From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Industry Faces Uncertainty Amid Energy Concerns and Potential Outsourcing: Activity Declines Observed

Germany’s steel industry faces challenges stemming from energy costs and the potential relocation of production, as highlighted in news articles such as “German ‘steel dialogue’ highlights competitive electricity supply importance” and “Relocation of steel production from Germany threatens billions in losses“. While these articles discuss broad industry concerns, no direct link can be currently established between them and the observed satellite activity for each individual plant.

Here’s a summary of observed plant activity:

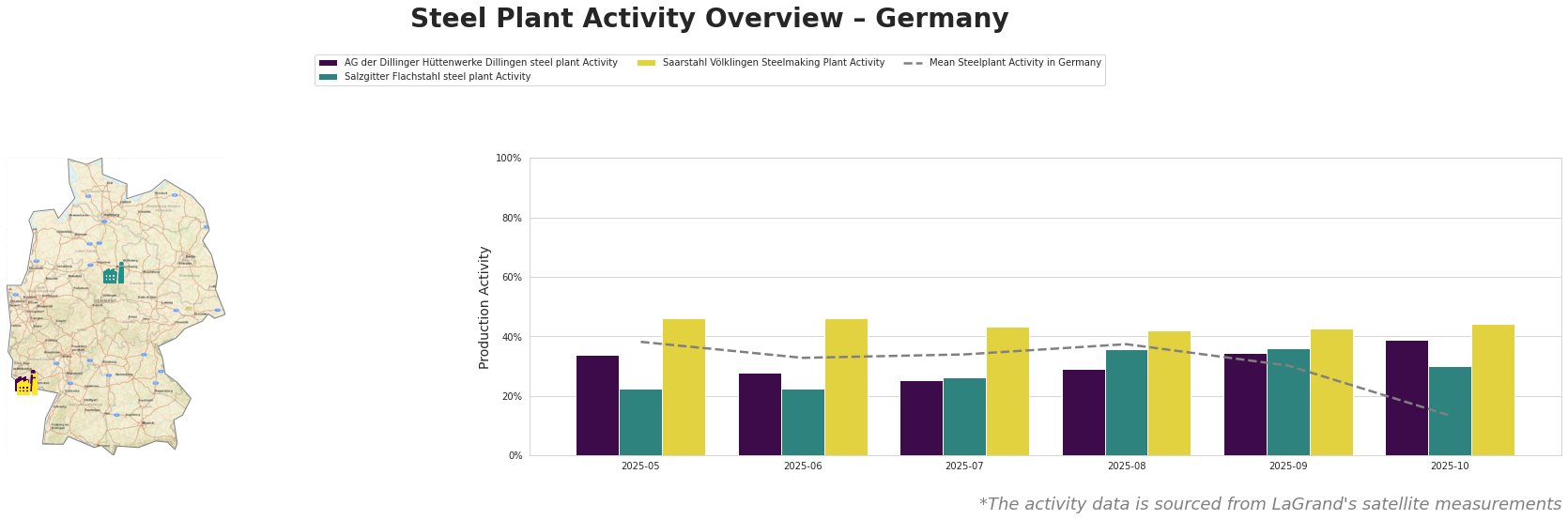

The mean steel plant activity in Germany shows a significant drop to 13.0% in October, after hovering between 30% and 38% in the preceding months.

AG der Dillinger Hüttenwerke Dillingen, a major integrated steel plant in Saarland with a BOF capacity of 2760 ttpa producing heavy-plate products, saw its activity fluctuate. From May to July, plant activity declined from 34% to 25%, then rose to a peak of 39% in October, contrasting the trend of the overall German steel activity dropping significantly in October. No direct link can be established between these fluctuations and the developments mentioned in the provided news articles.

Salzgitter Flachstahl, an integrated BF/BOF steel plant with a crude steel capacity of 5200 ttpa, focusing on flat steel products for automotive and construction, experienced fluctuating activity. Activity declined to 22% in June, rose to a peak of 36% in August and September, and then declined to 30% in October, following the general market trend in that period. Salzgitter is planning a transition to hydrogen-based steel production by 2050. No direct link can be established between observed activity changes and announcements around the company’s green transition plans, or with discussions from the news articles regarding energy costs.

Saarstahl Völklingen, an electric and oxygen steelmaking plant in Saarland, has a BOF capacity of 3240 ttpa and an EAF capacity of 300 ttpa. The plant maintained a relatively stable activity level, ranging from 42% to 46% over the observed period, with slight declines in July and August. No direct connection can be established between the stable activity levels at Saarstahl Völklingen and the concerns about industry-wide challenges discussed in the provided news articles.

Evaluated Market Implications:

Given the significant drop in mean steel plant activity in Germany, steel buyers should prepare for potential supply disruptions. While the articles “Germany will support EU plan to protect steel industry – steel summit” and “Germany to lose billions if steel outsourced: study” suggest government support for the industry, the immediate impact of these initiatives on production is uncertain.

Recommended Procurement Actions:

- Steel Buyers: Given the instability highlighted by both news and activity in October 2025, review existing contracts with German suppliers and assess potential risks related to delivery timelines. Diversify supply sources to mitigate potential disruptions. Prioritize suppliers demonstrating stable production or those with robust energy hedging strategies. Consider increasing inventory levels of critical steel products to buffer against potential shortages. Request transparency from suppliers regarding their energy costs and contingency plans for production adjustments.

- Market Analysts: Closely monitor energy policy developments in Germany and their potential impact on steel production costs. Track capacity utilization rates at individual steel plants in Germany to identify potential bottlenecks. Assess the financial health of German steel producers to identify companies at higher risk of production cuts or closures. Monitor trade flows to anticipate potential shifts in steel sourcing patterns.