From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Navigates Production Declines Despite Global Growth: Procurement Strategies Emerge

Europe’s steel market presents a mixed landscape, with production declines in key regions juxtaposed against global growth. Germany’s steel sector faces challenges, highlighted by news articles: “Germany reduced steel production by 10.5% y/y in August” and “German crude steel output down 11.9 percent in January-August 2025“. These declines are compounded by falling sales, as noted in “Steel sales in Germany fell by 13% m/m in August – BDS“. In contrast, “Global steel production rose by 0.3% y/y in August,” signaling growth outside of Europe. “Steel production in Ukraine decreased by 6.1% YoY in August” but showed an increase of 11.7% compared to the previous month, illustrating a volatile regional situation. Currently, no direct relationship can be established between the satellite-observed activity data and these news articles.

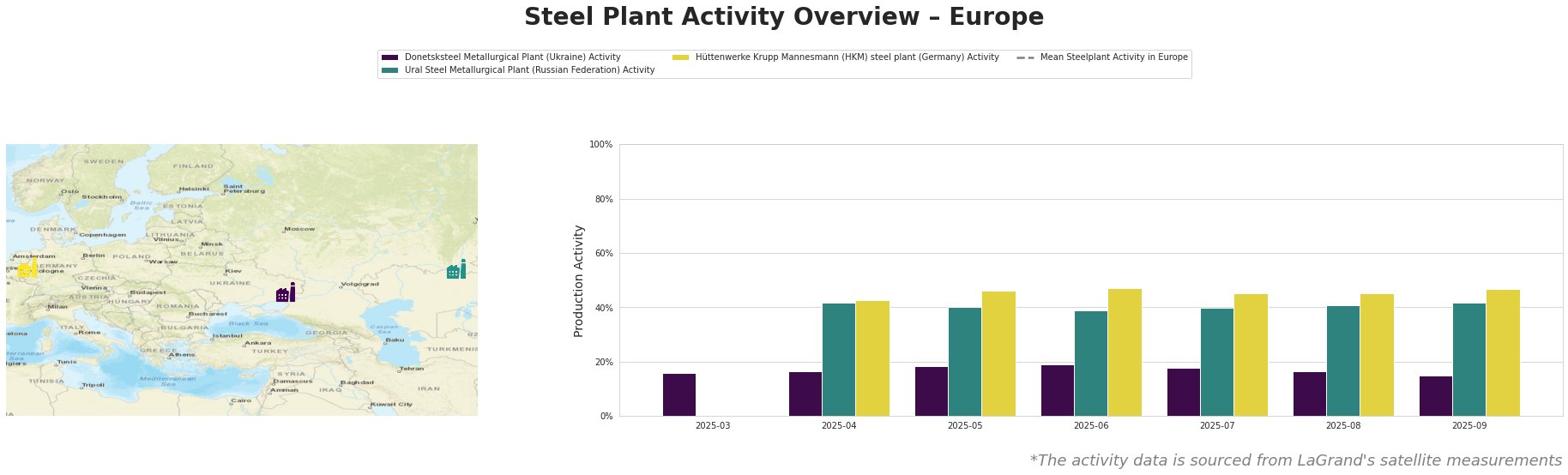

The data shows the mean steel plant activity in Europe experienced significant fluctuations, dropping sharply in April, rising in May, fluctuating until August and then sharply dropping in September. Donetsksteel Metallurgical Plant’s activity shows a slight increase from March to June, peaking at 19.0, before declining to 15.0 by September. Ural Steel Metallurgical Plant demonstrates relatively stable activity, fluctuating between 39.0 and 42.0 from April to September. Hüttenwerke Krupp Mannesmann (HKM) steel plant shows a similar stable trend, with activity ranging from 43.0 to 47.0 during the same period, peaking in June and September. The observed activity levels for Ural Steel and HKM are consistently above the average, while Donetsksteel remains significantly below the average. No direct connection between the satellite-observed activity data and the named news articles can be established.

Donetsksteel Metallurgical Plant, located in the Donetsk region of Ukraine, primarily produces pig iron using integrated BF-EAF processes. Satellite data indicates its activity peaked at 19.0 in June but decreased to 15.0 by September. This decline does not directly correlate with the overall “Steel production in Ukraine decreased by 6.1% YoY in August”, however, the general trend is negative.

Ural Steel Metallurgical Plant, situated in the Orenburg region of Russia, utilizes integrated BF-EAF processes to produce crude, semi-finished, and finished rolled steel products. The plant’s activity has remained relatively stable, fluctuating between 39.0 and 42.0 from April to September. No direct connection between this stable activity and the provided news articles can be established.

Hüttenwerke Krupp Mannesmann (HKM) steel plant, located in North Rhine-Westphalia, Germany, relies on integrated BF-BOF processes, and produces crude, semi-finished, and finished rolled steel. HKM’s activity has been relatively stable, ranging from 43.0 to 47.0 between April and September. Despite reports of declining German steel production in “Germany reduced steel production by 10.5% y/y in August”, HKM’s observed activity remains stable and high. No direct connection between HKM’s activity and the reported German steel output decrease can be established based on this data alone.

Based on the news articles highlighting declining German steel production and sales (“Germany reduced steel production by 10.5% y/y in August”, “German crude steel output down 11.9 percent in January-August 2025”, and “Steel sales in Germany fell by 13% m/m in August – BDS”), potential supply disruptions are indicated within the German steel market.

Recommended Procurement Actions:

- Diversify Sourcing: Given the declining steel production and sales in Germany, as a mitigation strategy, steel buyers should proactively diversify their supply chains beyond Germany. Consider sourcing from regions where production is stable or increasing, such as India, as highlighted in the “Global steel production rose by 0.3% y/y in August” news article.

- Monitor Ukrainian Production Closely: While overall Ukrainian steel production decreased by 6.1% YoY in August as shown in the news article “Steel production in Ukraine decreased by 6.1% YoY in August,” monitor this region closely. If procurement from this source, it is important to closely follow the monthly fluctuations in case of disruptions.