From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Faces Disruption: ArcelorMittal Fire and Plant Activity Shifts Signal Supply Concerns

In Europe, the steel market is facing headwinds due to production disruptions and fluctuating plant activity. The “ArcelorMittal Fos-sur-Mer shut down blast furnace No. 2 due to a fire,” “ArcelorMittal Shuts Down Fos-sur-Mer Blast Furnace After Major Fire,” and “ArcelorMittal shuts down Fos-sur-Mer blast furnace after major fire incident” articles directly correlate with anticipated supply chain disruptions. Satellite data may confirm impacts on overall European steel production levels as a result of the blast furnace shutdown, though direct correlation isn’t possible at this point, based solely on the provided dataset.

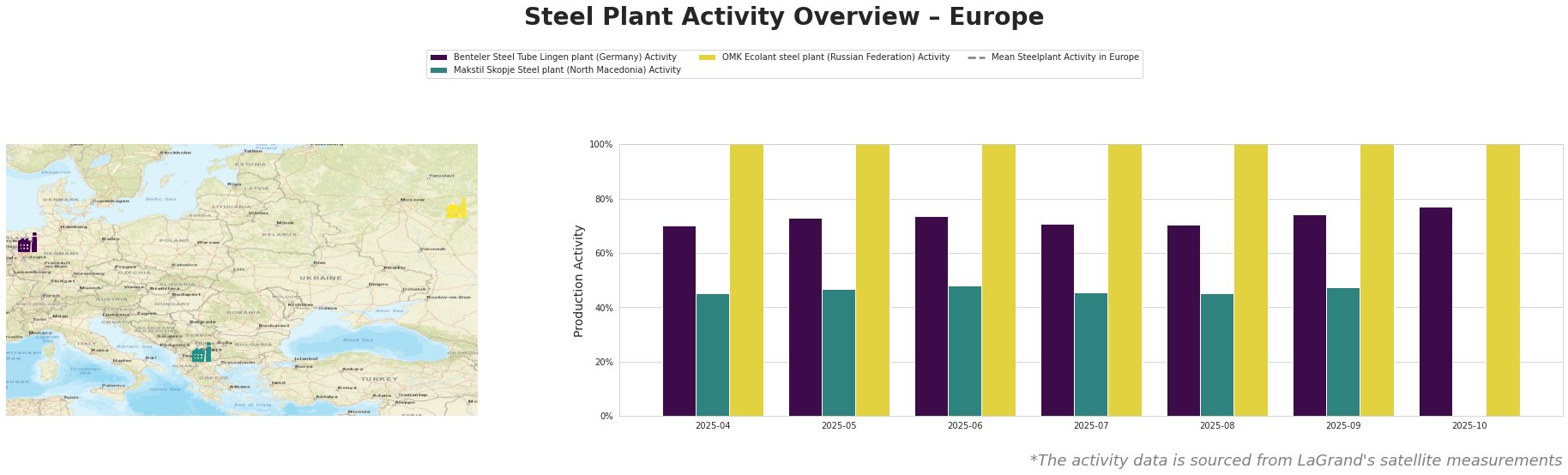

The mean steel plant activity in Europe has fluctuated, peaking in May, July, August and October 2025.

Benteler Steel Tube Lingen plant: This German plant, equipped with a 650,000-tonne EAF and producing semi-finished and finished rolled products like tubes, billets, and slabs primarily for the automotive and building sectors, shows a consistent activity level. Activity has ranged between 70% and 74% for most months, increasing to 77% in October. No direct correlation could be established between the observed activity changes and the provided news articles.

Makstil Skopje Steel plant: This North Macedonian EAF-based plant, with a 550,000-tonne capacity, produces slabs. Activity remained consistent between April and September at 45% to 48%. Activity levels are unavailable for October. No direct correlation could be established between the observed activity changes and the provided news articles.

OMK Ecolant steel plant: The OMK Ecolant plant in Russia, featuring a 1.8 million tonne EAF and DRI-based integrated production, has consistently high activity levels, as indicated by the data. No activity change is visible from April to October. The plant produces slabs and round billets for the building, energy, and transport sectors. No direct correlation could be established between the observed activity changes and the provided news articles.

Evaluated Market Implications:

The fire and subsequent shutdown of Blast Furnace No. 2 at ArcelorMittal’s Fos-sur-Mer plant, as reported in “ArcelorMittal Fos-sur-Mer shut down blast furnace No. 2 due to a fire”, “ArcelorMittal Shuts Down Fos-sur-Mer Blast Furnace After Major Fire”, and “ArcelorMittal shuts down Fos-sur-Mer blast furnace after major fire incident,” present a clear risk of supply disruption, particularly for slabs and related downstream products. Given the steelmaking shop’s central role at Fos-sur-Mer, the disruption will impact production for an unknown duration, and may negatively affect the regional steel production.

Recommended Procurement Actions:

* Steel Buyers: Given the potential disruption caused by the ArcelorMittal Fos-sur-Mer incident, immediately assess your reliance on supply from this plant and its associated product lines (particularly slabs). Proactively engage with ArcelorMittal to understand the extent and expected duration of the disruption. Diversify your sourcing by contacting alternative slab suppliers, particularly those in regions unaffected by production issues. Closely monitor developments via industry news and satellite-observed activity for potential delays in the blast furnace restart and overall plant activity.

* Market Analysts: Closely monitor European slab prices for upward pressure, which can be verified by tracking the satellite data. Also, analyze how the event may impact overall European steel output, keeping in mind that other plants like the Benteler Steel Tube Lingen plant are operating at high utilization.