From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market: Climate Action Initiatives Drive Optimism Amidst Plant Activity Fluctuations

South America’s steel market exhibits a very positive sentiment, influenced by climate action initiatives spearheaded by Brazil, as indicated in “Cop 30 presidency looking to ‘advance negotiations’,” “TFFF, REDD+ can generate $9bn/yr for deforestation,” “Fossil fuels in Cop 30 action agenda spotlight,” “Pre-Cop leaves most negotiations to Belem,” and “COP presidency advances action agenda.” These developments create a backdrop of potential investment and infrastructure projects, indirectly influencing steel demand. However, a direct correlation between these news articles and specific steel plant activity changes observed via satellite cannot be definitively established.

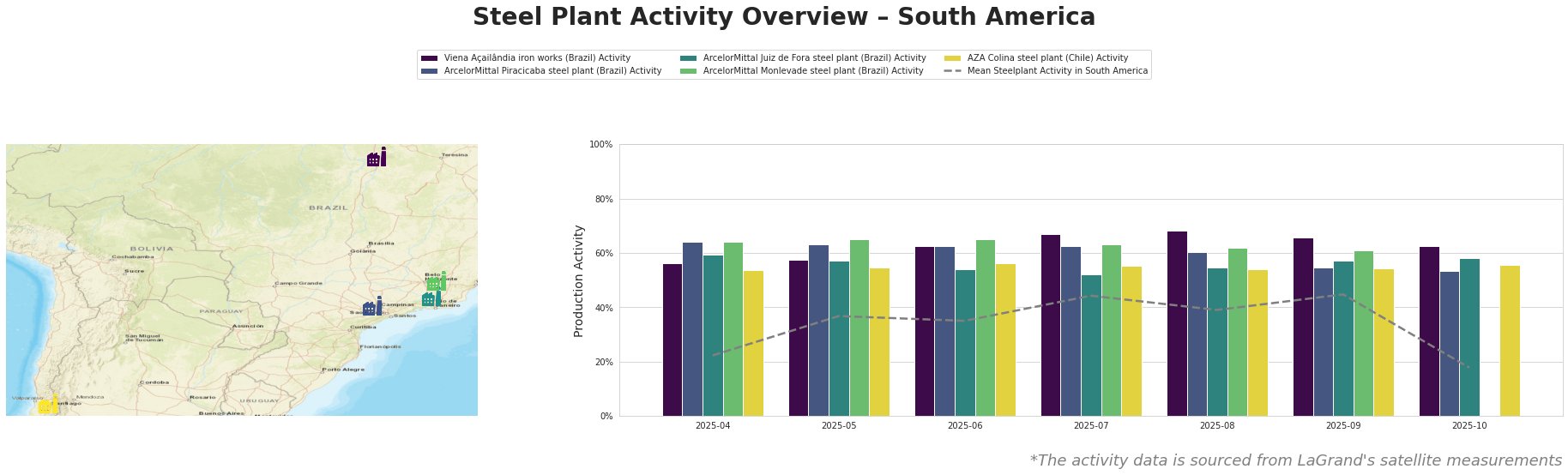

The mean steel plant activity across South America fluctuated, peaking at 45% in September 2025 before dropping sharply to 18% in October 2025. Viena Açailândia iron works consistently operated well above the mean, peaking at 68% in August before declining to 63% in October. ArcelorMittal Piracicaba steel plant activity was also above average until September 2025. In October the plant saw a drop from 55% to 53%. ArcelorMittal Juiz de Fora steel plant remained relatively stable and consistently above the mean. ArcelorMittal Monlevade steel plant activity was not observed in October 2025. The AZA Colina steel plant in Chile consistently showed activity close to the overall mean.

Viena Açailândia iron works, located in Maranhão, Brazil, primarily focuses on iron production using blast furnaces, with a capacity of 500 ttpa. Its activity remained significantly above the South American average throughout the observed period, peaking at 68% in August 2025 and settling at 63% in October 2025. As the plant is a certified ResponsibleSteel facility, it could benefit from the climate investments discussed in “TFFF, REDD+ can generate $9bn/yr for deforestation“, but no direct connection can be established.

ArcelorMittal Piracicaba steel plant, situated in São Paulo, Brazil, produces 1100 ttpa of crude steel via EAF technology, specializing in finished rolled products like rebar and wire rod for the building and infrastructure sectors. After consistent activity levels of around 63-64% between April and July, it showed a decrease to 53% in October 2025. No specific link to the COP30-related news can be directly established.

ArcelorMittal Juiz de Fora steel plant, based in Minas Gerais, Brazil, has a crude steel capacity of 1100 ttpa, utilizing both BF and EAF processes. Its activity remained relatively stable. Again, no direct correlation between the stability of the activity and the COP30-related news can be established.

ArcelorMittal Monlevade steel plant, also located in Minas Gerais, Brazil, boasts a larger integrated operation with BF and BOF processes, producing 1200 ttpa of crude steel. October activity is not present in the data.

AZA Colina steel plant in the Región Metropolitana, Chile, has a 520 ttpa crude steel capacity using EAF technology. Its activity remained consistently close to the average across the South American plants. No direct connection between the Chilean plant’s activity and the COP30-related news can be established.

The observed decrease in overall average activity in October, coupled with the fluctuating activity at individual plants warrants careful monitoring. Although the news paints a positive picture of future investment, the current market conditions must be considered.

Given the observed reduction in activity at ArcelorMittal Piracicaba steel plant in October, and the absence of data for ArcelorMittal Monlevade steel plant, steel buyers relying on these specific plants for rebar and wire rod may consider the following:

* Diversify Sourcing: Explore alternative suppliers of rebar and wire rod in Brazil and potentially in neighboring countries to mitigate potential supply disruptions.

* Monitor Activity: Closely track the activity levels of ArcelorMittal Piracicaba and Monlevade using available data sources to anticipate any further reductions.

* Engage Suppliers: Communicate with ArcelorMittal representatives to understand the reasons behind the reduced activity and their plans for future production.

* Factor in logistical delays: Factor in logistical delays when planning procurement.

Market analysts should monitor the implementation of climate action initiatives discussed in the cited news articles and how they translate into actual steel demand, particularly in infrastructure and construction projects.