From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineJapan Steel Market Heats Up: Automation & Activity Surge Signal Strong Outlook

Japan’s steel sector is showing strong signals of growth and modernization. The commissioning of advanced straightening technology, as detailed in “SMS group, Yamato Steel Commission Japan’s First CRS® Roller Straightener” and “Yamato Steel commissions Japan’s first compact roller straightener,” points to enhanced product quality and efficiency. Simultaneously, investment in new production lines, exemplified by “SMS group to deliver fully automated extruded stainless tube line to Japan’s Maruichi“, indicates an expansion in capacity and a focus on decarbonization. A direct relationship between observed plant activities and these commissioning events cannot be explicitly established from the provided data, although these investments are expected to influence activity in the medium term.

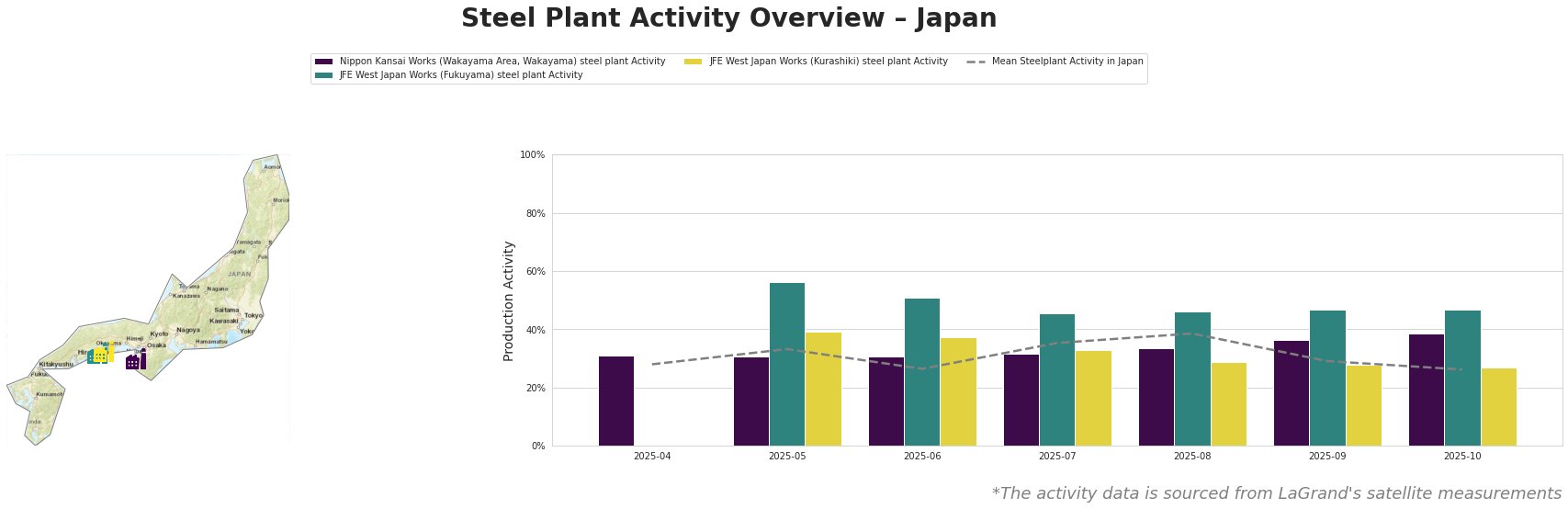

Overall, the mean steel plant activity in Japan shows fluctuations, peaking at 39% in August and dropping to 26% in both June and October. Nippon Kansai Works consistently operates above the average, reaching a high of 39% in October. JFE West Japan Works (Fukuyama) shows the highest activity levels, peaking at 56% in May, before decreasing. JFE West Japan Works (Kurashiki) exhibits the lowest activity levels among the three, with a maximum of 39% in May, falling to 27% in October. A direct connection between these fluctuations and the named news articles cannot be explicitly established.

Nippon Kansai Works (Wakayama Area, Wakayama) steel plant, located in the Kansai region, is an integrated BF steel plant with a crude steel capacity of 5.49 million tonnes, comprising both BOF and EAF production. It produces seamless pipes, H-shaped steel hyperbeems, and steel sheet piles, serving the building, infrastructure, and transport sectors. The plant’s activity level increased steadily from 31% in April to 39% in October, consistently remaining above the national average. The ResponsibleSteel certification underscores its commitment to sustainability. No direct link between observed activity and the news articles can be established.

JFE West Japan Works (Fukuyama) steel plant, situated in the Chūgoku region, is a major integrated BF steel plant boasting a crude steel capacity of 13 million tonnes, dedicated exclusively to BOF production. Its diverse product portfolio includes hot-rolled, cold-rolled, and coated sheets, along with plates, sheet piles, H-profiles, rails, bars, wire rods, and UOE pipes, catering to the automotive, building, energy, packaging, machinery, and transport industries. The plant recorded the highest activity among the observed plants, reaching 56% in May, before fluctuating and settling at 47% in October, still notably above the national average. The ResponsibleSteel certification reflects its sustainability efforts. A direct relationship between observed activity and the news articles cannot be explicitly established from the provided data.

JFE West Japan Works (Kurashiki) steel plant, also in the Chūgoku region, is another integrated BF steel plant with a crude steel capacity of 10 million tonnes, relying primarily on BOF production. Its product range mirrors that of the Fukuyama plant, indicating a similar focus on sheets, plates, and long products for a broad range of end-user sectors. The plant’s activity remained relatively stable compared to the other two plants, peaking at 39% in May and decreasing to 27% in October, slightly above the national mean. The ResponsibleSteel certification signals a commitment to sustainable practices. No direct link between observed activity and the news articles can be established.

Given the commissioning of new straightening technology at Yamato Steel, coupled with the consistently high activity levels at the JFE West Japan Works (Fukuyama), steel buyers focused on long products (sheet piles, H-profiles, rails, bars, wire rods) should proactively engage with JFE to secure supply contracts. Although Yamato Steel is not explicitly part of the plants mentioned by name, its cooperation with SMS group to commission new straightening technology (“SMS group, Yamato Steel Commission Japan’s First CRS® Roller Straightener” and “Yamato Steel commissions Japan’s first compact roller straightener“) indicates a focus on enhancing product quality and potentially increasing output of heavy sections and sheet piles, therefore creating a potential competitive alternative. Buyers should monitor Yamato Steel’s output of straightened products. The investment by Maruichi Stainless Tube Co. Ltd. (“SMS group to deliver fully automated extruded stainless tube line to Japan’s Maruichi“) signals a future increase in stainless steel tube production starting in 2027. Stainless steel buyers should consider establishing relationships with Maruichi Stainless Tube Co. Ltd. in anticipation of increased domestic supply in the long term.