From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market: CBAM Uncertainty & Demand Weakness Impacting Production, No Major Price Changes Expected Before Q1 2026

European steel faces persistent challenges due to weak demand and upcoming trade regulations. According to “EUROFER: Apparent steel consumption not expected to improve substantially before Q1 2026,” EU steel consumption is unlikely to improve significantly before Q1 2026 due to factors including the war in Ukraine and high energy prices. The “European steel HRC market still quiet amid push for higher offers” article highlights “terribly low” demand and the upcoming EU Carbon Border Adjustment Mechanism (CBAM) as key factors. While there is a push for higher offers reported in “Overview of European roll and environmentally friendly steel: roll prices in Northwest Europe are rising,” this is largely driven by anticipated import restrictions rather than a fundamental demand surge, and is not reflected in increased plant activity. No direct relationship between the ‘European longs market stable overall‘ news and plant activity can be established from the available data.

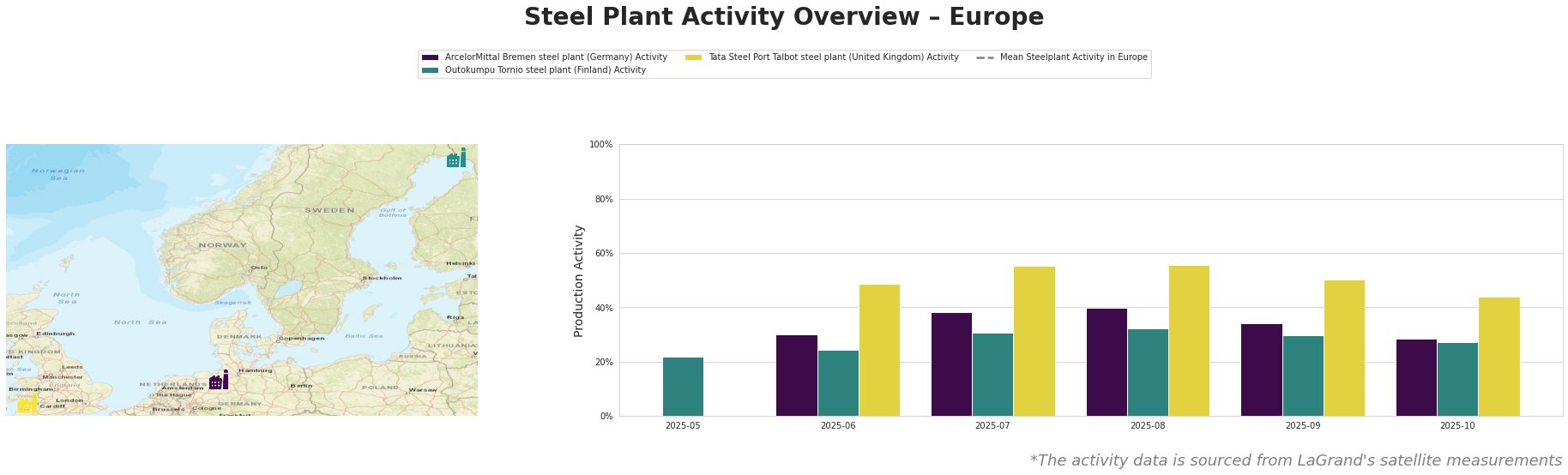

The average steel plant activity in Europe has fluctuated significantly, with a high in July/August and a marked decline in October, showing general instability.

ArcelorMittal Bremen: An integrated BF/BOF steel plant with a crude steel capacity of 3.8 million tonnes per year, primarily producing finished rolled products for automotive, construction, and energy sectors. Plant activity increased steadily from 30% in June to 40% in August but has since decreased to 29% in October. This recent downturn might correlate with the weak demand described in “European steel HRC market still quiet amid push for higher offers” and the overall consumption outlook from “EUROFER: Apparent steel consumption not expected to improve substantially before Q1 2026,” though a direct causal relationship cannot be explicitly confirmed.

Outokumpu Tornio: A stainless steel plant with an EAF-based production route and a crude steel capacity of 1.2 million tonnes annually, supplying to automotive, construction and other industries. Activity increased from 22% in May to 32% in August and then experienced a decrease to 27% in October. This activity pattern could be related to broader trends outlined in the EUROFER report, but no direct connection can be explicitly established based on the provided news.

Tata Steel Port Talbot: An integrated BF/BOF steel plant with a crude steel capacity of 5 million tonnes per year. It produces slabs, hot-rolled, cold-rolled and galvanised coils. Activity at Port Talbot exhibited a more stable trend compared to the other two plants, peaking at 56% in August and decreasing to 44% in October. There is no explicit evidence in the provided news articles to directly explain this decline.

Given the uncertainty surrounding CBAM and its potential impact on import availability, as well as the weak demand outlook, steel buyers should:

- Focus on Short-Term Contracts: Due to the volatile market conditions and unclear impact of CBAM, prioritizing shorter-term contracts (e.g., 1-3 months) will allow for greater flexibility and responsiveness to price fluctuations. This aligns with the news regarding “terribly low” demand (European steel HRC market still quiet amid push for higher offers).

- Closely Monitor Import Quotas: Closely monitor announcements regarding import quotas and CBAM implementation details, as this will directly affect the availability and cost of imported steel, as highlighted in “Overview of European roll and environmentally friendly steel: roll prices in Northwest Europe are rising“.

- Diversify Suppliers, particularly local suppliers: While EUROFER’s report highlights general production weakness, it is reasonable to anticipate local suppliers, especially those focusing on green steel production may become more competitive in the near future.

- No Immediate Price Increases Expected: Based on the news and plant activity, it is not likely prices will significantly increase in the short-term. Buyers can expect more stable prices until Q1 2026.