From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Chinese Exports Surge Amidst Shifting Production, Regional Growth Outpaces Global Slowdown

Asia’s steel market presents a mixed landscape. While global GDP growth is slowing, emerging Asian countries demonstrate strong growth, per the news article “IREPAS Meeting: 2025 set to be record year for China’s steel exports“. This article, detailing Alexander Gordienko’s prediction of record Chinese steel exports in 2025 due to stagnant domestic demand, is broadly consistent with observed high activity levels at the VAS Nghi Son Cast Iron and Steel plant in Vietnam, but no direct connection can be definitively established. Simultaneously, “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry” highlights the challenges faced by other producers due to these exports and rising protectionism.

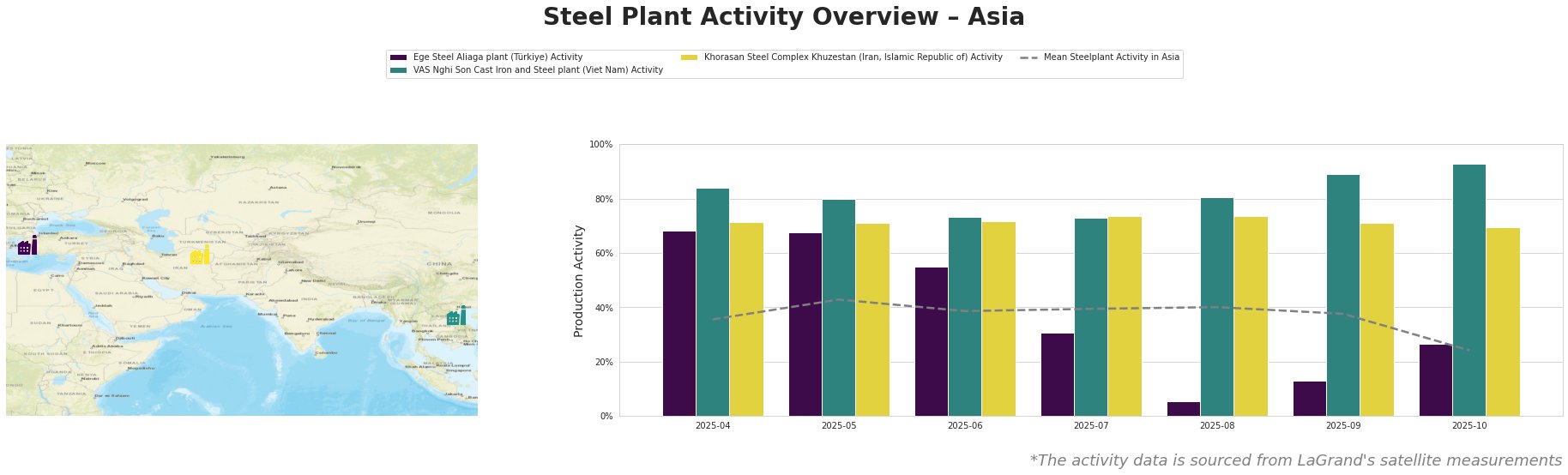

The mean steel plant activity in Asia shows a decrease towards the end of the observed period. Activity peaked in May 2025 at 43.0% and then generally declined, with a notable drop to 24.0% in October 2025. Ege Steel Aliaga plant shows a sharp activity drop in August 2025. VAS Nghi Son Cast Iron and Steel plant, however, shows the opposite development of overall increasing activity in the period of observation. Khorasan Steel Complex Khuzestan shows overall stable high activity in the observed period.

Ege Steel Aliaga plant, located in İzmir, Türkiye, operates with a 2,000 ttpa EAF-based crude steel capacity, specializing in rebar and wire rod production. The plant experienced a significant activity drop, plummeting from 68% in May 2025 to 5% in August 2025, followed by a slight rebound to 27% in October 2025. This sharp decline, occurring while Chinese steel exports are projected to surge (“IREPAS Meeting: 2025 set to be record year for China’s steel exports”), could reflect increased competitive pressure, as reported in “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry“.

VAS Nghi Son Cast Iron and Steel plant, situated in Thanh Hoa, Vietnam, boasts a 3,150 ttpa EAF-based crude steel capacity, producing billet, rebar, and wire rod. Activity at this plant has remained consistently high, peaking at 93% in October 2025. This sustained high activity level, which deviates significantly from the overall mean activity across Asian plants, suggests strong regional demand and efficient operations. This aligns with the article, “Anastasiia Kononenko: Consumption growth outlook rather strong for both India and ASEAN region,” which highlights the strong steel consumption outlook for the ASEAN region.

Khorasan Steel Complex Khuzestan, located in Razavi Khorasan, Iran, has an integrated DRI-EAF production route with a crude steel capacity of 1,500 ttpa, producing rebar, billets, DRI, and HBI. The plant maintained relatively stable activity levels throughout the observed period, ranging from 69% to 74%. The stability contrasts with the fluctuations seen in other plants, but no direct connection to specific news articles can be established.

Given the projected surge in Chinese steel exports and its potential impact on regional producers, as highlighted in “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry,” steel buyers should:

- Monitor Turkish Rebar Supply: The activity decline at Ege Steel Aliaga plant could indicate potential supply disruptions in Turkish rebar. Buyers relying on this plant should secure alternative sources or consider forward purchasing to mitigate risks.

- Secure ASEAN Supply Contracts: The high activity at VAS Nghi Son Cast Iron and Steel plant, coupled with the positive ASEAN consumption outlook (“Anastasiia Kononenko: Consumption growth outlook rather strong for both India and ASEAN region“), suggests stable regional supply. Buyers should prioritize securing long-term contracts with ASEAN producers to capitalize on this stability.

These recommendations are grounded in the observed activity data and explicitly linked to the provided news articles, offering concrete guidance for steel procurement professionals in navigating the evolving Asian steel market.