From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Surge: New Investments and High Plant Activity Signal Bullish Outlook

Italy’s steel sector is experiencing a surge in activity, driven by significant investments in new facilities and ESG initiatives. This positive trend is highlighted by “Italy’s Feralpi invested €223 million in key projects in 2024” and the finalization of “Metinvest, Danieli complete €3bn flats mill JV closing,” which point towards increased production capacity and a focus on low-carbon steel. Satellite data reveals correlated increases in plant activity for select producers.

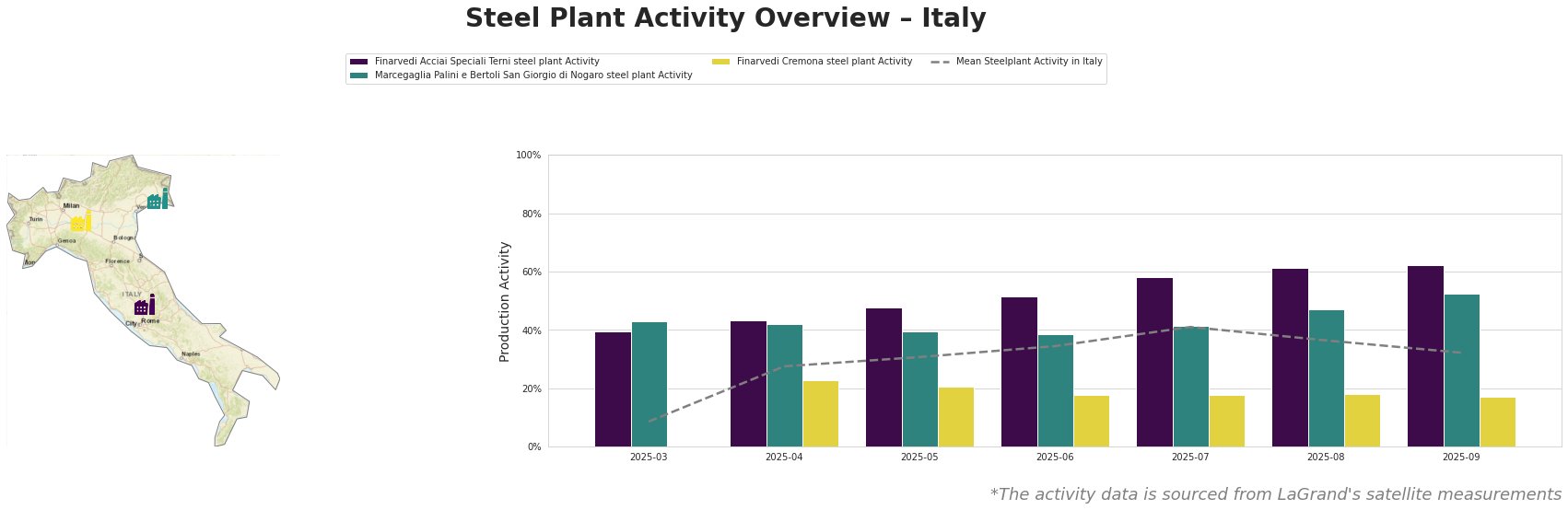

The mean steel plant activity in Italy showed a steady increase from March (9%) to July (41%) before decreasing to 32% in September. Finarvedi Acciai Speciali Terni steel plant consistently operated above the mean, reaching a peak of 62% in September, indicating robust production of its hot-rolled, cold-rolled, and stainless steel products. Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant activity also exceeded the mean, peaking at 53% in September. Finarvedi Cremona steel plant activity consistently remained below the mean with a maximum of 23% in April, and 17% in September.

The Finarvedi Acciai Speciali Terni steel plant, located in the Province of Terni, boasts a crude steel capacity of 1450 thousand tonnes per annum (ttpa) using electric arc furnace (EAF) technology. Satellite data shows a continuous increase in activity, peaking at 62% in September. While there is no direct news linking this increase to specific events, the steady rise could reflect the general positive sentiment and increased demand.

Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant, situated in the Province of Udine, has a crude steel capacity of 600 ttpa, relying on EAF technology for its semi-finished hot rolled plate production. The plant’s activity, reaching 53% in September, outpaces the Italian average, but there is no direct news correlation to explain this performance.

Finarvedi Cremona steel plant, located in the Province of Cremona, features a larger crude steel capacity of 3850 ttpa, using EAF technology. In contrast to the other two plants, its activity consistently lags behind the mean. There is no explicit news connecting this lower-than-average activity.

The finalization of the Metinvest-Danieli joint venture, detailed in “Metinvest, Danieli complete €3bn flats mill JV closing” and “Metinvest and Danieli are completing the closure of a joint venture for the production of rolled products worth €3 billion,” underscores a long-term positive outlook. However, as this project is still under construction and commissioning, it does not directly impact current plant activity data. “Italy’s Feralpi invested €223 million in key projects in 2024” confirms the positive investment climate, although specific activity impacts are not yet discernible in the aggregated satellite data.

The Italian steel market presents a positive outlook. The increase in observed plant activity is not uniform across all plants, indicating that buyers should expect regional variations in supply capacity. The investment by Feralpi and the Metinvest-Danieli joint venture will likely increase overall availability of steel products; however, the short-term impact on prices remains uncertain given the investments and general market dynamics.

Recommended Procurement Actions:

* Monitor Terni & San Giorgio di Nogaro Supply: Procurement professionals relying on hot-rolled, cold-rolled, or stainless steel from the Terni region, where Finarvedi Acciai Speciali Terni steel plant is, or hot rolled plate from San Giorgio di Nogaro, where Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant is, should anticipate stable supply from these regions due to high observed plant activity.

* Factor in Future Flat Steel Availability: Given the Metinvest-Danieli JV (“Metinvest, Danieli complete €3bn flats mill JV closing”), buyers sourcing flat steel should proactively engage with Metinvest and Danieli to understand the future availability and pricing of low-carbon hot-rolled steel from the Piombino facility, anticipating a potential shift in the supply landscape in the medium term.