From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: JSW Salem Ramps Up Amidst Broader Uncertainty

Asia’s steel market presents a mixed picture. While activity at some plants is increasing, potential global headwinds and uncertainty remain. Activity data shows significant deviation between individual steel plants. While no explicit relationship to the activity changes can be established directly, the global economic uncertainty indicated by “US gov shutdown lowers shroud on jobs, inflation data” and “US services sector stagnates in September: ISM survey” might impact overall demand.

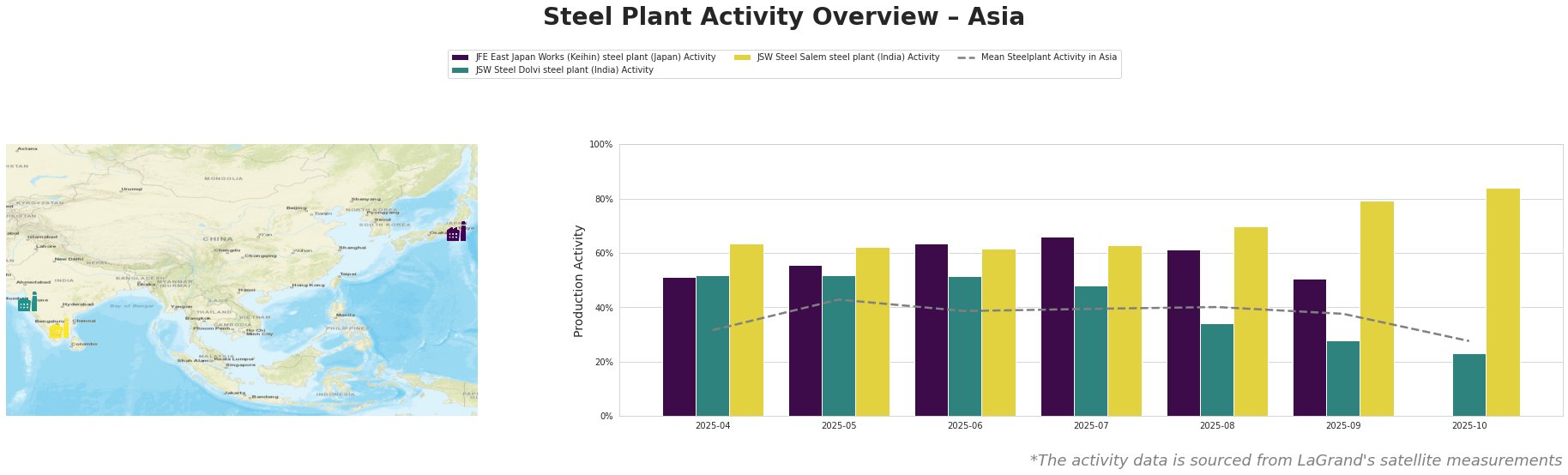

The mean steel plant activity in Asia has fluctuated over the observed period, peaking at 43.0 in May and then decreasing to 28.0 by October. JFE East Japan Works (Keihin) steel plant activity peaked in July at 66.0 and then dropped to 51.0 by September; no data is available for October. JSW Steel Dolvi steel plant activity showed a significant decline from 52.0 in April to 23.0 in October. Meanwhile, JSW Steel Salem steel plant has shown a steady increase in activity, rising from 64.0 in April to 84.0 in October, far exceeding the Asian average.

JFE East Japan Works (Keihin) steel plant, located in the Kantō region of Japan, is an integrated steel plant with a crude steel capacity of 4.075 million tonnes per annum (ttpa), utilizing both BOF (3.5 ttpa) and EAF (0.574 ttpa) technologies. Activity at this plant peaked at 66.0 in July 2025 before falling to 51.0 by September. Given the plant’s reliance on integrated BF-BOF production, any disruptions to raw material supply chains, potentially exacerbated by global economic uncertainty reflected in reports like “US gov shutdown lowers shroud on jobs, inflation data,” could impact output, although no direct connection can be established based on the provided news.

JSW Steel Dolvi steel plant, located in Maharashtra, India, has a crude steel capacity of 5.0 ttpa, utilizing both BF and DRI processes. The plant’s activity decreased significantly from 52.0 in April to 23.0 in October. The plant’s integrated BF and DRI operations, along with its reliance on potentially imported iron ore and met coal, make it susceptible to supply chain disruptions and price volatility; however, no explicit link to the news can be established.

JSW Steel Salem steel plant, located in Tamil Nadu, India, demonstrates a consistent increase in activity, reaching 84.0 in October. This plant, with a smaller capacity of 1.03 ttpa, primarily produces semi-finished and finished rolled products like hot rolled bars and wire coils. The plant sources iron ore from captive mines in Odisha, which might provide some insulation from global supply chain disruptions. Given the increase in activity, “US gov shutdown lowers shroud on jobs, inflation data” might not influence it to the same extent as others. There is no direct connection between the activity increase at the Salem plant and the provided news articles that can be established.

Evaluated Market Implications:

The diverging activity trends among these steel plants present both risks and opportunities. The decrease in activity at JSW Steel Dolvi, coupled with broader economic uncertainties reflected in “US gov shutdown lowers shroud on jobs, inflation data” and “US services sector stagnates in September: ISM survey”, signal potential supply constraints, while JSW Steel Salem’s increasing production could mitigate this risk.

Procurement actions: Steel buyers should prioritize securing supply contracts with JSW Steel Salem to leverage their increased production capacity. Diversifying suppliers is crucial to mitigate risks associated with potential disruptions at other plants. Closely monitor market prices, which could be affected by the uncertainty from economic data releases mentioned in the “US gov shutdown lowers shroud on jobs, inflation data” article.