From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Dips Amidst Oil Production Hikes, Supply Chain Shifts

Asia’s steel market presents a mixed outlook, with recent satellite data showing a decline in overall plant activity. This dip coincides with shifting dynamics in related sectors as highlighted in “Opec+ set to approve another output hike: Sources,” yet no direct causal link can be explicitly established between OPEC+ decisions and Asian steel plant activity based on the provided information. News regarding base oil market dynamics like “South Korea’s Sep base oil exports hit 11-month high” and “Singapore’s base oil imports hit four-year high in Sep“, reveal broader economic trends that could influence steel demand, although a direct connection to steel production levels cannot be verified within the current dataset.

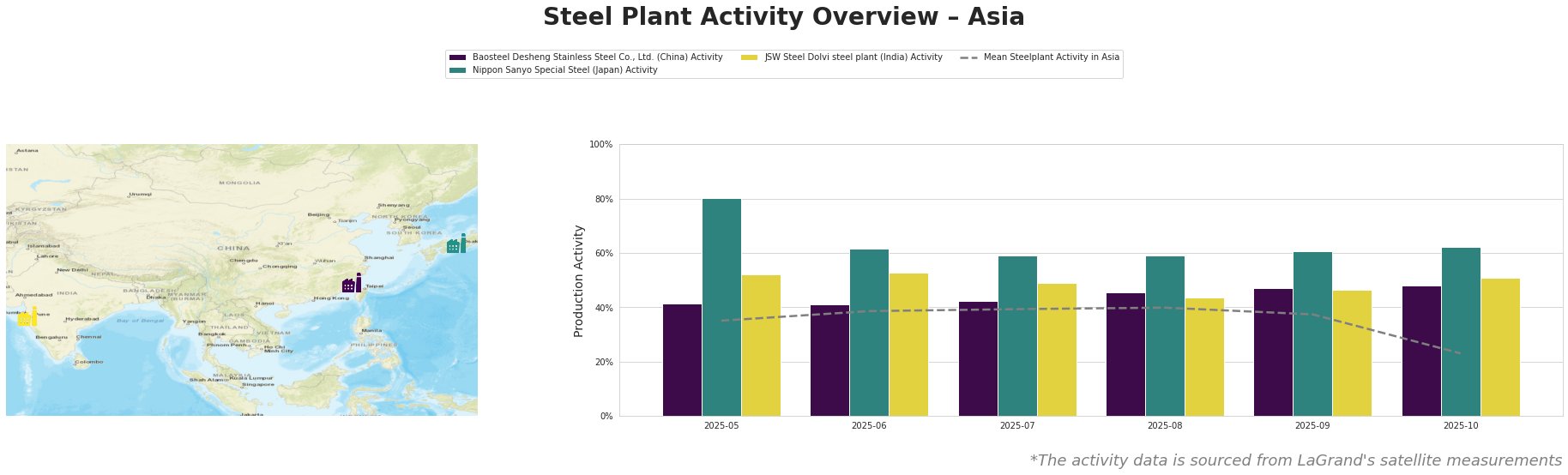

The table illustrates a general decline in the Mean Steelplant Activity in Asia, culminating in a significant drop to 23% in October. Baosteel Desheng consistently outperformed the average, reaching 48% activity in October, while Nippon Sanyo, after starting strong at 80% in May, experienced fluctuations but remained above average at 62% in October. JSW Steel Dolvi steel plant initially mirrored the average but also faced a decline, ending at 51% in October. The significant drop in mean activity in October does not have an obvious correlation to any of the provided news articles, and potential causal factors remain unclear.

Baosteel Desheng Stainless Steel Co., Ltd., a major integrated steel producer in Fujian, China, primarily uses BF and BOF technologies with a crude steel capacity of 3.41 million tonnes. The plant consistently operated above the Asian average in the observed period and maintained a steady increase in activity, reaching 48% in October. This stable performance, while the regional average declined, suggests robust demand for its stainless steel products, but no direct correlation to the provided news articles can be established.

Nippon Sanyo Special Steel, located in the Kansai region of Japan, focuses on special steel production using EAF technology, with a crude steel capacity of 1.59 million tonnes. The plant caters to diverse sectors, including automotive and energy. Although showing the highest activity initially, the activity decreased from 80% in May to 62% in October. The activity remains relatively high, indicating continued demand for special steel products, although the overall trend suggests a possible moderation. No direct relationship to the provided news articles can be established.

JSW Steel Dolvi steel plant in Maharashtra, India, operates as an integrated plant with both BF/BOF and DRI/EAF routes and a crude steel capacity of 5 million tonnes. The plant produces a range of products, including wire rod and cold-rolled steel. Activity decreased from 52% in May to 51% in October. While seemingly stable, the facility experienced fluctuations throughout the period. No specific events in the provided news explain this behavior.

Given the significant drop in overall Asian steel plant activity and the increase in global base oil supply as indicated by “India’s Group I heavy-grade base oil prices fall in Oct” and “Aug base oil output hits highest level since 2018: EIA” steel buyers should:

- Closely monitor inventory levels: Given the drop in average production, proactive inventory management is recommended to mitigate potential shortages, particularly if demand unexpectedly increases.

- Diversify sourcing: Consider exploring alternative steel suppliers, especially those in regions not experiencing similar activity declines, to ensure supply chain resilience.

- Negotiate strategically: Utilize the current period of potentially reduced demand to negotiate favorable contract terms, but remain aware that a sudden surge in demand could quickly shift the balance.

Important Note: These recommendations are based solely on the provided news articles and activity data. A comprehensive market analysis should incorporate a broader range of factors and data sources.