sector continues to grapple with challenges as evidenced by declining plant activity, mirroring weak EU demand. Recent activity levels appear to reflect concerns detailed in the EUROFER report: “EUROFER: Apparent steel consumption not expected to improve substantially before Q1 2026” which outlines ongoing disruptions from the war in Ukraine, high energy prices, and global economic uncertainty. This overall weak demand reported by EUROFER appears to be influencing activity at steel plants within Ukraine.

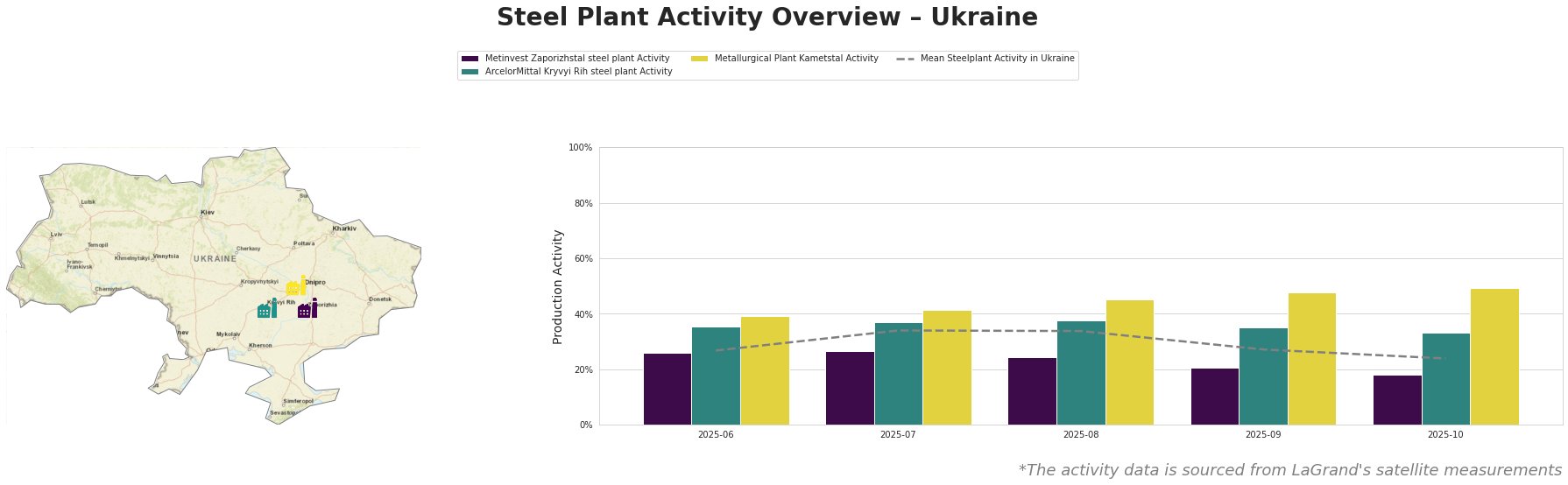

Overall, the mean steel plant activity in Ukraine has declined from 34% in July and August to 24% in October. Metinvest Zaporizhstal saw the most pronounced decline, falling to 18% activity in October. ArcelorMittal Kryvyi Rih showed a milder decrease to 33% in October. In contrast, Metallurgical Plant Kametstal increased production throughout the period to 49% activity in October, diverging from the overall downtrend and other plants.

Metinvest Zaporizhstal steel plant, an integrated BF-OHF plant with a crude steel capacity of 4.1 million tonnes per annum (TTPA), specializing in finished rolled products for automotive and steel packaging, experienced a significant drop in activity. From June to October, its observed activity plummeted from 26% to 18%. This aligns with the concerns highlighted in “EUROFER: Apparent steel consumption not expected to improve substantially before Q1 2026” regarding the negative impact of the war and broader EU economic downturn which may be impacting demand from key sectors like automotive, though a direct causal link cannot be definitively established.

ArcelorMittal Kryvyi Rih steel plant, a large integrated BF-BOF-OHF plant with a crude steel capacity of 8 million TTPA, producing semi-finished and finished rolled products for building and infrastructure, saw a decrease in activity from 35% in June to 33% in October. Although less dramatic than Metinvest, this decline potentially reflects the weaker steel demand across the EU as indicated in “EUROFER: Steel consumption is not expected to increase significantly until Q1 2026“, though a definitive connection cannot be explicitly established, and local plant specific factors could also be involved.

Metallurgical Plant Kametstal, an integrated BF-BOF plant with a crude steel capacity of 4.2 million TTPA, focusing on semi-finished and finished rolled products for energy and transport, bucked the trend. Its activity levels steadily increased from 39% in June to 49% in October. While this is a positive sign for the plant, the broader implications in light of the EUROFER reports and declines at other plants in the region remain uncertain. No direct connection between Kametstal’s increased production and the news articles can be established.

Given the overall negative market sentiment and declining plant activity (especially at Metinvest and ArcelorMittal), buyers should anticipate potential supply disruptions. Specifically, buyers who rely on hot-rolled coil, cold-rolled sheets, and carbon and low-alloy steel coils from Metinvest Zaporizhstal should proactively diversify their supply chains to mitigate risks associated with reduced production capacity at this plant. Conversely, monitor pricing from Kametstal, as their increased output may provide a degree of stability or competitive advantage in certain product categories like wire rods and rails. Buyers should closely monitor further EUROFER reports for more specific forecasts regarding the impact of US tariffs and trade uncertainties on steel demand to better anticipate future market volatility and make informed procurement decisions.