From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineCzech Steel Market Outlook: Positive Activity Trends Amid Political Uncertainty

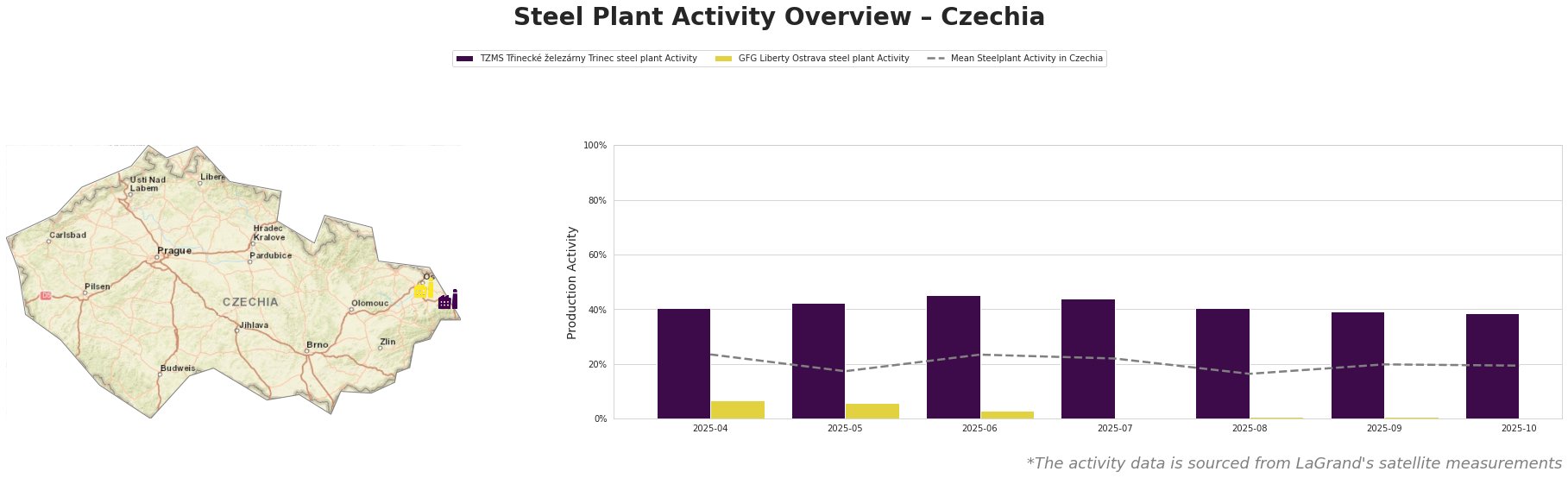

Recent reports indicate a positive sentiment in the Czech steel market, particularly regarding satellite-observed activity at major steel plants. The upcoming elections, detailed in Wahl in Tschechien: „Es ist die unbeliebteste tschechische Regierung seit 1989“ and Wahl in Tschechien: „Babis ist ein richtiger populistischer Anführer, der eine Catch-All-Partei geformt hat“, reflect a turbulent political landscape but do not appear to directly affect production levels. Notably, satellite data show varying activity trends across steel plants.

TZMS Třinecké železárny has seen relatively stable activity levels, peaking at 45.0% in June, while GFG Liberty Ostrava experienced significant fluctuations, with an alarming drop to 0.0% in July. This drop may indicate operational issues, though no clear connection to the political articles could be established, indicating potential isolated production challenges.

At GFG Liberty Ostrava, with a production capacity of 3,600k tonnes, the sustained drop, particularly from June to July, signals serious operational disruptions. The plant heavily relies on integrated BF processes, and the recent low activity levels warrant close monitoring for any threats to supply continuity.

In contrast, TZMS Třinecké železárny, with a diversified product lineup including rails and seamless tubes, has maintained activity levels around the mean while reaching highs that suggest resilience against political uncertainties. Their certifications and established production capabilities support steady output despite the shifting political situation discussed in Tschechien-Wahl: „Wichtige Rolle bei der Ukraine-Unterstützung“, which emphasizes the country’s strategic commitment to aid initiatives aligning with economic stability.

Overall, while the backdrop of political turbulence in Czechia may bring uncertainties, the positive output levels from Třinecké železárny present a reliable sourcing option. For procurement professionals, leveraging supplies from Třinecké and preparing contingency plans around GFG’s operational status is advisable, given their potential supply disruptions stemming from recent activity downturns. Regular engagement with these plants will be crucial as market dynamics continue to evolve.