From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel: EU Trade Actions Loom as Production Dips Signal Supply Concerns

In Asia, the steel market faces increased uncertainty due to potential trade disruptions and production adjustments. The observed shift in activity levels, though not directly linked, occurs in the context of the EU’s increasing trade defenses, as evidenced by news articles like “EU launches AD probe on cold-rolled steel imports from five countries” and “EU launches anti-dumping investigation into cold-rolled steel from five countries,” which cite concerns regarding imports from countries including India, Japan, Taiwan and Vietnam.

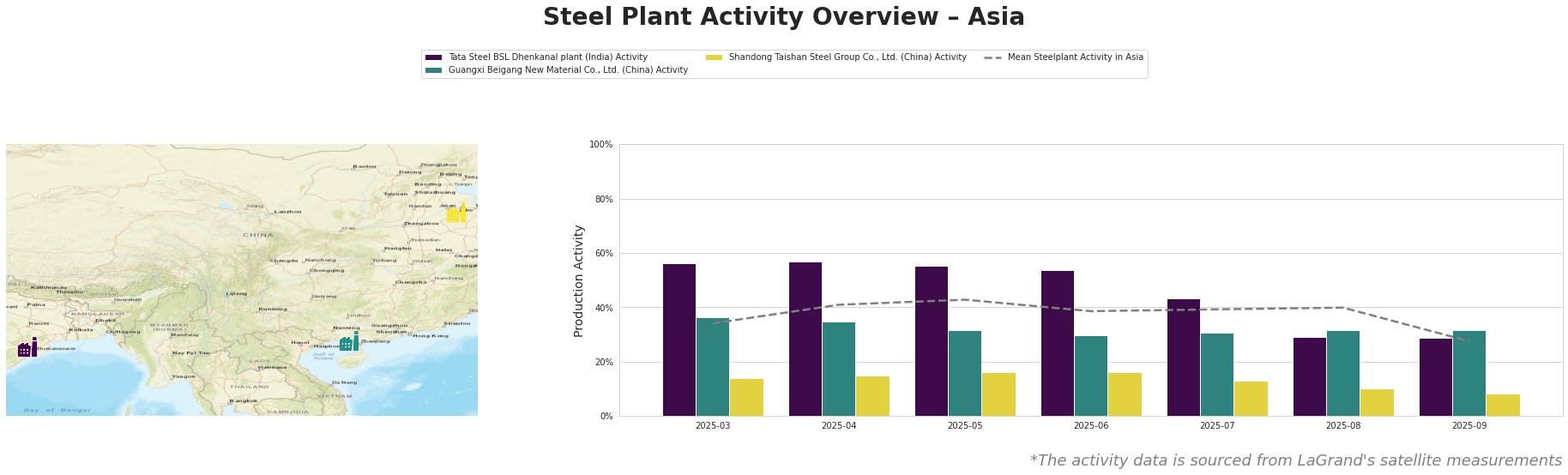

Measured Activity Overview

The mean steel plant activity in Asia showed a consistent level between March and August, ranging from 34% to 43%. September, however, saw a significant drop to 28%. Tata Steel BSL Dhenkanal plant (India) demonstrated the most substantial decline, dropping from 57% in April to 29% in both August and September. Guangxi Beigang New Material Co., Ltd. (China) showed relatively stable activity, fluctuating between 30% and 36%. Shandong Taishan Steel Group Co., Ltd. (China) consistently showed the lowest activity levels among the three plants, decreasing gradually from 14% in March to 8% in September.

Steel Plant Information

Tata Steel BSL Dhenkanal plant, located in Odisha, India, is an integrated steel plant with a crude steel capacity of 5.6 million tonnes per annum (MTPA), primarily utilizing BF and DRI processes. The plant produces semi-finished and finished rolled products including hot rolled coil and cold rolled products. The plant’s activity experienced a sharp decline from 57% in April to 29% in August and September. While the news articles “EU launches AD probe on cold-rolled steel imports from five countries” and “EU launches anti-dumping investigation into cold-rolled steel from five countries,” mention anti-dumping investigations into imports from countries including India, there’s no direct established link between these EU trade actions and the production decline at the Dhenkanal plant.

Guangxi Beigang New Material Co., Ltd., situated in Guangxi, China, has a crude steel capacity of 3.4 MTPA and uses an integrated BF process along with EAF technology. The plant’s primary products are finished rolled products like hot rolled coil and cold rolled coil, as well as specialized nickel-chromium alloy slabs. Activity levels for this plant remained relatively stable between 30% and 36% throughout the observed period. There is no direct connection that can be established with the news articles.

Shandong Taishan Steel Group Co., Ltd., located in Shandong, China, possesses a crude steel capacity of 5 MTPA and relies on integrated BF processes. Its product portfolio includes hot rolled coil, cold rolled coil, and stainless steel. The plant’s activity levels were consistently low, decreasing gradually from 14% in March to 8% in September, relative to the other plants and Asian mean. There is no direct connection that can be established with the news articles.

Evaluated Market Implications

The EU’s anti-dumping investigations against several Asian countries, including India, as reported in “EU launches AD probe on cold-rolled steel imports from five countries” and “EU launches anti-dumping investigation into cold-rolled steel from five countries“, could lead to supply disruptions in the European market. While a definitive causal link between these investigations and observed production declines at plants like Tata Steel BSL Dhenkanal cannot be directly established from the given information, the timing raises concerns.

Recommended Procurement Actions:

- For steel buyers in Europe: Given the EU’s anti-dumping investigations, immediately diversify your cold-rolled coil supply base to include regions not targeted by the investigations. Prioritize suppliers with established track records and transparent pricing.

- For steel buyers globally: Monitor the EU’s anti-dumping case developments closely, particularly timelines for provisional duties. Assess potential ripple effects on global steel trade flows and adjust sourcing strategies accordingly to mitigate price volatility.

- For market analysts: Track production data and export volumes from the affected Asian countries (India, Japan, Taiwan, Turkey, and Vietnam) to identify shifts in trade patterns as the EU investigations progress. Focus on how these countries redirect their exports to other regions.