From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Export Surge Amidst Production Shifts

In Asia, the steel market is experiencing a complex interplay of increased Chinese exports and fluctuating regional production. According to “China’s semi-finished steel exports up 292% in January-August 2025,” Chinese semi-finished steel exports have surged, driven by weak domestic demand. However, satellite observation data offers limited direct correlation, except in its potential influence on production dynamics at plants like the Kim Chaek Iron and Steel Complex. Simultaneously, the article “Japan’s crude steel output down 3.4 percent in August 2025” reports a decrease in Japanese crude steel production, suggesting a regional shift in output, even if that is not visible in satellite observations from other plants.

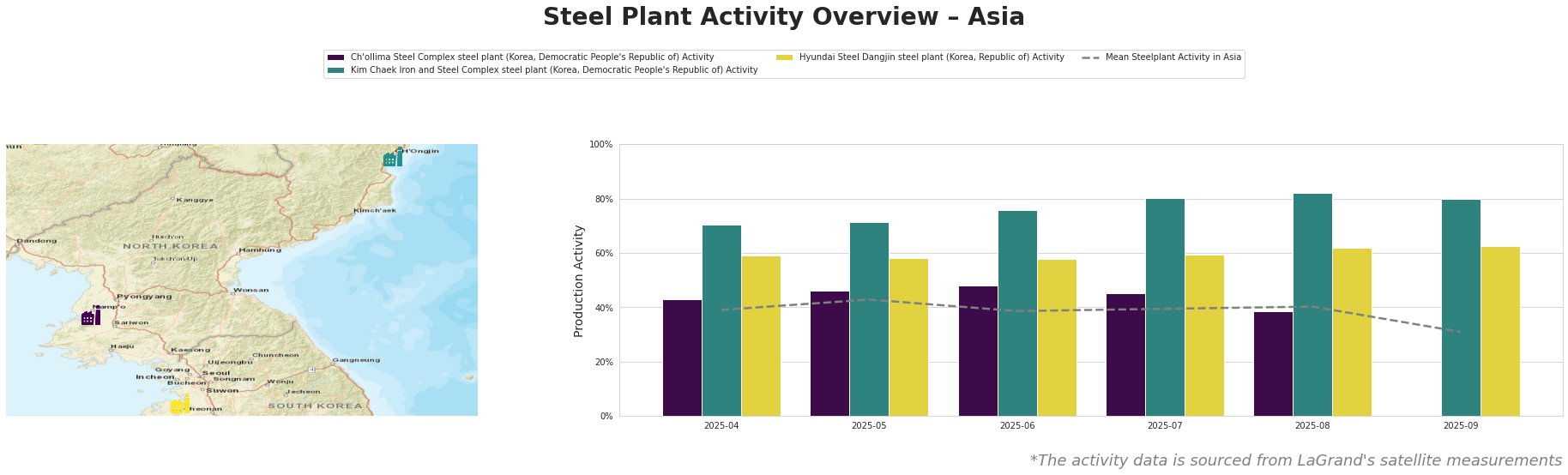

The mean steel plant activity in Asia has fluctuated, showing a notable drop to 31% in September 2025. Activity at the Kim Chaek Iron and Steel Complex steel plant has consistently been significantly higher than the Asian average, peaking at 82% in August before a slight decrease in September. The Hyundai Steel Dangjin steel plant has shown a steady activity level, hovering around 60%, with a peak of 62% in August and September. The Ch’ollima Steel Complex steel plant saw a significant drop in measured activity in August (39%). September data for Ch’ollima is unavailable.

Ch’ollima Steel Complex steel plant: This North Korean plant, with a crude steel capacity of 760 thousand tonnes per annum (ttpa), focuses on semi-finished and finished rolled products like plates and wire rod. The observed activity drop to 39% in August potentially suggests reduced production capacity. Considering the surge in Chinese semi-finished steel exports reported in “China’s semi-finished steel exports up 292% in January-August 2025” this decrease might be related to increased competition from Chinese exports, though no direct link can be definitively established using the available data.

Kim Chaek Iron and Steel Complex steel plant: As an integrated steel plant with a substantial crude steel capacity of 6 million ttpa, Kim Chaek’s activity has been consistently high, significantly exceeding the Asian average. The plant produces a wide range of products, including hot-rolled, cold-rolled, and galvanized steel. The sustained high activity levels do not currently appear to be correlated with any of the provided news articles.

Hyundai Steel Dangjin steel plant: This South Korean plant, possessing both BOF and EAF production routes with a total crude steel capacity of 16.6 million ttpa, has maintained a relatively stable activity level. Its product portfolio includes hot-rolled sheet, cold-rolled sheet, and rebar, targeting the automotive and construction sectors. No direct connection can be established between Hyundai Steel Dangjin’s activity level and the provided news articles.

Based on the news articles and plant activity data, the following market implications can be identified:

- Potential Supply Disruptions: The decrease in Japanese crude steel production, as indicated in “Japan’s crude steel output down 3.4 percent in August 2025,” combined with the observed drop in activity at the Ch’ollima Steel Complex steel plant, may lead to regional supply constraints, particularly in specific product categories that these plants focus on (e.g., plates, wire rod). While production in India as of “India Raises Steel Exports by 22% in April–August 2025” is increasing, it is possible there may be increased pricing pressures due to lower regional output.

- Procurement Actions: Steel buyers should closely monitor the price trends of semi-finished steel products, especially those imported from China, considering the surge in exports reported in “China’s semi-finished steel exports up 292% in January-August 2025“. It’s recommended to diversify the source of steel scrap given that “Japan’s Steel Scrap Exports Up 16.2% in January–August 2025” may create opportunities to tap into the Japanese scrap market as well as create additional pressures on regional sourcing of steel scrap.