From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineTurkish Steel Demand Surge Fuels Chinese Plant Activity Amidst Export Growth

Asia’s steel market shows a very positive outlook, influenced by rising Turkish demand and corresponding plant activity, particularly in China. The surge in Turkish imports, as highlighted in “Turkey’s billet imports up 50.8 percent in Jan-Sept 2025” and “Turkey’s HRC imports up ten percent in Jan-Sept 2025,” suggests increased global demand impacting Asian steel production. This aligns partially with observed activity levels in some Chinese plants, however, a direct relationship cannot be established definitively based solely on the provided news articles.

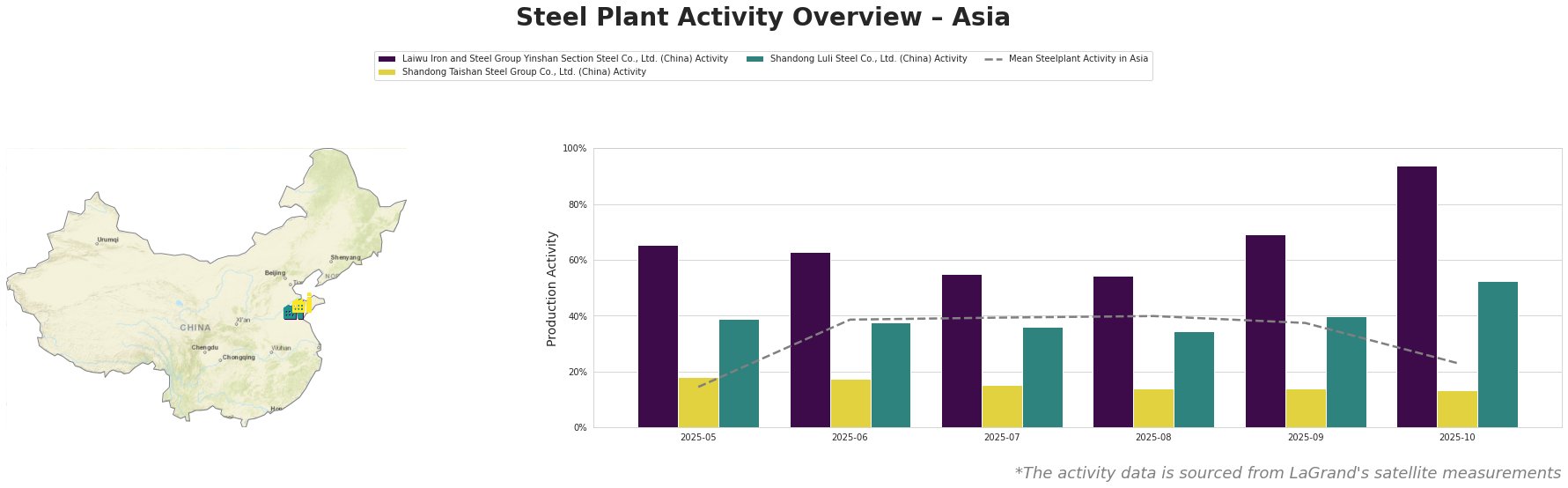

The mean steel plant activity in Asia shows volatility, peaking at 40% in August and then decreasing to 23% in October. Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd. demonstrates a significant upward trend, jumping to 94% activity in October. Shandong Taishan Steel Group Co., Ltd.’s activity has remained consistently low, fluctuating between 13% and 18%. Shandong Luli Steel Co., Ltd. shows a moderate increase, reaching 53% in October, compared to a low of 34% in August.

Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd., an integrated steel plant with a capacity of 5.4 million tons of crude steel utilizing BF and BOF technologies, produces semi-finished and finished rolled products like section steel and billets. Its activity level increased significantly, reaching 94% in October, a substantial rise from 65% in May. While “Turkey exported over 16 million tons of steel in January-October” indicates increasing Turkish exports, a direct correlation to Laiwu’s increased production cannot be established based solely on the provided information, though increased demand may be a contributing factor.

Shandong Taishan Steel Group Co., Ltd., also an integrated plant, has a crude steel capacity of 5 million tons and utilizes BF, BOF, and EAF processes to produce hot and cold rolled coil and stainless steel. The plant’s activity remained consistently low, fluctuating between 13% and 18% throughout the observed period. No direct connection can be established between this consistently low activity and the provided news articles.

Shandong Luli Steel Co., Ltd., an integrated steel plant with a capacity of 1.4 million tons, produces hot rolled ribbed steel bars, round steel, and billets using BF and BOF processes. Its activity increased to 53% in October from 39% in May. As with Laiwu, a direct connection to Turkish steel import trends cannot be definitively established based on the provided news articles, but may indicate a broader increase in regional demand.

Evaluated Market Implications:

The significant increase in activity at Laiwu Iron and Steel, reaching 94% in October, coupled with Turkey’s rising steel imports, suggests potential constraints in regional supply. Steel buyers should consider:

- Diversifying sources for section steel and billets: Given Laiwu’s production focus and high activity, reliance on this single supplier poses a risk.

- Securing contracts for Q1 2026: Anticipating continued demand from Turkey and potentially elsewhere, locking in contracts now can mitigate price increases.

- Monitoring Shandong Luli Steel Co., Ltd: Its increased activity might indicate an emerging supplier, but further monitoring is warranted to assess its reliability and capacity.

While Shandong Taishan Steel Group Co., Ltd.’s low activity does not currently pose immediate concerns, its capacity should be considered in long-term procurement strategies.