From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Exports Surge: Plant Activity and Market Implications for Buyers

China’s steel market is experiencing a surge in exports, particularly in rebar and semi-finished steel, presenting both opportunities and challenges for buyers. According to “China’s Steel rebar Exports Surge in January–August 2025” and “China’s semi-finished steel exports up 292% in January-August 2025“, exports of rebar and semi-finished products have seen significant year-on-year increases. Direct connections between this export surge and satellite-observed changes in plant activity levels can only partially be established.

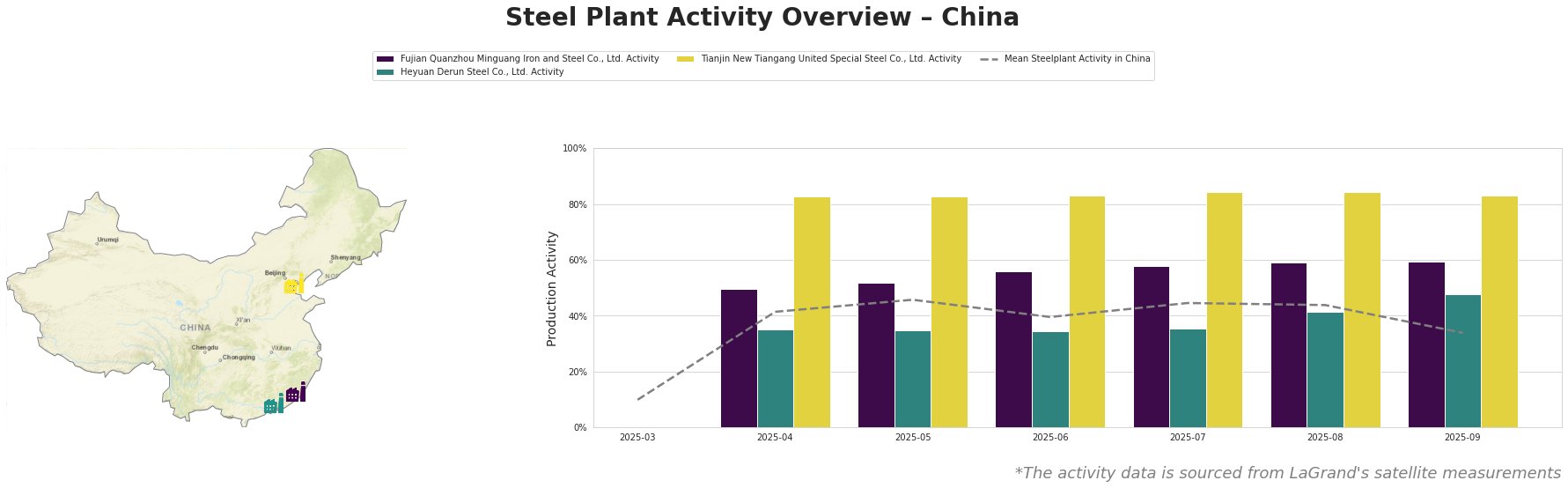

The mean steel plant activity in China shows volatility, dropping to 34% in September after reaching 46% in May. Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF-BOF producer of finished rolled products like rebar and wire rod, has consistently operated above the national average. Its activity steadily increased from 50% in April to 60% in September. While “China’s Steel rebar Exports Surge in January–August 2025” confirms rising rebar exports, a direct causal link between the rising activity at Fujian Quanzhou Minguang and the export data cannot be conclusively established based on the provided information.

Heyuan Derun Steel Co., Ltd., an EAF-based producer of hot rolled rebar and billet, has maintained relatively stable activity levels between 34% and 48% from April to September. Although the company produces rebar, a direct link to the increase reported in “China’s Steel rebar Exports Surge in January–August 2025” is not apparent from the available data.

Tianjin New Tiangang United Special Steel Co., Ltd., a major integrated BF-BOF producer of angle steel and billets, has operated at consistently high activity levels, fluctuating narrowly between 83% and 84% from April to September. While the company produces semi-finished products (billets), no direct relationship between these elevated production levels and the reported surge in semi-finished exports documented in “China’s semi-finished steel exports up 292% in January-August 2025” can be explicitly confirmed based on the provided data.

Evaluated Market Implications:

Given the increased export activity reported in “China’s Steel rebar Exports Surge in January–August 2025” and “China’s semi-finished steel exports up 292% in January-August 2025”, and the consistently high activity level at Tianjin New Tiangang United Special Steel Co., Ltd., buyers should anticipate potential supply tightening and price increases, particularly for angle steel. Procurement professionals are recommended to:

- Secure Long-Term Contracts: Prioritize securing long-term contracts for angle steel, especially given Tianjin New Tiangang’s sustained high production.

- Diversify Suppliers: Explore alternative suppliers for rebar and wire rod outside of China to mitigate potential price increases due to increased Chinese export demand. Although Fujian Quanzhou Minguang Iron and Steel Co., Ltd.’s activity is increasing, relying solely on this source may introduce supply chain vulnerabilities.

- Monitor Semi-Finished Steel Prices: Closely monitor global prices for semi-finished steel, as the significant export increase reported in “China’s semi-finished steel exports up 292% in January-August 2025” may lead to shortages and price volatility in downstream markets.