From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Update: Chinese Exports Surge Amid Mixed Plant Activity – Insights for Buyers

In Asia’s steel market, recent trends indicate a Neutral sentiment with significant changes observed. Notably, “China’s semi-finished steel exports up 292% in January-August 2025“ highlights a substantial increase in exports driven by weak domestic demand, coinciding with satellite data showing fluctuating activity levels among steel plants. Furthermore, “India Raises Steel Exports by 22% in April–August 2025“ reflects a regional boost in supply, while “China’s coke exports decrease by 20 percent in January-August 2025“ points to potential supply pressures.

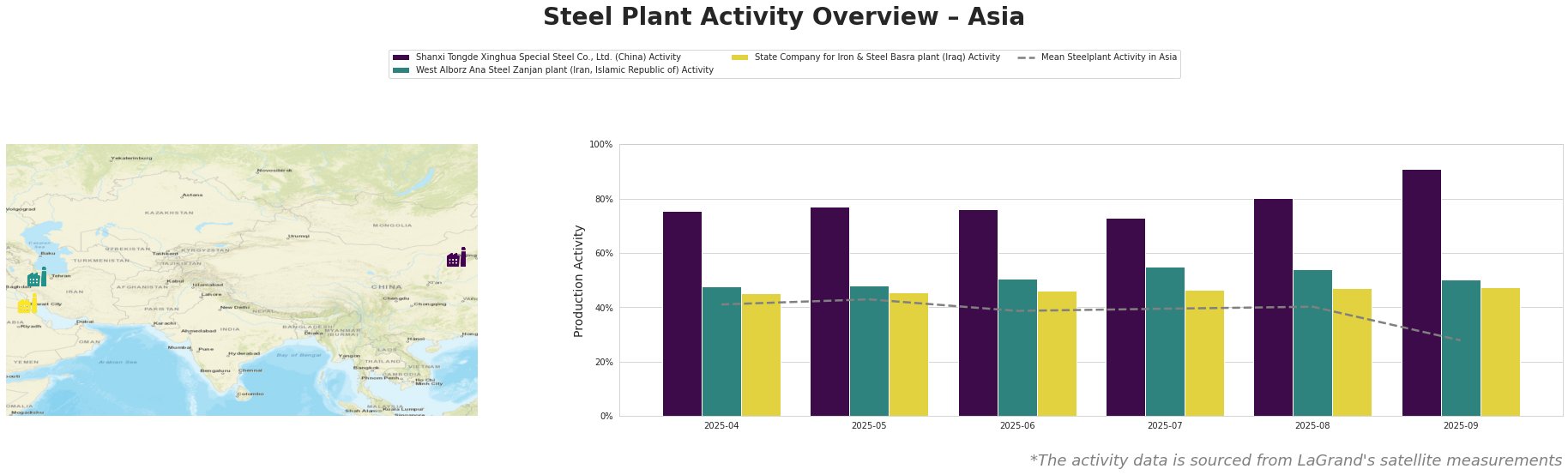

The Shanxi Tongde Xinghua Special Steel Co., Ltd. in China has exhibited the most notable activity spike, rising to 91% in September from 80% in August. This aligns with increased export activities referenced in “China’s semis exports up 12% in August from July, up 292% in Jan-Aug 2025,” indicating that the plant has likely redirected its output to export markets due to reduced domestic demand.

Conversely, the West Alborz Ana Steel Zanjan plant reported stable activity, fluctuating from 51% in June to 50% in September, relatively unaffected by external news developments. The Basra plant shows marginal stability but is significantly lower than on average at 48% as of September, indicating consistent but low production levels.

In light of these dynamics, procurement professionals should consider the following actionable insights:

-

Chinese Semi-Finished Steel: With the notable increase in China’s semi-finished steel exports and the strategic redirection observed at Shanxi Tongde, buyers should prioritize sourcing semi-finished products to leverage favorable pricing before potential declines in export capacity are realized due to weakening demand.

-

Monitoring Export Trends: Given India’s rising exports, as stated in “India Raises Steel Exports by 22% in April–August 2025,” buyers should diversify sources by engaging with suppliers from India, reducing dependency on potentially volatile Chinese exports.

-

Coke Supply Considerations: The declining coke exports, highlighted in “China’s coke exports decrease by 20 percent,” may foreshadow increasing raw material costs, prompting immediate procurement actions for those relying on coke in steel production.

By aligning purchase strategies with the observed activity levels and recent market shifts, steel buyers can better safeguard against supply disruptions and capitalize on favorable pricing trends within this complex market landscape.