From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Price Pressure Amidst Mill Hikes and Production Fluctuations

European steel buyers face increased uncertainty as mills push for higher prices despite buyer resistance and fluctuating plant activity. The article titled “European HRC prices face upward pressure despite buyer resistance over impending trade measures” highlights the rising HRC prices driven by mill offers, countered by buyer concerns about existing stock and weak demand. This is further corroborated by “European HRC prices rise as mills push for higher levels as expected“, detailing ArcelorMittal’s increased offers and buyer resistance. Satellite data reveals fluctuating activity levels at key plants, although direct causal links to price pressures and trade measures are not always evident.

Steel Plant Activity

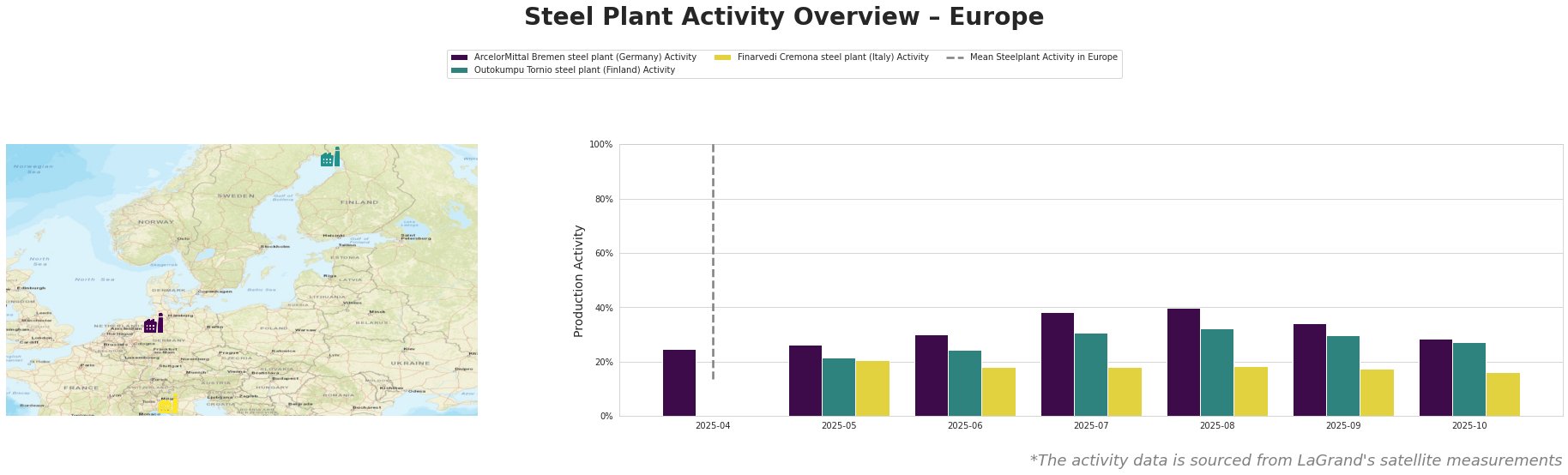

The mean steel plant activity in Europe fluctuated significantly throughout the observed period, peaking between May and August, then showing a decline in September and October.

ArcelorMittal’s Bremen plant, an integrated BF-BOF producer with a crude steel capacity of 3.8 million tonnes, showed a steady increase in activity from April (25%) to August (40%), followed by a decline to 29% in October. While “European HRC prices face upward pressure despite buyer resistance over impending trade measures” references a fire at ArcelorMittal Fos-sur-Mer, potentially impacting supply, a direct causal link between that event and the Bremen plant’s activity is not established. The Bremen plant’s product portfolio, including hot-rolled and cold-rolled coils used in automotive and construction, suggests a broad impact from overall market demand.

Outokumpu’s Tornio plant, an EAF-based stainless steel producer with a 1.2 million tonne capacity, saw activity rise from May (22%) to August (32%), followed by a decrease to 27% in October. The news articles do not specifically mention Outokumpu or stainless steel, therefore no direct correlation between market events described in the articles and the activity at the Tornio plant can be established.

Finarvedi’s Cremona plant, another EAF-based producer with a 3.85 million tonne capacity, displayed a relatively stable but lower activity level throughout the period, decreasing from 21% in May to 16% in October. The decline in observed plant activity is consistent with the more subdued price sentiment and uncertainty in Italy reported in “European HRC prices face upward pressure despite buyer resistance over impending trade measures.”

The article “European coil and green steel round-up: EU coil prices supported by good order books, reduced access to imports” notes the impact of CBAM and potential steel protection overhauls, and this has an indirect effect on the market.

Evaluated Market Implications

The combination of rising mill offers, cautious buyer sentiment, and fluctuating plant activity suggests a period of increased volatility. The pressure on prices from the supply side, as highlighted in “European HRC prices rise as mills push for higher levels as expected“, may not be sustainable if demand remains weak and inventories are high, as noted in “European HRC buyers stay cautious; mills push for higher prices amid policy-driven optimism“. The decline in activity at the Finarvedi Cremona steel plant (Italy) aligns with this cautious buyer sentiment.

Specific Procurement Actions:

- For Buyers with Short-Term Needs: Given the upward pressure on prices and potential supply disruptions, secure necessary volumes in the near term, but avoid overstocking due to the uncertainty surrounding demand. Closely monitor the impact of trade measures, as highlighted in “European HRC prices face upward pressure despite buyer resistance over impending trade measures,” on import availability and pricing.

- For Buyers with Longer-Term Contracts: Negotiate contracts with built-in flexibility to adjust volumes and pricing based on market conditions. Explore alternative supply sources and consider the potential impact of CBAM on import costs. Focus on building stronger relationships with European suppliers, as suggested by the anticipation of relying on European supplies in early 2026, as outlined in “European HRC buyers stay cautious; mills push for higher prices amid policy-driven optimism“. The reduced access to imports will be a crucial factor to consider going forward as per the article “European coil and green steel round-up: EU coil prices supported by good order books, reduced access to imports“.

- For Market Analysts: Closely monitor import statistics and policy changes to assess their impact on domestic prices. Track plant activity levels as an indicator of supply dynamics. Pay close attention to any further announcements regarding ArcelorMittal’s production and supply chain following the fire at Fos-sur-Mer, referenced in “European HRC prices face upward pressure despite buyer resistance over impending trade measures“.