From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market Signals Strong Production Despite Climate Policy Debates

Germany’s steel market shows signs of resilience, supported by ongoing production activity amid debates on climate policy and emissions targets. Recent news articles, including “EU-Staaten einigen sich auf Klimaziel für 2040” and “Forschung: Gesellschaftliche Blockaden gefährden laut Studie Deutschlands Klimaziele,” highlight the tension between ambitious climate goals and practical implementation. While no direct correlation can be established, shifts in plant activities could be indicative of preparations for the upcoming changes.

The “Germany upbeat on Cop 30, defends EU climate deal” article suggests a proactive stance on climate partnerships, which could influence long-term investment decisions within the steel sector. The article “Analyse eines Ökonomen: Das große Risiko der grünen Umverteilungsdebatte“ raises concerns regarding the feasibility and timing of green redistribution policies, but no direct connection could be established with the satellite activity changes.

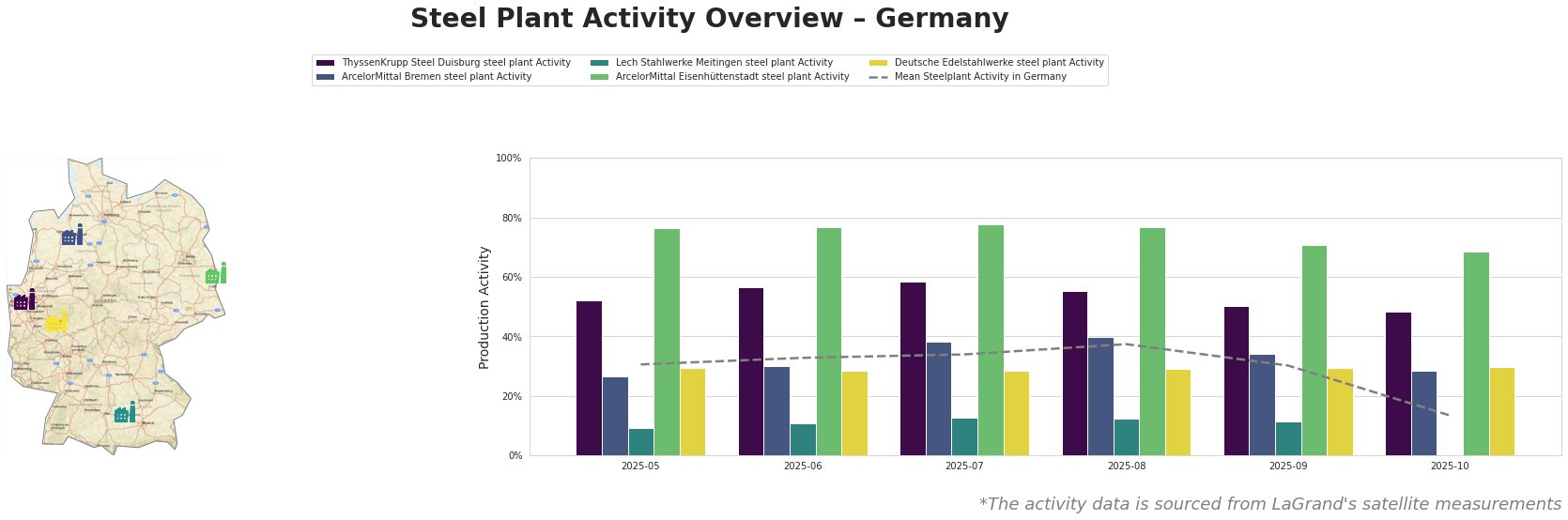

Observed plant activity levels are presented in the following table:

Overall, the mean steel plant activity in Germany has fluctuated, peaking at 37% in August and declining sharply to 13% in October. ThyssenKrupp Steel Duisburg consistently operates above the average, reaching a peak of 59% in July before decreasing to 48% in October. ArcelorMittal Bremen experienced a steady increase until August (40%), followed by a decline to 29% in October. Lech Stahlwerke Meitingen consistently shows activity levels significantly below the mean. ArcelorMittal Eisenhüttenstadt consistently shows activity levels significantly above the mean. Deutsche Edelstahlwerke remains relatively stable, showing slight fluctuations.

ThyssenKrupp Steel Duisburg: As a major integrated steel producer (13,000 kt crude steel capacity via BOF), ThyssenKrupp Steel Duisburg’s activity levels, although dropping from a peak of 59% in July to 48% in October, remain significantly above the national average. Given its focus on automotive, building, and energy sectors, this relatively high activity suggests sustained demand despite climate policy uncertainty. No direct link can be established.

ArcelorMittal Bremen: This integrated plant (3,800 kt crude steel capacity via BOF) showed increasing activity until August but experienced a notable drop to 29% in October. The plant’s reliance on hot rolled coils for automotive and building sectors might be affected by the evolving EU climate deal as described in “Germany upbeat on Cop 30, defends EU climate deal.” No direct link can be established.

Lech Stahlwerke Meitingen: A smaller electric arc furnace (EAF) based plant (1,400 kt crude steel capacity), Lech Stahlwerke Meitingen’s activity remains consistently low. The lack of activity increase contrasts with the generally positive market sentiment. No direct link to the provided articles can be established.

ArcelorMittal Eisenhüttenstadt: This integrated plant (2,400 kt crude steel capacity via BOF) maintains consistently high activity, significantly above the national average. Its product range, including hot-dip galvanized steel, used in automotive and construction, appears to be in strong demand. No direct link to the provided articles can be established.

Deutsche Edelstahlwerke: With a focus on specialty steel production via EAF (600 kt crude steel capacity), Deutsche Edelstahlwerke shows stable activity levels. Its position in providing billets and forged products implies steady demand from its end-user sectors. No direct link to the provided articles can be established.

Market Implications:

- The observed drop in overall average activity, combined with the concerns raised in “Forschung: Gesellschaftliche Blockaden gefährden laut Studie Deutschlands Klimaziele“, may indicate a cautious approach to production levels pending clarity on future climate policy implementations. The “EU-Staaten einigen sich auf Klimaziel für 2040” article suggests that while the broad direction of climate policy is set, the specifics of implementation and cost distribution remain uncertain, potentially influencing production planning.

- While ArcelorMittal Eisenhüttenstadt shows stable activity, the decline in ArcelorMittal Bremen activity, though without a direct correlation to specific news, could indicate regional or product-specific supply constraints, particularly for hot-rolled coils, potentially impacting the automotive and construction sectors.

Procurement Actions:

- Steel Buyers: Given the overall positive sentiment, continuously monitor activity for ArcelorMittal Bremen as potential supply chain disruptions are possible due to the observed decrease of plant activity. Seek to diversify HRC supply sources.

- Market Analysts: Closely watch the implementation details of the EU 2040 climate target and Germany’s domestic climate policies, focusing on their potential impact on individual steel plants and production costs.