From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Resilient Despite Political Uncertainty: Activity Stable Amidst Financing Disputes

Europe’s steel market shows resilience despite political headwinds. While EU leaders grapple with internal financing disputes, as evidenced by news articles like “EU-Staaten zerstreiten sich über Ukraine-Finanzierung” and “Gipfel in Brüssel: EU-Staaten zerstreiten sich über Ukraine-Finanzierung,” satellite-observed steel plant activity in Europe remains relatively stable. However, it’s important to note that no direct correlation between these political disputes and steel plant activity could be established based on provided data. The broader implications of bureaucratic hurdles highlighted in “Kommentar zu Merz beim EU-Gipfel: Tacheles allein reicht nicht” and the general political deadlock described in “EU-Gipfel: Der Minimalkompromiss für Kiew und ein Konflikt, der Brüssel noch lange beschäftigen wird” could eventually impact long-term market sentiment, although no immediate effect on plant activity is apparent.

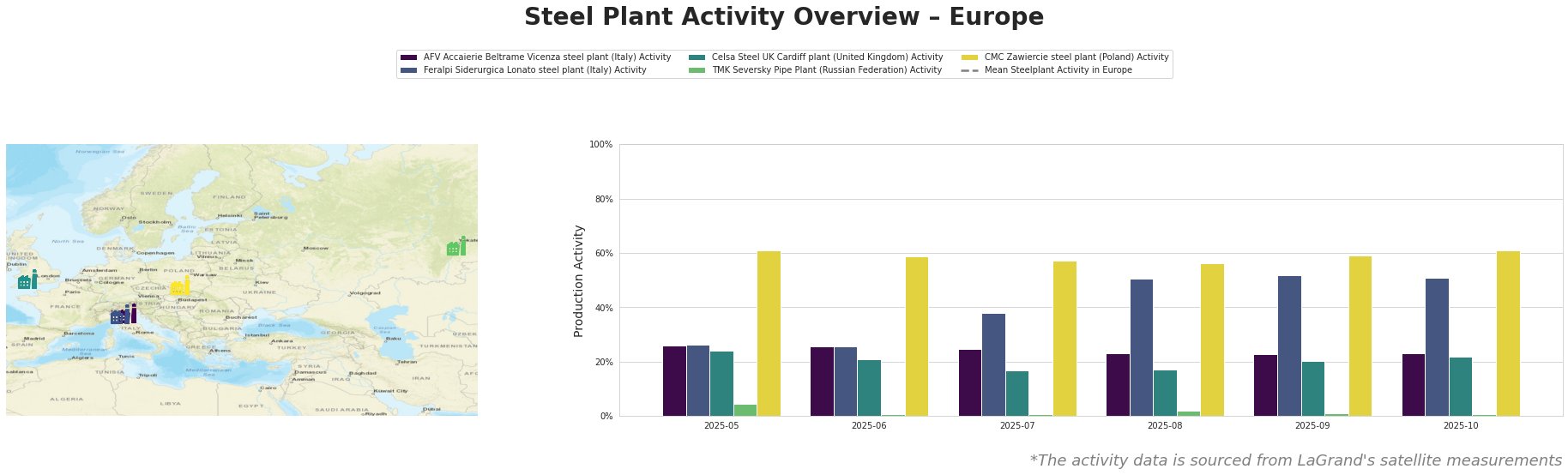

The mean steel plant activity in Europe fluctuated throughout the observed period, with peaks in July and August 2025. AFV Accaierie Beltrame Vicenza showed consistent activity levels, hovering around 23-26%. Feralpi Siderurgica Lonato experienced a notable increase in activity from 26% in May/June to over 50% by September/October. Celsa Steel UK Cardiff plant saw a gradual decline from 24% to 17% followed by a slight recovery to 22%. TMK Seversky Pipe Plant consistently showed very low activity (around 1-2%). CMC Zawiercie displayed a relatively high and stable activity level, generally above 55%.

AFV Accaierie Beltrame Vicenza, an EAF steel plant in Italy with a crude steel capacity of 1.2 million tonnes, primarily serves the building and infrastructure, tools and machinery, and transport sectors. Its activity has remained relatively stable around 23-26% throughout the observed period. No explicit connection could be established between its steady activity and the political developments described in the news articles.

Feralpi Siderurgica Lonato, another Italian EAF steel plant producing rebar, billets, mesh, and wire rod with a 1.1 million tonne capacity, saw a significant increase in activity, rising from 26% in May/June to over 50% in September/October. This increase appears independent of the broader EU-level political discussions described in the provided news.

Celsa Steel UK Cardiff, a UK-based EAF steel plant producing rebar, wire rod, merchant bar, and light sections with a capacity of 1.2 million tonnes, experienced a decrease in activity from 24% to 17% between May and July/August, then slightly recovered to 22% in October. No specific link to the provided news articles can be established for this activity pattern.

TMK Seversky Pipe Plant, a Russian EAF steel plant focusing on billets and pipes with a capacity of 1 million tonnes, shows consistently very low activity. While the news articles discuss EU funding for Ukraine and disagreements over Russian assets, no direct connection between these political factors and the very low activity level at this plant can be explicitly established from the provided data.

CMC Zawiercie, a Polish EAF steel plant with a 1.7 million tonne capacity, serving the automotive, building, energy, and other sectors, maintained a consistently high activity level, around 60%, throughout the observed period. Again, no direct correlation between its activity and the cited news articles is apparent.

Despite political uncertainty and disagreements within the EU, the steel market exhibits a generally positive outlook, supported by stable to increasing plant activity levels. Specifically, the increase in activity at Feralpi Siderurgica Lonato suggests robust demand for its products (rebar, billets, mesh, wire rod).

Recommended Procurement Actions:

- Monitor Feralpi Siderurgica Lonato’s production: Steel buyers reliant on rebar, billets, mesh, and wire rod should closely monitor the production levels of Feralpi Siderurgica Lonato in Italy. Although the rise may be temporary, the continued high-activity may indicate reduced spare capacity and thus potentially longer lead times.

- Assess Political Risk: While current steel plant activity doesn’t reflect immediate disruption, steel buyers should factor political risks discussed in “EU-Gipfel: Der Minimalkompromiss für Kiew und ein Konflikt, der Brüssel noch lange beschäftigen wird” into long-term supply chain considerations. Monitor news and expert analysis regarding potential future impacts from EU policy shifts and funding disagreements.

- Diversify supply sources: Given the TMK Seversky Pipe Plant’s consistently low activity and the general uncertainty, consider diversifying away from this plant.