From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market: German Production Surge Masks Broader Declines; DRI Import Slump Impacts Supply Chains

European steel production presents a mixed picture. While “Germany increased steel production by 15.4% m/m in September,” according to a recently published article, other regions face challenges. This increase in German production might offset some of the impact of “France cut steel production by 20.8% y/y in September.” The article regarding French output cites weak demand and high energy costs. The global trend, as noted in “Global steel production in September decreased by 1.6% y/y,” indicates an overall contraction that may influence European supply dynamics. These dynamics align partially with satellite-observed activity at a few selected steel plants, further explained below. Additionally, the article “The EU reduced imports of direct reduced iron by 24.8% y/y in January-August” highlights potential disruptions in DRI supply chains, particularly impacting Germany and the Netherlands, where the largest import drops where experienced, and potentially affecting steelmakers relying on this material.

Measured Activity Overview

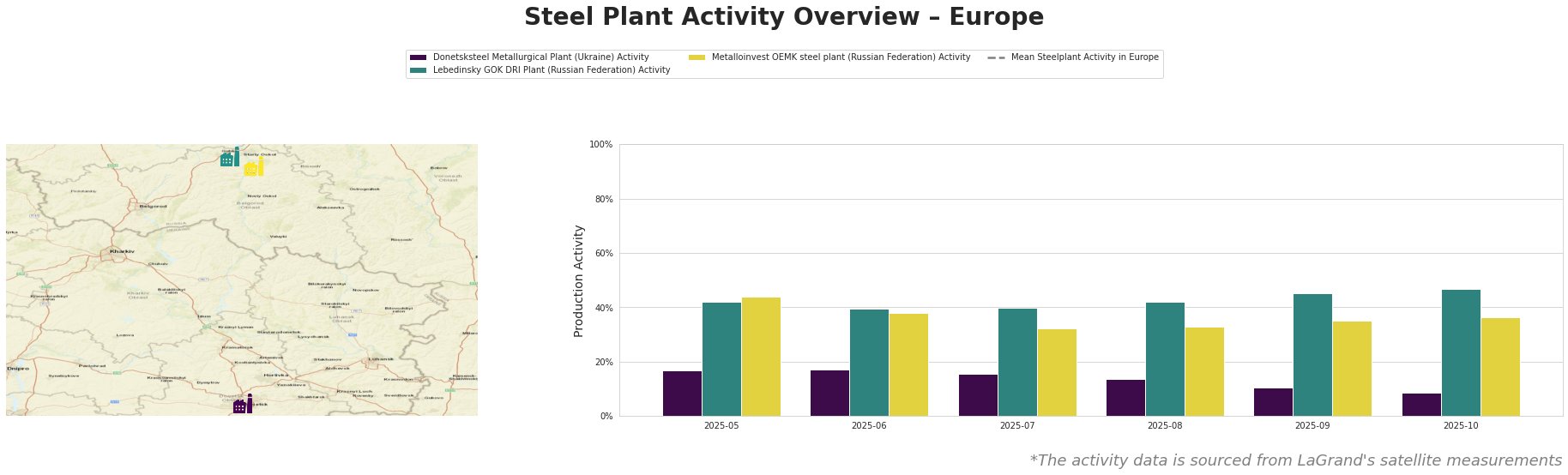

The mean steel plant activity in Europe experienced a peak in July and August 2025, followed by a sharp decline in September and October. Donetsksteel Metallurgical Plant consistently shows the lowest activity levels of the monitored plants, declining from 17% in May/June to 9% in October. Lebedinsky GOK DRI Plant’s activity has been relatively stable, fluctuating between 39% and 47%. Metalloinvest OEMK steel plant showed a dip to 32% in July, rising to 36% in October. The activity changes observed at Donetsksteel Metallurgical Plant do not have a direct link to any of the provided news articles. Similarly, there is no immediate news-driven explanation for the fluctuations at Lebedinsky GOK DRI Plant and Metalloinvest OEMK steel plant.

Steel Plant Information

Donetsksteel Metallurgical Plant, located in Donetsk, Ukraine, primarily produces pig iron using integrated (BF) processes. Its capacity includes 1500 thousand tons per annum (ttpa) of iron production via blast furnaces (BF). The observed activity decline from 17% in May/June to 9% in October suggests potential operational challenges. No direct link to any news articles could be established.

Lebedinsky GOK DRI Plant, situated in Belgorod, Russian Federation, focuses on ironmaking via direct reduced iron (DRI) with a capacity of 4500 ttpa. It also has significant sinter (22063 ttpa) and pelletizing (8968 ttpa) capacity. The plant’s relatively stable activity, oscillating between 39% and 47%, contrasts with the volatility seen in other regions. The article “The EU reduced imports of direct reduced iron by 24.8% y/y in January-August” mentions Russia as the largest supplier of DRI to the EU, however, it also notes that its exports have decreased. While a direct link can’t be established based on the data and news articles provided, reduced exports to the EU might have an impact on production volumes in the coming months.

Metalloinvest OEMK steel plant, also in the Belgorod region of Russia, is an integrated (DRI) plant with both DRI (3200 ttpa) and EAF (3500 ttpa) capacity. It produces crude, semi-finished, and finished rolled products, including DRI, billets, and pipes. Activity rose slightly from 32% in July to 36% in October. No direct connection to specific news articles could be established.

Evaluated Market Implications

The observed decrease in EU DRI imports, as highlighted by the article “The EU reduced imports of direct reduced iron by 24.8% y/y in January-August,” coupled with stable but not increasing activity at the Lebedinsky GOK DRI Plant, suggests potential supply constraints for EU steelmakers relying on DRI, especially given that a main importer, Germany, also saw the largest import drop. While “Germany increased steel production by 15.4% m/m in September,” buyers should monitor DRI availability and prices closely.

Recommended procurement actions for steel buyers and analysts:

* For buyers focused on DRI-based steel production: Diversify DRI sourcing beyond traditional suppliers like Russia, considering increased exports from Venezuela and the US, as mentioned in the DRI import article. Negotiate contracts with built-in flexibility to adjust for potential price fluctuations caused by DRI supply constraints, particularly if your supply chain relies on German or Dutch imports.

* For analysts tracking the European steel market: Closely monitor import data for DRI and alternative iron sources (e.g., HBI) to assess the true impact of import reductions. Analyze how German mills are increasing output despite the EU-wide DRI import contraction, identifying potential sources of alternative supply or shifts in production methods that could inform procurement strategy adjustments.