From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimistic: Strong Chinese Activity Offsets Global Uncertainties

Asia’s steel market shows positive sentiment, driven by robust activity in Chinese steel plants, despite global uncertainties. Activity increases correlate with European market dynamics discussed in “European heavy plate round-up: EU heavy plate prices set to rise on improved demand, higher costs“, where increased demand from infrastructure projects and CBAM-driven import costs potentially favor Asian exports. However, no direct link can be established between these developments and the NLMK USA price hikes reported in “NLMK USA raises prices for hot-rolled and cold-rolled steel by $50/t“.

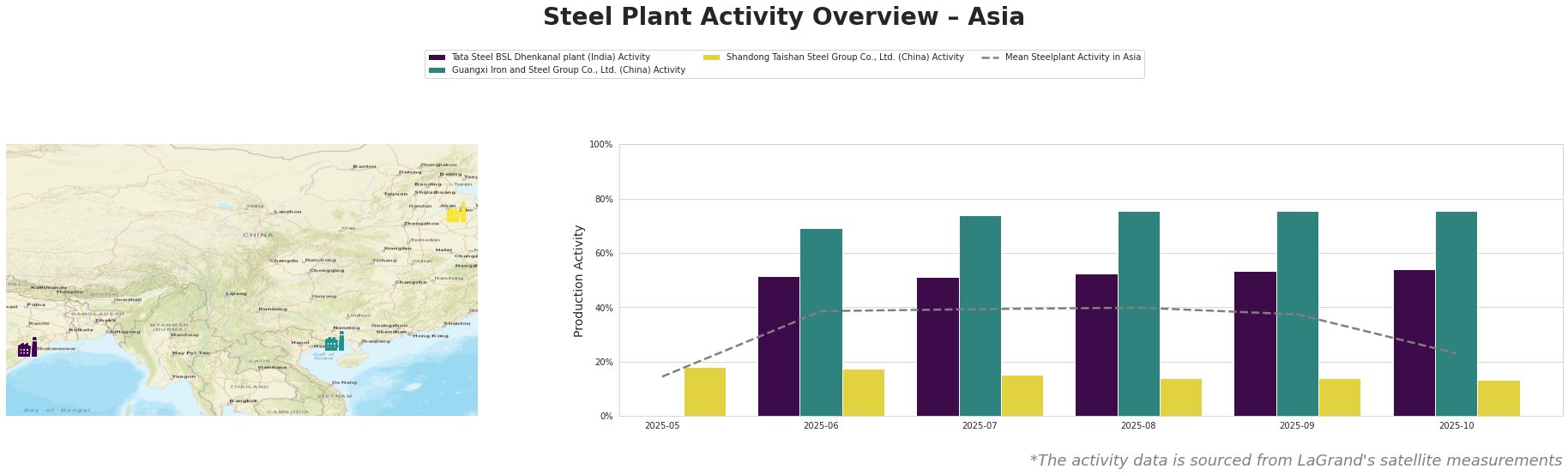

The mean steel plant activity in Asia increased significantly from May (14%) to August (40%) before decreasing to 23% in October.

Tata Steel BSL Dhenkanal plant (India): This integrated steel plant (BF and DRI) shows a consistently increasing activity trend, rising from 51% in June to 54% in October. As Tata Steel BSL produces hot rolled coil, pipe, sheet, and cold-rolled products, the increase in activity does not clearly relate to the events in the European market as described in “European heavy plate round-up: EU heavy plate prices set to rise on improved demand, higher costs“. Similarly, no direct impact can be established between its activity levels and the US price hikes reported in “NLMK USA raises prices for hot-rolled and cold-rolled steel by $50/t“.

Guangxi Iron and Steel Group Co., Ltd. (China): This integrated BF-based plant, producing finished rolled products such as cold-rolled coil and hot-dip galvanized coil, exhibits the highest activity levels of the observed plants. Activity steadily increased from 69% in June to a peak of 76% in September and October. The high and stable activity levels at Guangxi Iron and Steel Group Co., Ltd potentially supports the statement in “Prices for derivative metals in Europe are rising, consumption remains low“, indicating large material volumes arriving in Europe from Asia.

Shandong Taishan Steel Group Co., Ltd. (China): This integrated BF and BOF steel plant experienced relatively low activity levels compared to the others. Starting from 18% in May and June, its activity decreased to 13% in October. The stable but low activity does not directly correlate with the European developments described in “European heavy plate round-up: EU heavy plate prices set to rise on improved demand, higher costs” or the US price increases discussed in “NLMK USA raises prices for hot-rolled and cold-rolled steel by $50/t“.

Evaluated Market Implications:

The high activity at Guangxi Iron and Steel Group combined with the information in “Prices for derivative metals in Europe are rising, consumption remains low” suggests strong export capacity from this plant. This can potentially lead to downward pressure on European prices for cold-rolled and hot-dip galvanized coils.

Recommended Procurement Actions:

- Steel Buyers: Focus on procuring hot-dip galvanized and cold-rolled coils from Guangxi Iron and Steel Group to capitalize on potentially lower prices due to high production volumes and strong export capacity into the European Market.

- Market Analysts: Closely monitor pricing trends for cold-rolled and hot-dip galvanized coils in Europe and the potential impact of Asian imports, particularly from Guangxi Iron and Steel Group, on market prices, especially considering information available in “Prices for derivative metals in Europe are rising, consumption remains low“.