From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Anti-Dumping Duties & Japanese Steel Production: Market Downturn

Japan’s steel market faces headwinds due to recent EU anti-dumping duties, with observed plant activity showing a fluctuating trend. According to “EU imposes final anti-dumping duties on goods from Japan, Egypt, Vietnam” and “EU imposes definitive anti-dumping duties on HRC from Japan, Egypt, Vietnam“, the EU has implemented duties ranging from 6.9% to 30.0% on Japanese hot-rolled flat products (HRC). These duties, impacting major players like Nippon Steel, JFE Steel, and Tokyo Steel, are likely to affect export volumes and profitability. While it would be easy to assume that this is driving down steel production immediately, no clear correlation between these measures and current satellite-observed activity can be definitively established.

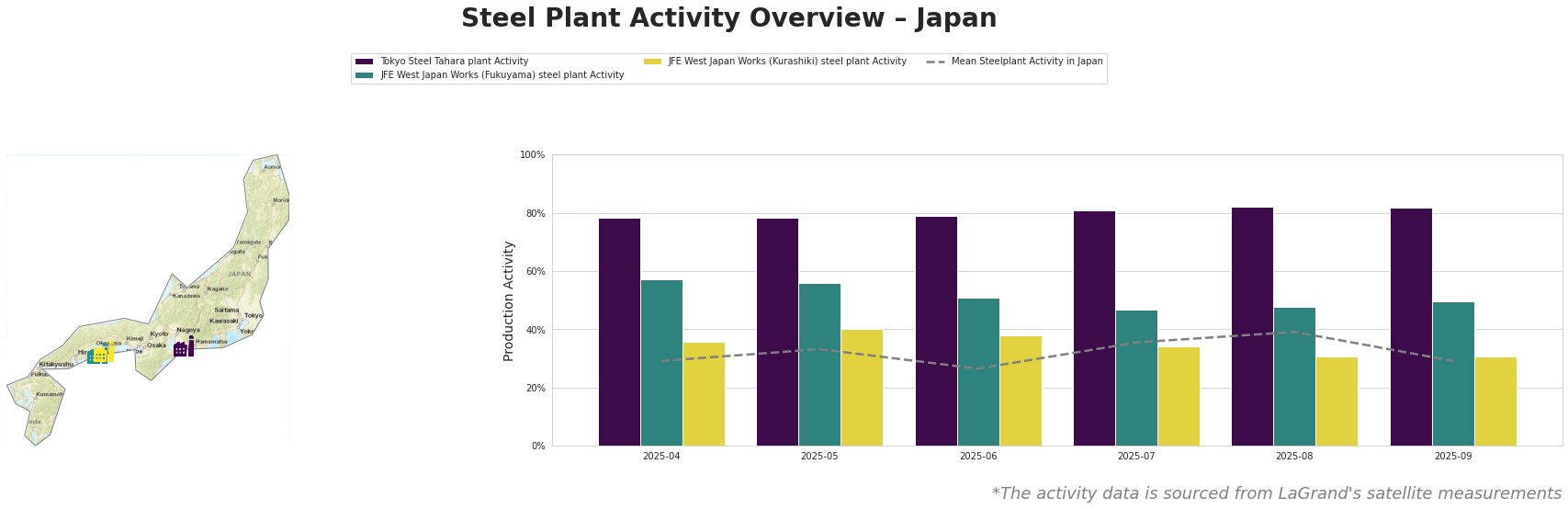

The mean steel plant activity in Japan has fluctuated significantly, from a low of 26.0% in June to a peak of 39.0% in August, before dropping back to 29.0% in September. Tokyo Steel’s Tahara plant consistently shows high activity (78.0% to 82.0%). JFE West Japan Works (Fukuyama) has seen a decrease from 57.0% in April to 47.0% in July, recovering slightly to 50.0% in September. JFE West Japan Works (Kurashiki) has exhibited a declining trend, dropping from 36.0% in April to 31.0% in both August and September.

Tokyo Steel Tahara plant, an EAF-based facility with a 2,500 thousand tonnes per annum (ttpa) crude steel capacity, focuses on semi-finished and finished rolled products like hot rolled coils and steel sheets. Its consistently high activity levels (around 80%), even amidst the fluctuations in the overall Japanese market, suggest stable domestic demand or alternative export markets. There is no established connection between activity observed here and EU anti-dumping duties in the provided material.

JFE West Japan Works (Fukuyama), an integrated BF/BOF plant with a crude steel capacity of 13,000 ttpa, produces a wide range of products including hot-rolled, cold-rolled, and coated sheets, and caters to various sectors like automotive and infrastructure. The observed activity decline from 57.0% in April to 47.0% in July, followed by a slight rebound to 50.0% in September, may indirectly reflect a reduced demand for its HRC products in the EU due to the duties, although no direct link can be established based on the provided information.

JFE West Japan Works (Kurashiki), also an integrated BF/BOF plant with a 10,000 ttpa crude steel capacity, exhibits a consistent decline in activity from 36.0% in April to 31.0% in August and September. Similar to the Fukuyama plant, it produces HRC. The decline in activity could be influenced by reduced EU demand due to the anti-dumping duties, but no causal connection can be directly confirmed with the supplied data.

The EU’s anti-dumping duties on HRC from Japan, as reported in “EU imposes final anti-dumping duties on goods from Japan, Egypt, Vietnam” and “EU imposes definitive anti-dumping duties on HRC from Japan, Egypt, Vietnam”, pose a potential risk to Japanese steel exports. Steel buyers and analysts should expect potential supply disruptions and price increases for HRC originating from Japan.

Recommendation: Diversify sourcing options to mitigate risks associated with Japanese HRC. Actively explore alternative suppliers from regions not subject to EU anti-dumping duties. Closely monitor the impact of these duties on specific Japanese producers like Nippon Steel, JFE Steel, and Tokyo Steel, as their individual responses will affect market dynamics. Negotiate contracts with clauses allowing for price adjustments based on trade policy changes.