From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Faces Production Cuts Amidst Russian Import Debate and Energy Crisis

Europe’s steel sector is under pressure, with production adjustments observed amidst ongoing debates surrounding Russian steel imports and the impact of high energy costs. The German steel industry is particularly affected, as highlighted in “Germany convenes steel summit in light of ongoing crisis in the sector” and “Klingbeil will kriselnden Stahlherstellern helfen“. These articles point to a confluence of factors threatening the industry’s competitiveness and leading to government intervention. While these factors provide a backdrop for potential production adjustments, a direct causal link between these articles and the satellite-observed activity levels cannot be explicitly established.

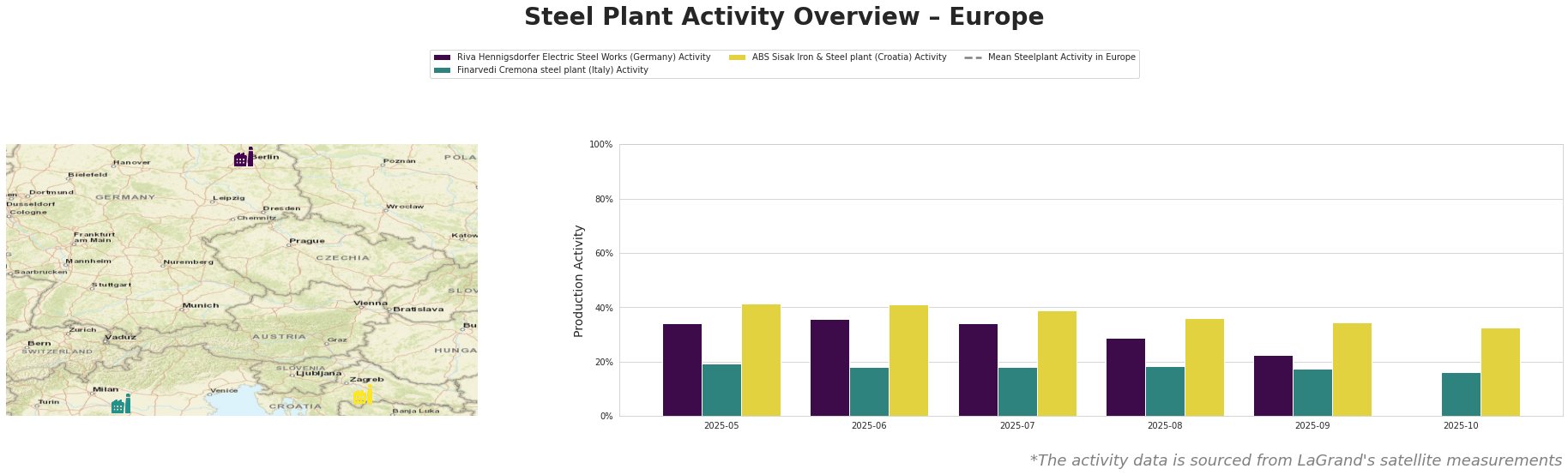

The mean steel plant activity in Europe fluctuated considerably between May and October 2025, peaking in July and August before declining in September and October. Riva Hennigsdorfer Electric Steel Works in Germany shows a decreasing trend in activity, from 36% in June to 22% in September. Finarvedi Cremona steel plant in Italy has shown a stable, low activity level across the observed months, with a slight dip to 16% in October. ABS Sisak Iron & Steel plant in Croatia experienced a steady decline from May (41%) to October (33%).

Riva Hennigsdorfer Electric Steel Works, located in Brandenburg, Germany, operates with two Electric Arc Furnaces (EAF) and has a crude steel capacity of 1 million tons per year, producing steel billets, rebar, bright steel, and round steel, primarily for the automotive sector. The plant’s activity saw a notable decline from 36% in June to 22% in September. This decrease could be related to the challenges outlined in “Germany convenes steel summit in light of ongoing crisis in the sector” which mentions the automotive crisis and high energy costs affecting the German steel industry. However, a direct causal link cannot be definitively established based solely on the provided information.

Finarvedi Cremona steel plant in Italy, equipped with two EAFs, boasts a crude steel capacity of 3.85 million tons per year and produces hot rolled coil and galvanized products for the automotive sector. Its activity remained consistently low between May and October 2025, ranging from 19% to 16%. No direct correlation can be explicitly established between the plant’s activity and the provided news articles.

ABS Sisak Iron & Steel plant in Croatia operates with a single EAF, has a crude steel capacity of 350,000 tons per year, and focuses on billet production for the automotive, energy, and transport sectors. The plant’s activity gradually decreased from 41% in May to 33% in October. No direct correlation can be explicitly established between the plant’s activity and the provided news articles.

The ongoing debate surrounding Russian steel imports, as highlighted in “German Vice Chancellor calls for early termination of imports of steel slabs from Russia” and “German vice chancellor calls for swift end to Russian steel slab imports“, could further disrupt supply chains if stricter measures are implemented. These articles reveal the complexity of EU sanctions and the continued reliance on Russian slabs.

Evaluated Market Implications:

- Potential Supply Disruptions: The declining activity at Riva Hennigsdorfer, coupled with the potential for stricter sanctions on Russian steel, raises concerns about supply disruptions, particularly for rebar and bright steel in the automotive sector.

-

Recommended Procurement Actions:

- Steel Buyers: Given the uncertainty surrounding Russian steel imports and the energy crisis, steel buyers should prioritize diversifying their supply base away from plants potentially reliant on Russian slabs or heavily impacted by high energy costs. Specifically, given the potential disruption at Riva Hennigsdorfer, buyers relying on their products should seek alternative suppliers in advance.

- Market Analysts: Analysts should closely monitor the outcome of the German steel summit on November 6, 2025, to assess the potential impact of government interventions on the German and broader European steel market. Focus should be on any announced subsidies for electricity prices, tariffs on imports, or restrictions on Russian steel.