From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Exports Mixed Amidst Domestic Growth: Pig Iron Surges, Semi-Finished Falters, and Plant Activity Varies

Ukraine’s steel sector presents a mixed outlook, with rising pig iron exports contrasting with declines in semi-finished products. According to “Ukraine’s total steel exports down 9.9 percent in Jan-Oct 2025,” overall steel exports decreased by 9.9% year-on-year, while domestic steel sales increased by 30.1%. “Ukraine reduced exports of semi-finished products by 35.5% y/y in January-October” directly correlates with satellite observed activity data, where no significant decline can be observed for any of the selected steel plants. This indicates that decline in export share is not directly related to a reduced crude steel production volume, which points towards challenges with transportation logistics and market access.

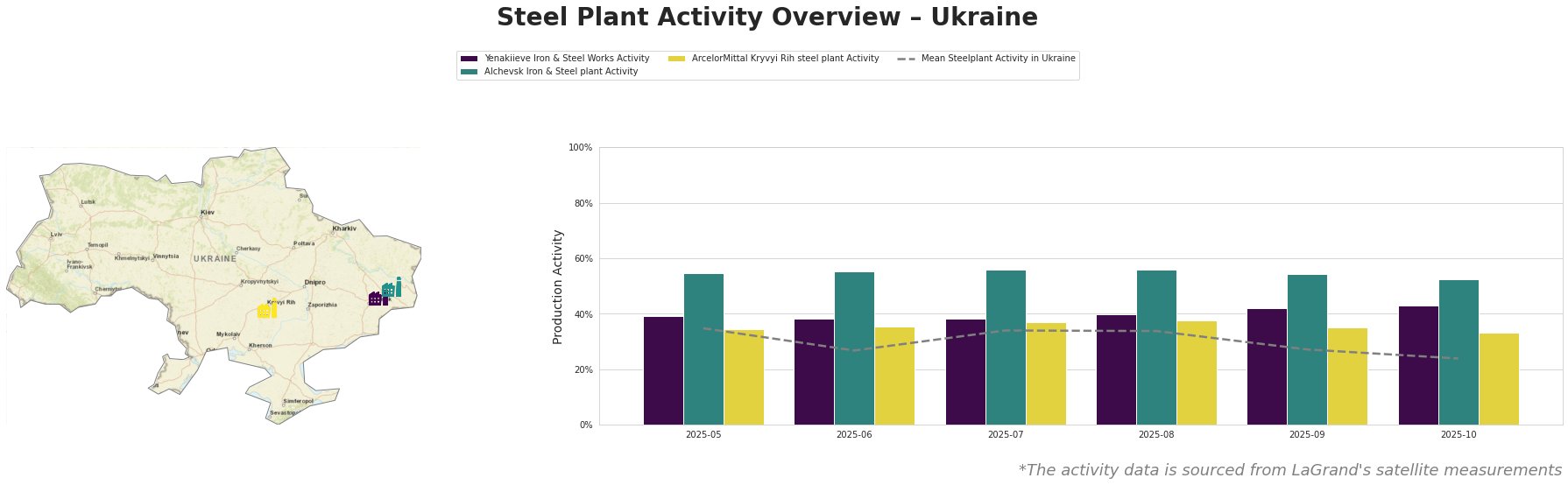

From May to October 2025, the mean steel plant activity in Ukraine shows a fluctuating trend, dropping from 35% in May to a low of 24% in October. Yenakiieve Iron & Steel Works consistently operated above the national average, peaking at 43% in October. Alchevsk Iron & Steel plant maintained the highest activity levels, ranging between 52% and 56%. ArcelorMittal Kryvyi Rih steel plant consistently operated at or below the national average.

Yenakiieve Iron & Steel Works, located in Donetsk, is an integrated BF-BOF steel plant with a crude steel capacity of 3.3 million tons. Satellite data indicates that the plant’s activity increased steadily from 39% in May to 43% in October, running above the average for all three plants. The increased export of pig iron reported in “Ukraine exported 1.59 million tons of pig iron in January-October”, may be attributable to this plant.

Alchevsk Iron & Steel plant, situated in Luhansk, also operates with integrated BF-BOF processes and has a crude steel capacity of 5.47 million tons. The plant has maintained a high activity level, ranging between 52% and 56% during the observed period, far above the average across Ukraine. This plant’s stable, high production could be contributing to the increased pig iron exports reported in “Ukraine exported 1.59 million tons of pig iron in January-October“.

ArcelorMittal Kryvyi Rih steel plant, located in Dnipropetrovsk, is the largest of the three, featuring integrated BF-BOF steelmaking with a crude steel capacity of 8 million tons. Activity at this plant has remained relatively stable but below average, fluctuating between 33% and 38%. The article “Ukraine reduced iron ore exports by 4.4% y/y in January-October” may be partly explained by observed relatively low activity levels, if the plant consumes iron ore from owned sources, as specified in the details.

The increase of ferroalloy exports reported in “Ferroalloy exports from Ukraine grew by 31.9% y/y in January-October” cannot be related to satellite-observed activity of the steel plants, as they are not producing this product.

Market Implications:

- The observed decline in mean steel plant activity, combined with decreased overall steel exports reported in “Ukraine’s total steel exports down 9.9 percent in Jan-Oct 2025,” suggests potential supply constraints and logistics challenges that may impact availability, despite increased domestic demand.

- Despite decreased export and steel production volumes, the relative resilience of Yenakiieve and Alchevsk Iron & Steel plants suggests they might represent more stable sources of supply.

Procurement Actions:

- Steel buyers should prioritize securing contracts with Yenakiieve and Alchevsk Iron & Steel, leveraging their higher, more stable observed activity levels to mitigate potential disruptions stemming from broader export declines highlighted in “Ukraine’s total steel exports down 9.9 percent in Jan-Oct 2025“.

- Given the decrease in semi-finished product exports reported in “Ukraine reduced exports of semi-finished products by 35.5% y/y in January-October,” purchasers requiring these products should diversify their supply base beyond Ukraine or secure long-term contracts to ensure availability and stable pricing, since domestic sales increased significantly.

- The increased trade deficit reported in “Ukraine’s foreign trade deficit in goods increased 1.5 times in January-September” warrants careful monitoring of currency fluctuations and trade policies, which could further impact steel prices and import/export dynamics.