From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market: Energy Subsidies and Russian Import Concerns Amidst Activity Fluctuations

Germany’s steel sector faces a complex landscape of potential energy subsidies, pressure to halt Russian slab imports, and observed plant activity variations. The planned introduction of subsidized industrial electricity prices as of 2026, as highlighted in “Germany to introduce industrial electricity price as of 2026” and “Germany expects to introduce industrial electricity prices in 2026“, aims to alleviate cost pressures. Simultaneously, “Berlin demands halt to imports of Russian slabs into the EU” underscores concerns about unfair competition. While these policies aim to stabilize the sector, satellite data reveals fluctuating plant activity, although a definitive link to these policy discussions cannot be directly established.

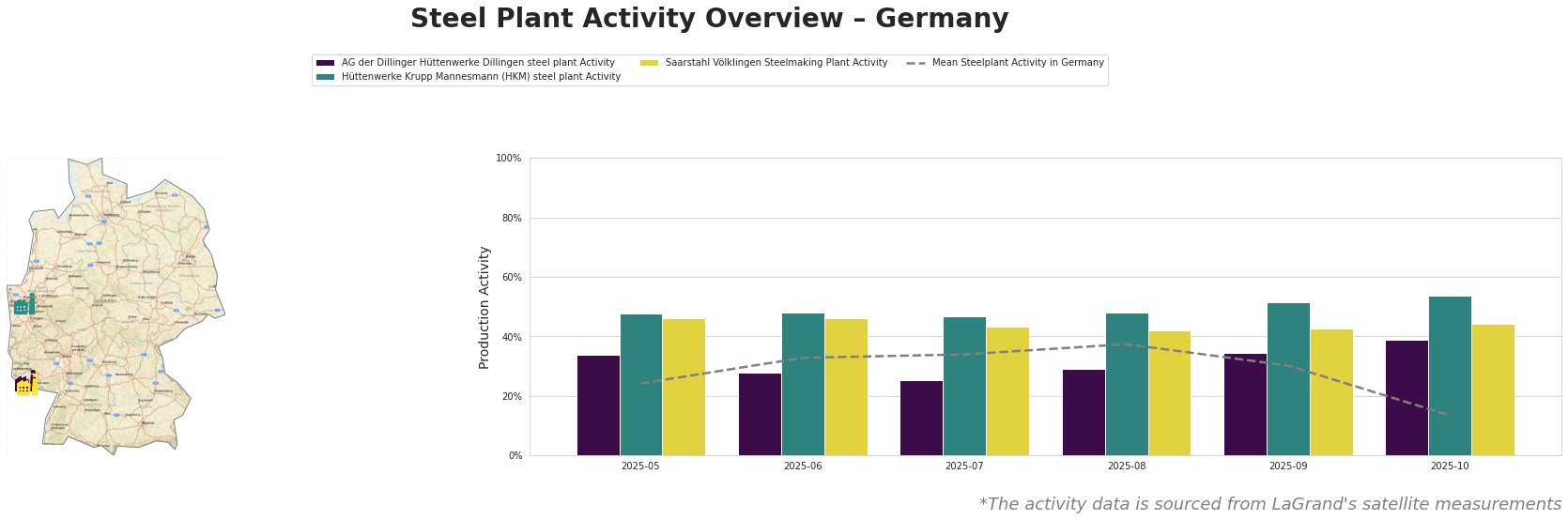

Here’s a breakdown of recent steel plant activity:

Overall, the mean steel plant activity in Germany demonstrates a considerable drop to 13% in October 2025, after relative stability between May and September 2025. This decline could be related to the uncertainty detailed in “Relocation of steel production from Germany threatens billions in losses” and “Germany to lose billions if steel outsourced: study“.

Plant-Specific Analysis:

-

AG der Dillinger Hüttenwerke Dillingen steel plant: This integrated (BF/BOF) plant, boasting a crude steel capacity of 2.76 million tonnes, exhibited fluctuating activity. Activity decreased from 34% in May 2025 to 25% in July 2025, then rebounded significantly, reaching 39% in October 2025, exceeding the national average. There is no clear connection between these activity changes and the news articles provided.

-

Hüttenwerke Krupp Mannesmann (HKM) steel plant: This integrated plant, with a substantial crude steel capacity of 6 million tonnes, primarily produces slabs and rolled products. HKM showed a consistently high activity level, fluctuating between 47% and 54%, substantially exceeding the national average in all reported months, peaking in October. There is no clear connection between these consistently high activity rates and the news articles provided.

-

Saarstahl Völklingen Steelmaking Plant: This plant, utilizing both BOF and EAF processes with a crude steel capacity of 3.54 million tonnes, maintained relatively stable activity levels. While there were fluctuations, the overall range was tighter (42% to 46%). There is no clear connection between these fairly stable activity rates and the news articles provided.

Evaluated Market Implications:

The potential for subsidized electricity prices, as discussed in “German ‘steel dialogue’ highlights competitive electricity supply importance“, could positively impact the cost structure of energy-intensive plants like HKM and Dillinger. The push to halt Russian slab imports, mentioned in “Germany will support EU plan to protect steel industry – steel summit“, if successful, could reduce the supply of semi-finished products, potentially increasing demand for domestically produced slabs from plants like HKM.

Procurement Actions:

- Monitor policy developments closely: Track the progress of the industrial electricity price implementation and the EU’s response to Germany’s call for a halt to Russian slab imports.

- Assess slab supply chain risks: Steel buyers relying on slab imports should evaluate alternative sourcing options in anticipation of potential disruptions resulting from stricter import regulations.

- Evaluate domestic supply options: Given the potential shift in demand towards domestic producers, steel buyers should explore and secure supply agreements with German steel plants, particularly HKM, which has demonstrated consistent high activity.

- Negotiate contracts with consideration of energy subsidies: Consider the impact of potential energy subsidies on pricing and negotiate contracts accordingly, especially with Dillinger and HKM, both energy-intensive integrated steel plants.