From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Signals Robust Recovery Amid Government Shutdown Resolution

North America’s steel market displays signs of a strong rebound, fueled by optimism surrounding the potential end of the government shutdown. While direct links between plant activity and the news article, “Morning Bid: Tech bounce stalls“ cannot be established, the article “Longest government shutdown in history nears likely end as House moves on funding bill“ directly impacts market sentiment and expectations for infrastructure projects, which could, in turn, increase steel demand. The article, “Stock market today: Dow, S&P 500, Nasdaq diverge as Big Tech wobbles ahead of House shutdown vote“ illustrates ongoing market instability, making a clear assessment difficult.

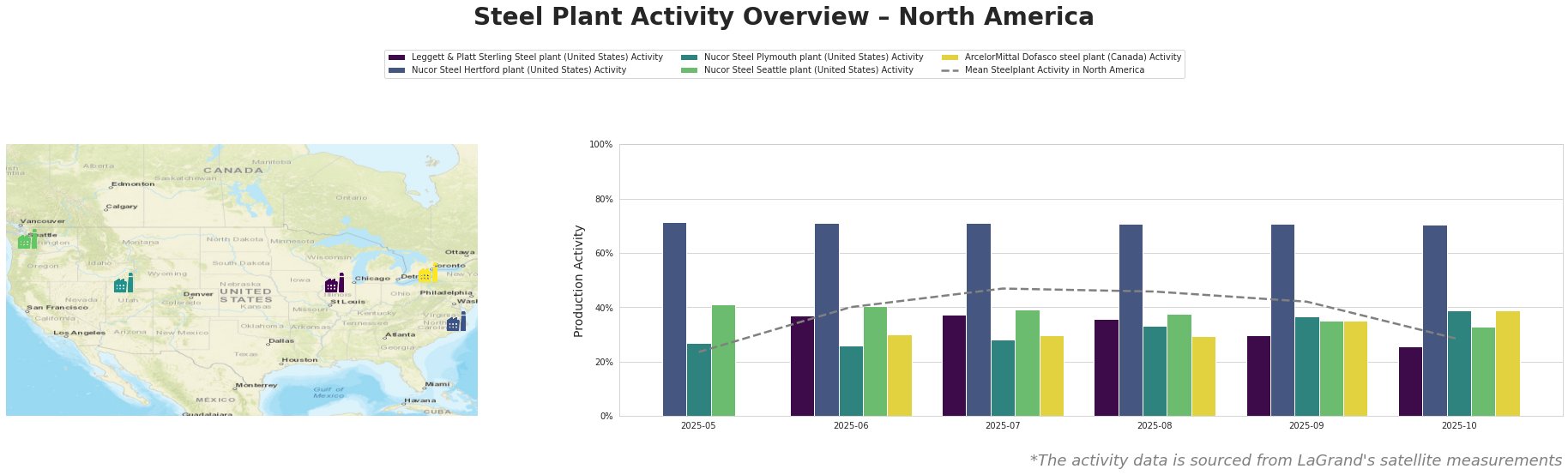

Overall, the mean steel plant activity in North America shows a decline from a peak of 47% in July 2025 to 28% in October 2025. Nucor Steel Hertford plant consistently operated at 71% activity throughout the observed period. The Leggett & Platt Sterling Steel plant shows a moderate decline from 37% in June/July to 26% in October. Nucor Steel Plymouth plant displays an increasing trend from 27% in May to 39% in October. Activity at the Nucor Steel Seattle plant declined steadily from 41% in May to 33% in October. The ArcelorMittal Dofasco steel plant activity increased from 30% in June/July to 39% in October.

Leggett & Platt’s Sterling Steel plant, located in Illinois, produces semi-finished and finished rolled products like billet and rod using EAF technology. Activity at this plant decreased from 37% in June/July to 26% in October. Given the focus on tools and machinery end-users, this decline might reflect broader industrial slowdowns. No direct connection to the provided news articles could be established.

Nucor Steel’s Hertford plant in North Carolina, with a capacity of 1542 ttpa of crude steel via EAF, maintained a consistently high activity level of 71% throughout the reporting period. This plant produces plate for diverse sectors, including automotive, building, and energy. Sustained high activity suggests robust demand across these sectors, irrespective of government shutdown concerns highlighted in “Longest government shutdown in history nears likely end as House moves on funding bill”.

Nucor Steel’s Plymouth plant in Utah, producing finished rolled bar products for similar end-user sectors as the Hertford plant, experienced an increase in activity from 27% in May to 39% in October. This rise may signal growing demand for bar products, possibly linked to infrastructure projects anticipating resolution of the government shutdown. Again, No direct connection to the provided news articles could be established.

Nucor Steel’s Seattle plant, also focused on finished rolled bar products, saw a decrease in activity from 41% in May to 33% in October. This contrasts with the Plymouth plant, potentially indicating regional demand variations or specific product mix adjustments within Nucor. No direct connection to the provided news articles could be established.

ArcelorMittal Dofasco, a major integrated steel plant in Canada with both BOF and EAF capabilities, produces a wide range of finished rolled products. Its activity increased from 30% in June/July to 39% in October. The increased plant activity could be related to pent-up demand if the “Longest government shutdown in history nears likely end as House moves on funding bill” is indeed resolved, which may benefit ArcelorMittal in the region due to their proximity.

Evaluated Market Implications:

The potential resolution of the government shutdown, discussed in “Longest government shutdown in history nears likely end as House moves on funding bill”, is expected to release pent-up demand, particularly in infrastructure projects. While Nucor Steel Hertford operates at high levels independent of the shutdown, other plants show fluctuating activity.

Recommended Procurement Actions:

- Steel buyers should closely monitor the progress of the House vote highlighted in the news articles. A successful vote could lead to a surge in steel demand, potentially impacting prices and availability.

- Given the increasing activity at Nucor Steel Plymouth and ArcelorMittal Dofasco, steel buyers should explore securing supply contracts with these plants, especially for bar products and a diverse range of finished rolled products, respectively. This could provide a hedge against potential supply disruptions elsewhere.

- Given the high activitiy of Nucor Steel Hertford, buyers of steel plate should monitor this plant closely.

- Buyers should consider the broader economic context highlighted in “Morning Bid: Tech bounce stalls”. While steel demand may increase with infrastructure spending, broader market volatility could still impact pricing and supply chains.