From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Navigates Trade Tensions: EU Tariffs Loom, Plant Activity Shifts

Asia’s steel market faces uncertainty amid potential EU tariffs and fluctuating plant activity. European trade measures impacting steel imports from Asia are a central concern, as highlighted in news articles such as “Assofermet expresses strong disappointment to EC over new AD action on CR flats” and “EU plans tariffs of 25%-50% on Chinese steel and related products, Handelsblatt reports“. While these articles primarily focus on EU policy, they could indirectly influence Asian steel production and export strategies. However, a direct correlation to recent observed steel plant activity levels in Asia cannot be definitively established based on the provided data.

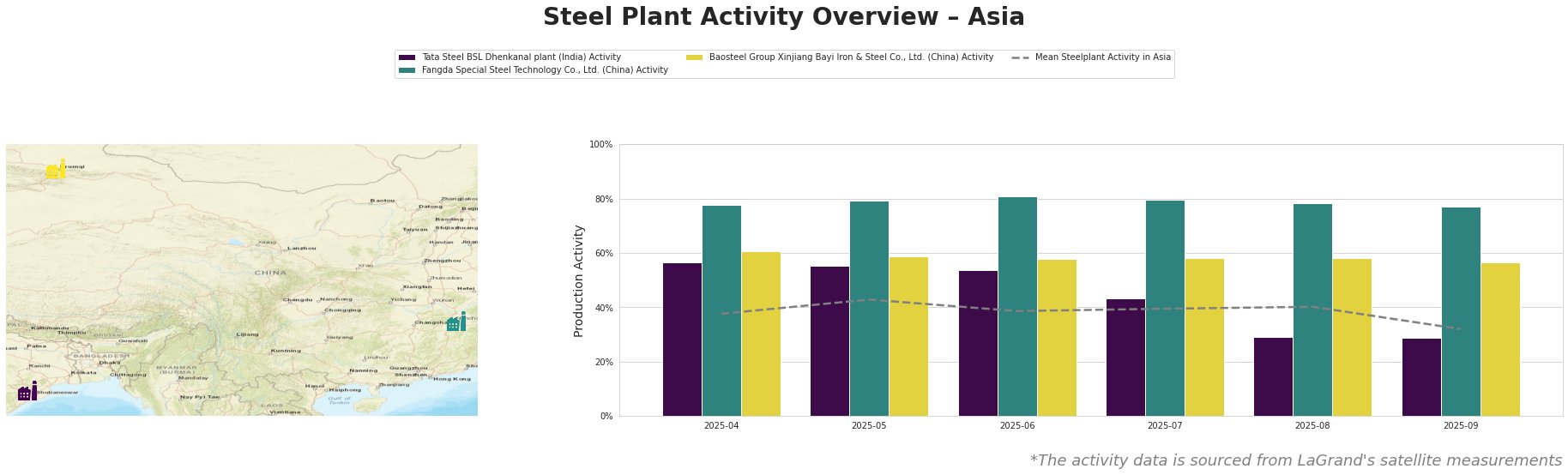

Here’s an overview of recent steel plant activity based on satellite observations:

The average steel plant activity in Asia experienced a notable decline to 32% in September after hovering around 40% for several months.

Tata Steel BSL Dhenkanal plant (India): This integrated steel plant in Odisha, India, with a crude steel capacity of 5.6 million tonnes, utilizes both BF and DRI processes, producing hot rolled coil, pipe, and cold rolled products. The plant activity dropped significantly from 57% in April to 29% in August and remained at 29% in September. This steep decline contrasts with the news articles addressing the EU market and trade policies; therefore, a direct link cannot be definitively established with the given information.

Fangda Special Steel Technology Co., Ltd. (China): This integrated BF-based steel plant in Jiangxi, China, boasting a crude steel capacity of 3.6 million tonnes, focuses on finished rolled products like spring flat steel and alloy structural round steel. The plant has consistently maintained a high activity level, fluctuating between 77% and 81% from April to September, significantly above the Asian average. While “The EU plans to impose duties of 25-50% on Chinese steel and related products, according to Handelsblatt.” suggests potential impacts on Chinese steel exports, there isn’t a directly observable effect on Fangda’s activity in the provided data.

Baosteel Group Xinjiang Bayi Iron & Steel Co., Ltd. (China): Located in Xinjiang, China, this integrated BF-based steel plant has a crude steel capacity of 7.3 million tonnes, manufacturing cold-rolled, hot-rolled, and plate products. The plant activity remained relatively stable around 57-61% from April to September. Like Fangda Special Steel, no direct correlation between the EU tariff discussions reported in “The EU plans to impose duties of 25-50% on Chinese steel and related products, according to Handelsblatt.” and the plant’s activity can be ascertained from the given information.

Evaluated Market Implications:

The observed decline in average Asian steel plant activity, alongside potential EU tariffs reported in “EU plans tariffs of 25%-50% on Chinese steel and related products, Handelsblatt reports“, introduces uncertainty into the market. The significant drop in activity at Tata Steel BSL Dhenkanal warrants close monitoring.

Recommended Procurement Actions:

- For steel buyers sourcing from Tata Steel BSL Dhenkanal: Given the substantial decrease in plant activity (a drop of 28 percentage points from April to August 2025), proactively engage with Tata Steel BSL to understand the reasons behind the reduction and potential impact on supply commitments. Secure alternative supply options to mitigate potential disruptions.

- For buyers exposed to EU import tariffs: Closely monitor the final outcome of the EU anti-dumping investigations and tariff implementations discussed in the articles “Assofermet expresses strong disappointment to EC over new AD action on CR flats“, “EU anti-dumping investigation reinforces steel importers’ concerns about prices“, and “The EU may impose tariffs of 25-50% on Chinese steel – Handelsblatt“. Diversify sourcing strategies to minimize reliance on regions potentially affected by the tariffs.