From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Pressure to Halt Russian Steel Imports Intensifies Amid EU Industry Concerns: Activity Monitoring Key

Europe’s steel market faces potential volatility driven by political pressure to halt Russian steel slab imports amid concerns about competitiveness. This report analyzes recent activity at selected steel plants in light of these developments. The introduction of duties, or the halt of imports, is related to the article Berlin demands halt to imports of Russian slabs into the EU, which explains that Germany is urging the EU to immediately halt imports of Russian steel slabs, a semi-finished product. Concerns in the German ‘steel dialogue’ highlights competitive electricity supply importance news article reveal that Germany is pushing for measures to support its steel industry, explicitly mentioning trade diversion and the need for robust trade protection.

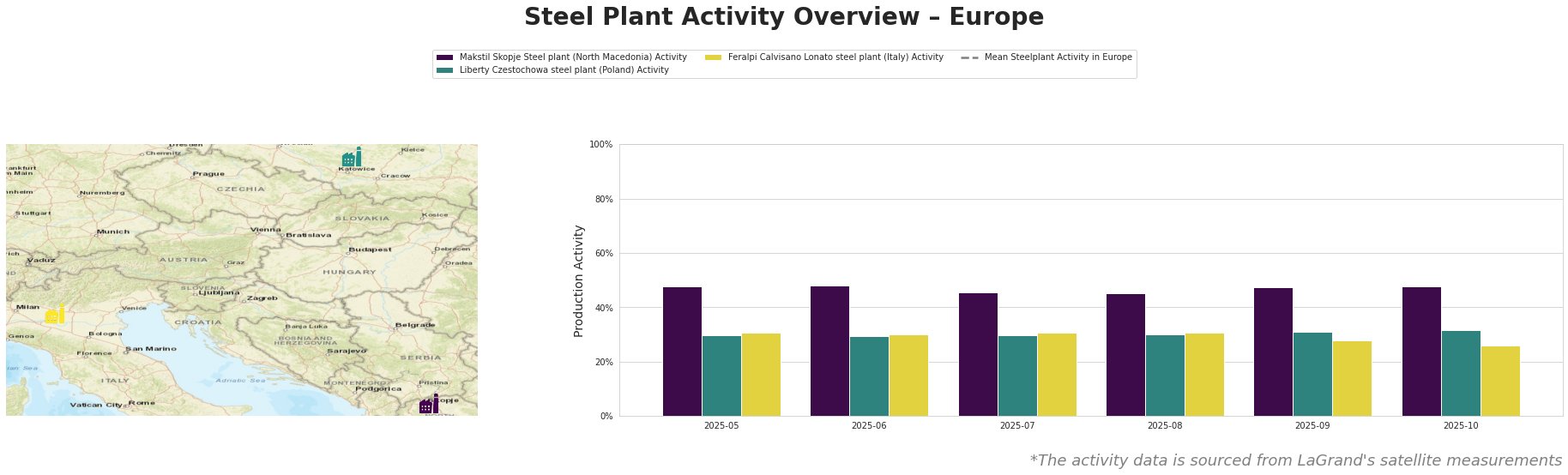

The mean steel plant activity in Europe has fluctuated significantly, peaking in July and August 2025 before declining sharply in September and October 2025. The decline in recent months potentially reflects market uncertainty related to trade policy and energy costs, although a direct link to any specific news article cannot be definitively established from the provided information.

Makstil Skopje Steel plant (North Macedonia): This EAF-based plant with a capacity of 550 ttpa, specializing in slab production, maintained a relatively stable activity level throughout the period, fluctuating between 45% and 48%. The plant’s stable activity contrasts with the fluctuations in the European mean, suggesting that local market factors may be outweighing broader European concerns related to Russian steel imports. No direct connection between the observed activity levels and the news articles could be established.

Liberty Czestochowa steel plant (Poland): This EAF-based plant, producing plate with a capacity of 840 ttpa, showed consistently low activity levels, ranging from 30% to 32%. A slight increase in activity was observed in September and October. Given the discussions about EU steel protectionism in the news article Germany will support EU plan to protect steel industry – steel summit, the low activity levels may indicate market pressures, or planned maintenance cycles. No explicit connection to the news articles could be established from the provided information.

Feralpi Calvisano Lonato steel plant (Italy): This EAF-based plant with a capacity of 600 ttpa, producing billets, experienced a slight decline in activity from 31% in August 2025 to 26% in October 2025. As a steel producer located within the EU, it may face greater market volatility due to overcapacities and increasing pressure in the market. No explicit connection between the observed activity and the provided news articles could be established.

Evaluated Market Implications:

The political pressure from Germany to halt Russian steel slab imports, as highlighted in Berlin demands halt to imports of Russian slabs into the EU and German Vice Chancellor Demands Immediate Halt to Russian Steel Slab Imports Amid Ongoing EU Industry Crisis, introduces a clear risk of supply disruption, particularly for companies relying on Russian slabs. The Relocation of steel production from Germany threatens billions in losses and Germany to lose billions if steel outsourced: study news articles also underscores the potential for broad market disruption if German steel production decreases.

Given this uncertainty, steel buyers and market analysts should prioritize the following procurement actions:

- Diversification of Slab Suppliers: Immediately identify and qualify alternative slab suppliers outside of Russia to mitigate potential disruptions caused by import bans.

- Monitoring Policy Developments: Closely monitor EU policy changes regarding steel imports and sanctions. Subscribe to relevant trade publications and engage with industry associations to stay informed.

- Contractual Flexibility: Negotiate contracts with steel suppliers that allow for flexibility in sourcing and pricing to adapt to potential market volatility.

- Regional Focus: Given the relatively stable activity at Makstil Skopje, consider exploring opportunities within the Balkan region to diversify supply chains.

- Supply Risk Assessment: Given the lower activity level of the plant in Poland, analysts should more closely scrutinize Liberty Czestochowa steel plant as a potential source of risk if procurement relies on this plant.

These measures will enable proactive management of the risks associated with the evolving European steel market.