From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Faces Downturn: Tech Sell-Off & Job Losses Impacting Production

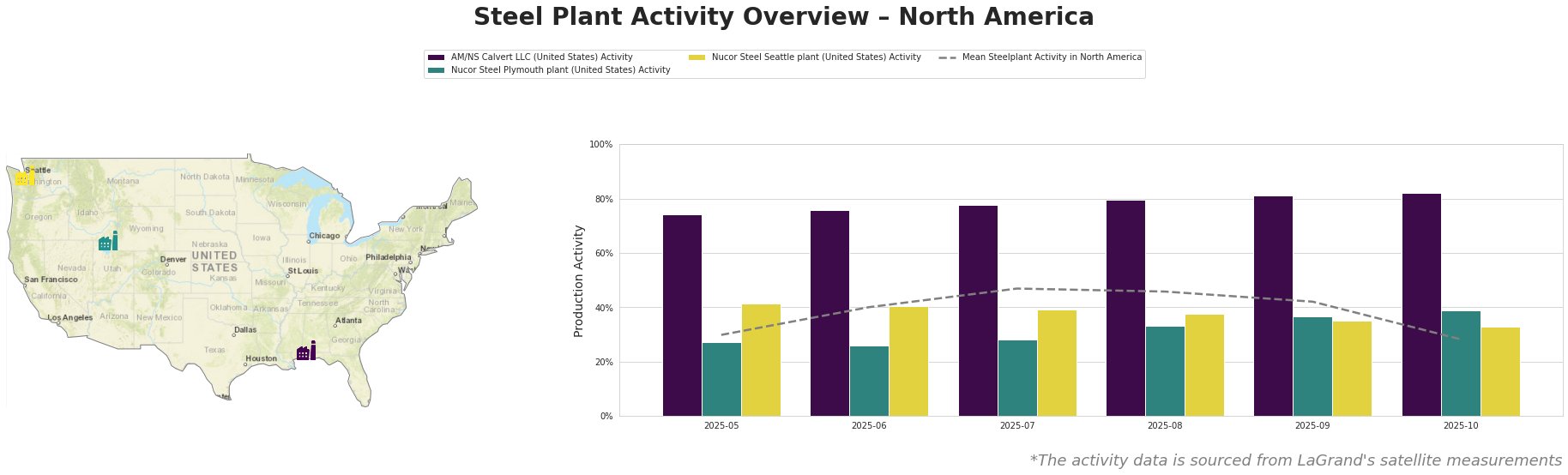

North America’s steel market is facing headwinds due to broader economic uncertainties. According to the news articles “Stock market today: Dow, S&P 500, Nasdaq sink as AI valuation concerns mount amid bleak jobs data” and “Stock market today: Dow, S&P 500, Nasdaq waver as layoffs jump, key Tesla vote looms“, disappointing jobs data and concerns about tech valuations are impacting market sentiment. Satellite data reveals a significant drop in the mean steel plant activity across North America in October, potentially reflecting these concerns, while no direct relationship could be established.

The mean steel plant activity in North America experienced a marked decline, dropping from 42.0% in September to 28.0% in October. AM/NS Calvert LLC consistently operated well above the mean, reaching 82.0% activity in October. Nucor Steel Plymouth plant activity has shown a gradual increase over the observed period, reaching 39.0% in October but remaining below the North American mean. Nucor Steel Seattle plant activity has demonstrated a gradual downward trend, reaching 33.0% in October and also remaining below the North American mean.

AM/NS Calvert LLC, located in Alabama, is a significant producer of finished rolled steel products, including hot-rolled, cold-rolled sheet, and advanced coated products, utilizing EAF technology with a crude steel capacity of 1500 ttpa. The plant has shown consistent high activity, reaching 82% in October, bucking the overall market trend. No explicit connection between this trend and the news articles could be established.

Nucor Steel Plymouth plant in Utah, with a crude steel capacity of 908 ttpa, produces bar products using EAF technology. The plant’s activity has seen a slight increase over the months, reaching 39% in October, but remains below the North American average. No explicit connection between this trend and the news articles could be established.

Nucor Steel Seattle plant in Washington, producing bar products via EAF with a crude steel capacity of 855 ttpa, has experienced a gradual decline in activity, reaching 33% in October, below the North American average. No explicit connection between this trend and the news articles could be established.

Evaluated Market Implications:

Given the overall negative market sentiment reflected in the news and the observed drop in mean steel plant activity in October, potential supply disruptions, especially from plants operating below the mean, may occur. The article “Stock market today: Dow, S&P 500, Nasdaq sink as AI valuation concerns mount amid bleak jobs data” highlights concerns about the overall economic outlook, which could further impact steel demand and production.

Recommended Procurement Actions:

- For steel buyers: Given the declining mean steel plant activity, especially in the context of news highlighting economic uncertainty, consider diversifying your supply base to mitigate potential risks associated with disruptions from lower-performing plants. Closely monitor inventory levels and secure contracts with suppliers exhibiting stable or increasing production, such as AM/NS Calvert, to ensure continuity of supply. Focus on suppliers with responsible steel certification to align with sustainability goals.

- For market analysts: Closely monitor the evolution of layoff announcements and the broader stock market sentiment, as mentioned in the provided articles, and analyze the potential impacts on steel demand. Track steel plant activity levels alongside macroeconomic indicators to anticipate potential supply-side adjustments. Pay close attention to companies in the building and infrastructure and automotive sectors, as they are key customers of the steel plants, whose products include hot-rolled, cold-rolled sheet, advanced coated products and bars, analyzed in this report.