From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Resilient Amidst Climate Policy Push: Activity Stable Despite CBAM Concerns

Europe’s steel market demonstrates resilience as the EU advances its climate agenda, reflected in relatively stable plant activity despite concerns over competitiveness and the implementation of the Carbon Border Adjustment Mechanism (CBAM). The articles “EU leaders seek industrial support measures ahead of 2040 climate target agreement” and “EU leaders demand industry support in setting new climate target” highlight the EU’s commitment to supporting its steel industry during the green transition, potentially mitigating negative impacts on production. The article “ANNOUNCEMENT: Round table «CBAM: Challenges and opportunities for the Ukrainian industry»” points to concerns about CBAM’s impact, particularly on Ukrainian steel imports. While these policy discussions are ongoing, no direct, immediate impact on observed steel plant activity can be explicitly established.

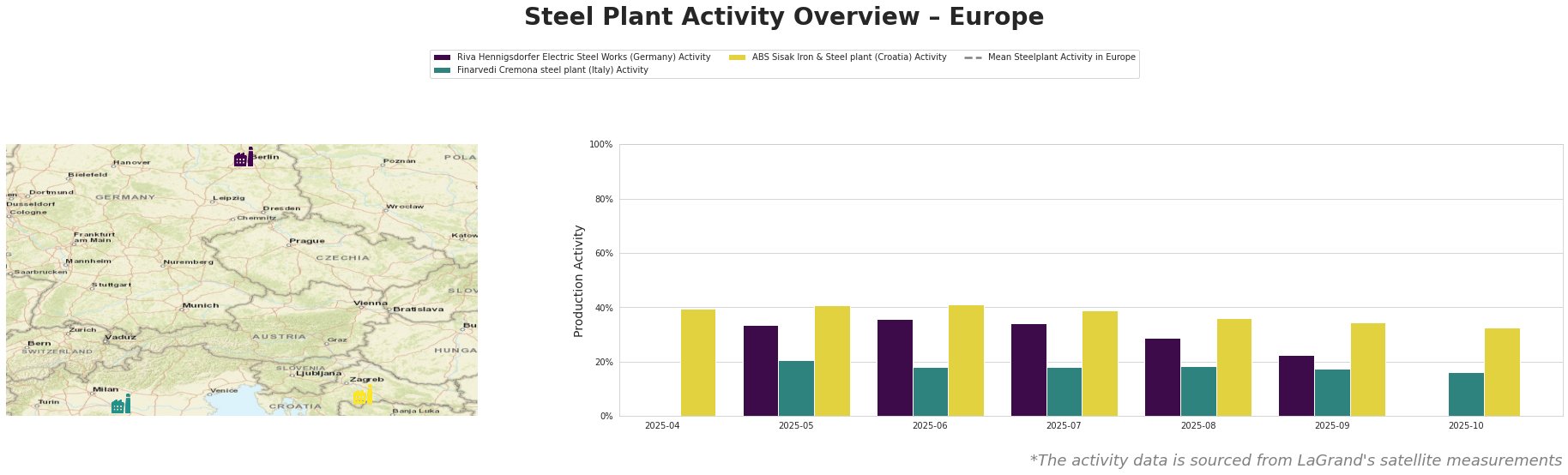

The mean steel plant activity in Europe shows fluctuations month-to-month.

Riva Hennigsdorfer Electric Steel Works, located in Brandenburg, Germany, operates two EAFs with a total melting capacity of 140t/h and a crude steel capacity of 1,000ktpa, focusing on semi-finished and finished rolled products for the automotive sector. The plant’s activity decreased from 34% in May and July 2025 to 22% in September 2025. No data is available for April and October 2025. No direct connection between this activity decrease and the provided news articles can be explicitly established.

Finarvedi Cremona steel plant in Italy uses two EAFs (one 300-tonne Consteel EAF) with a crude steel capacity of 3,850ktpa, producing hot-rolled coil and galvanized products, also serving the automotive sector. The plant’s activity has shown a downward trend, decreasing from 21% in May 2025 to 16% in October 2025. No direct connection between this trend and the provided news articles can be explicitly established.

ABS Sisak Iron & Steel plant in Croatia utilizes a single 67-ton EAF with a crude steel capacity of 350ktpa, specializing in billet production for the automotive, energy, and transport sectors. The plant maintained relatively stable activity levels, ranging from 33% to 41% between April and October 2025, showing more stability than the other plants in this sample. No direct connection between this stable activity and the provided news articles can be explicitly established.

Given the EU’s expressed commitment to supporting the steel industry’s green transition as indicated in “EU leaders seek industrial support measures ahead of 2040 climate target agreement”, and the stable activity observed at ABS Sisak, steel buyers should:

- Monitor CBAM developments closely: Specifically, track the outcomes of discussions highlighted in “ANNOUNCEMENT: Round table «CBAM: Challenges and opportunities for the Ukrainian industry»” and “EU leaders demand industry support in setting new climate target” regarding potential adjustments to CBAM and support mechanisms for the steel industry. Any changes could impact the cost and availability of imported steel.

- Diversify sourcing with caution: The round table in “ANNOUNCEMENT: Round table «CBAM: Challenges and opportunities for the Ukrainian industry»” points to Ukraine’s potential challenges and opportunities with CBAM. While potentially diversifying sources, steel buyers should consider any risks in the Ukrainian market, given the ongoing conflict.