From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Exports Surge Amidst Regional Production Shifts – Procurement Strategies

Asia’s steel market shows diverging trends, with increased exports from China and India juxtaposed against varying steel plant activity levels in the Middle East. “China’s semi-finished steel exports up 292% in January-August 2025” directly explains potential supply chain shifts as China significantly increases its semi-finished product exports. The activity level of the observed plants are not directly related to the news articles.

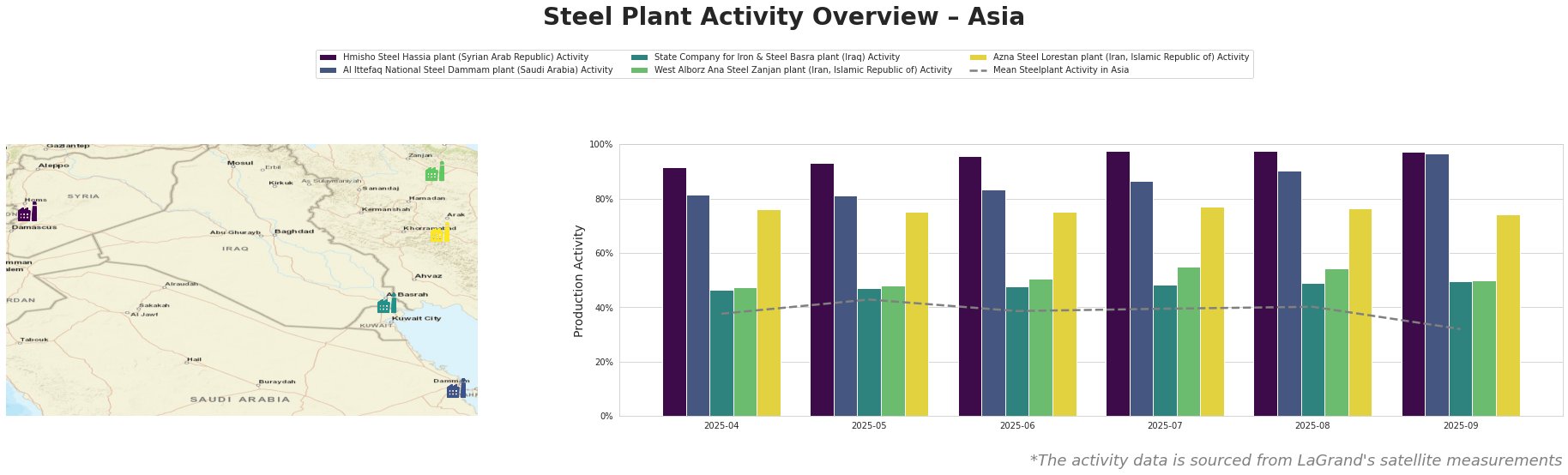

The mean steel plant activity across Asia fluctuated, peaking at 43% in May and subsequently dropping to 32% by September. Hmisho Steel Hassia plant in Syria consistently operated at high activity levels, remaining above 90% throughout the observed period, peaking at 98% in August. Al Ittefaq National Steel Dammam plant in Saudi Arabia also showed high activity, increasing from 82% in April to 97% in September. The State Company for Iron & Steel Basra plant in Iraq showed relatively stable activity, hovering around 47-50%. West Alborz Ana Steel Zanjan plant in Iran exhibited fluctuating activity, peaking at 55% in July before decreasing to 50% in September. Azna Steel Lorestan plant in Iran showed a slight increase followed by a slight decrease, fluctuating between 74% and 77%.

Hmisho Steel Hassia plant, a Syrian integrated steel producer with a BF and EAF, focuses on semi-finished products like billets. Its activity remained consistently high, at 97%, in September, indicating stable production despite regional market fluctuations. No direct correlation can be established between this activity and the provided news articles.

Al Ittefaq National Steel Dammam plant, a Saudi Arabian producer using DRI and EAF for semi-finished billet production, also showed persistently high activity, reaching 97% in September. This suggests a strong regional demand or export strategy. No direct correlation can be established between this activity and the provided news articles.

State Company for Iron & Steel Basra plant, an Iraqi EAF-based billet producer, maintained a steady activity level around 46-50%. This consistent activity, slightly above half capacity, suggests a stable but not rapidly expanding operational tempo. No direct correlation can be established between this activity and the provided news articles.

West Alborz Ana Steel Zanjan plant, an Iranian integrated steel producer with DRI and EAF capabilities focusing on billets, experienced a fluctuation in activity, decreasing to 50% in September after a peak of 55% in July. No direct correlation can be established between this activity and the provided news articles.

Azna Steel Lorestan plant, an Iranian EAF-based producer of sheets and slabs, saw its activity slightly decrease to 74% in September. No direct correlation can be established between this activity and the provided news articles.

The significant increase in Chinese semi-finished steel exports, as indicated in “China’s semi-finished steel exports up 292% in January-August 2025”, creates both opportunities and risks.

Procurement Recommendations:

- For buyers heavily reliant on Asian semi-finished steel: Given the increased Chinese exports, and decrease of coke and coal exports in (“China’s coke exports decrease by 20 percent in January-August 2025“), consider diversifying your supply base to mitigate potential price volatility and supply chain disruptions in China.

- Monitor Japanese scrap export trends: The surge in Japan’s steel scrap exports (“Japan’s Steel Scrap Exports Up 16.2% in January–August 2025“) may indicate increased demand for scrap-based steel production elsewhere, potentially impacting the cost of EAF-based steel. Closely track scrap prices and adjust procurement strategies accordingly.

- Explore opportunities in the Indian market: Given the significant rise of steel exports (“India Raises Steel Exports by 22% in April–August 2025“), evaluate Indian steel producers as alternative suppliers, particularly if facing constraints with traditional suppliers. However, ensure thorough due diligence on quality and delivery reliability.