From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth American Steel Market Surges Amid COP30 Momentum: Plant Activity Soars

South America’s steel market exhibits a very positive sentiment as Brazil prepares to host COP30, with increased steel plant activity suggesting strong demand. The UN climate summit in Belem is calling to action as referenced in, “Cop 30 success hinges on GHG cuts, finance response” which seeks tangible commitments, potentially boosting demand for steel in infrastructure and renewable energy projects.

The provided news data contains the following articles “Cop 30 success hinges on GHG cuts, finance response“, “Brazil environment minister defends mitigation“, and “COP30: Was Brasilien an Klimakonferenzen ändern will“. While the news articles emphasize climate action and the importance of emissions reduction, no direct relationship to observed activity levels can be established at this time.

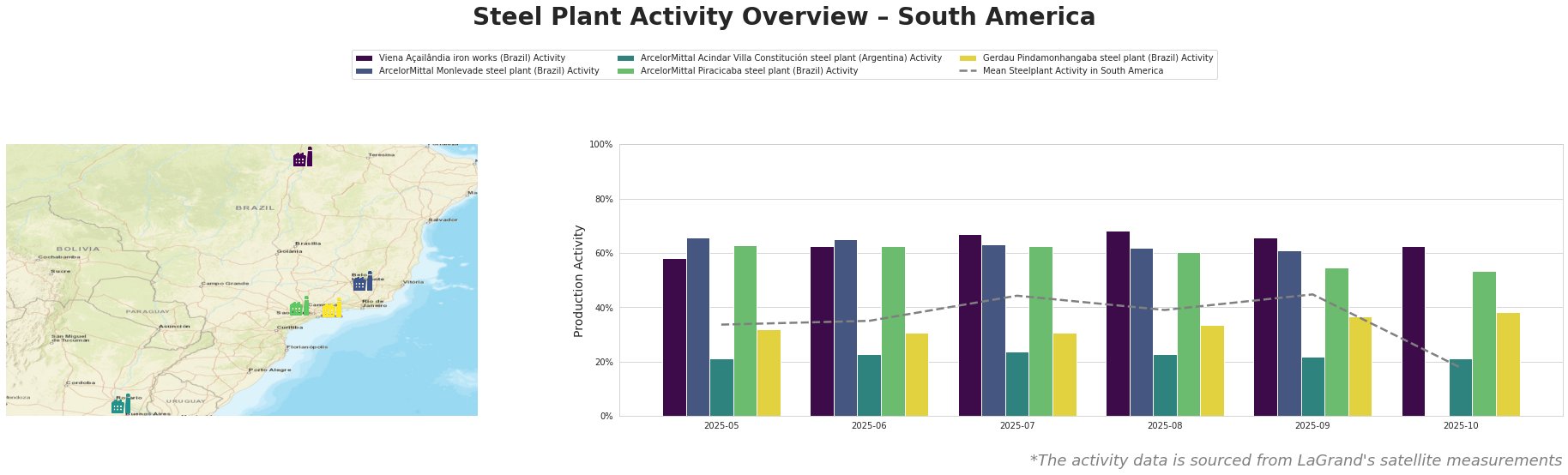

Here’s a summary of the observed steel plant activity:

Overall, the mean steel plant activity in South America experienced a significant drop in October, falling from 45% to 18%. Individual plant activities varied. Viena Açailândia iron works consistently maintained high activity levels, above 58%, peaking at 68% in August. ArcelorMittal Monlevade steel plant also saw high activity until September, with October’s data missing. ArcelorMittal Acindar Villa Constitución steel plant remained relatively stable, ranging from 21% to 24%. ArcelorMittal Piracicaba steel plant experienced a decrease from May to October (63% to 53%). Gerdau Pindamonhangaba steel plant had the lowest recorded activity, peaking at 38% in October.

Plant Details:

Viena Açailândia iron works, located in Maranhão, Brazil, primarily focuses on ironmaking using blast furnace technology, with a capacity of 500 ttpa. Observed activity remained high between May and October, peaking at 68% in August. While the plant holds a ResponsibleSteelCertification, the news articles about Brazil’s focus on GHG emission cuts at Cop 30 and emphasis on concrete action plans is unlikely to have a direct bearing on the iron works. No direct connection between news and activity could be established.

ArcelorMittal Monlevade steel plant in Minas Gerais, Brazil, is an integrated steel plant with a crude steel capacity of 1200 ttpa, utilizing BF and BOF technologies. Activity was high but data is missing for October. While the plant is ResponsibleSteelCertified, and is likely to benefit from the increased demand for sustainable steel production being advocated at COP30, no direct link between news and its recent activity levels can be definitively established.

ArcelorMittal Acindar Villa Constitución steel plant in Santa Fe, Argentina, is an integrated DRI plant with a crude steel capacity of 1750 ttpa, utilizing DRI and EAF technologies. Its activity remained stable. The plant is notable for a renewable energy project investment, aligning with the themes of “Cop 30 success hinges on GHG cuts, finance response” and “Brazil environment minister defends mitigation“. However, no direct connection between news and activity could be established.

ArcelorMittal Piracicaba steel plant in São Paulo, Brazil, focuses on EAF steelmaking with a capacity of 1100 ttpa. The plant saw a gradual decrease in activity from 63% in May to 53% in October. As a ResponsibleSteelCertified EAF steelmaker, its activity should benefit from the focus of Brazil hosting COP30 on mitigation. However, no direct connection between news and the decrease in activity could be established.

Gerdau Pindamonhangaba steel plant, also in São Paulo, Brazil, operates an EAF steel plant with a capacity of 620 ttpa. The plant’s activity remained the lowest among those observed. While it produces finished rolled products for building and infrastructure, its relatively low activity and lack of ISO certifications compared to other plants suggest potential constraints. No direct connection between news and plant activity could be established.

Evaluated Market Implications:

The sudden, significant drop in average steel plant activity in South America in October, combined with the backdrop of COP30 and its push for climate action, warrants careful consideration. The missing activity data for ArcelorMittal Monlevade in October adds to the uncertainty.

Recommended Procurement Actions:

- Steel Buyers: Given the overall positive market sentiment but also with the significant drop in activity for October, consider diversifying suppliers to mitigate potential short-term supply disruptions, especially from ArcelorMittal Piracicaba due to its continual activity decrease and unknown reasons behind the missing activity data for ArcelorMittal Monlevade.

- Market Analysts: Closely monitor the reasons behind the drop in average plant activity in October, and especially the reasons behind the activity of ArcelorMittal Monlevade, and the correlation with upcoming COP30 meetings. Any reports of production halts, supply chain bottlenecks, or policy changes will need to be assessed. Specifically, how mitigation or adaptation strategies are applied.

These recommendations are based on the observed activity data and the potential influence of the COP30 summit on the region’s steel industry.