From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Shows Mixed Signals: Rebar Exports Surge Amidst Price Declines

China’s steel market presents a complex picture. Despite a surge in rebar exports, domestic prices have declined and overall crude steel output fell in August. According to “China’s rebar output up 0.3 percent in January-August 2025,” rebar production saw a slight increase in the first eight months of the year, but “NBS: Local Chinese rebar prices down 1.3 percent in early September 2025” indicates a recent price decrease. While these news articles suggest increased production alongside price softening, a direct relationship to observed steel plant activity levels cannot be definitively established from the provided data.

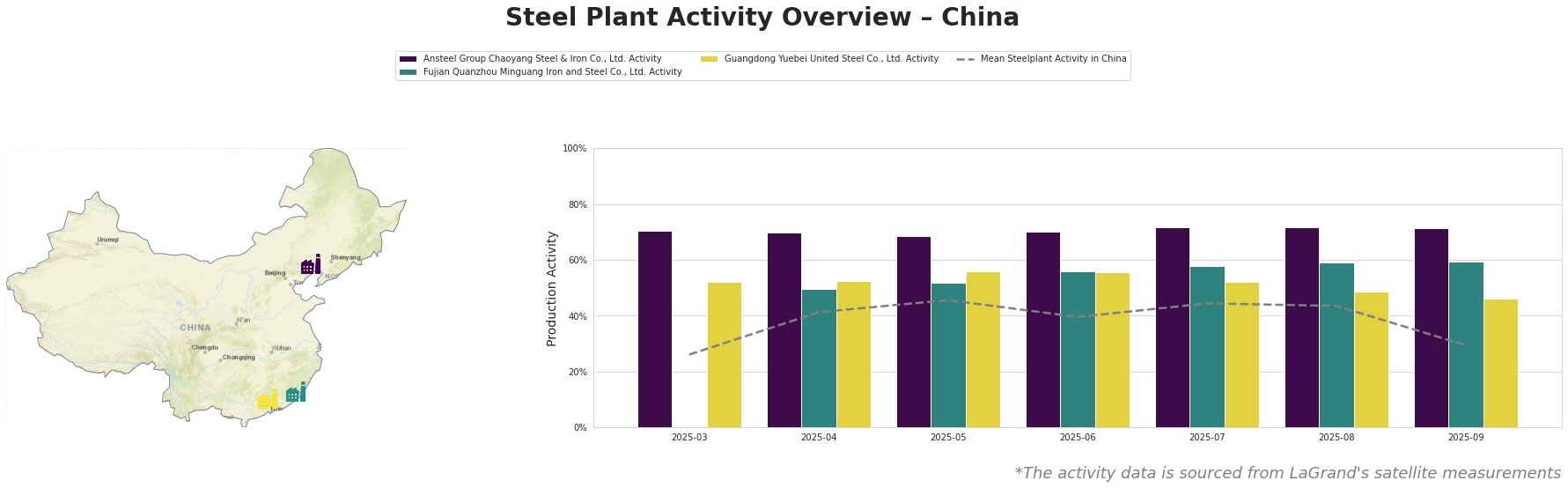

Observed mean steel plant activity in China peaked in May at 46% and then declined sharply to 29% in September.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., located in Liaoning province, is an integrated steel plant with a crude steel capacity of 2.1 million tonnes, primarily utilizing basic oxygen furnace (BOF) technology. Notably, its activity level has remained consistently high, fluctuating narrowly between 69% and 72% from March to September, significantly above the national mean. There is no clear connection between Ansteel’s high activity and the news articles available.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., another integrated steel plant with a 2.55 million tonne capacity, has shown a steady increase in activity levels from 50% in April to 60% in September. Like Ansteel, its activity remains above the national average. Despite producing rebar and wire rod, no direct relationship can be established between its activity and the article “China’s rebar output up 0.3 percent in January-August 2025” or “China’s Steel rebar Exports Surge in January–August 2025.”

Guangdong Yuebei United Steel Co., Ltd., an integrated plant that produces Rebar, started with high levels in March of 52%, peaked in May/June at 56% and showed a decline to 46% in September. It is unclear whether this reduction in observed activity has implications for “China’s rebar output up 0.3 percent in January-August 2025” or the rebar price decrease mentioned in the article “NBS: Local Chinese rebar prices down 1.3 percent in early September 2025”.

The article “China’s crude steel output fell below 80 million mt again in August” and the sharp decline in the overall mean activity level across monitored steel plants in China, from 44% in July/August to 29% in September, indicates potential supply side disruptions. In conjunction with the article “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025“, steel buyers should anticipate potential volatility in sheet and plate availability. It is advisable to monitor inventory levels closely and consider diversifying suppliers, especially if relying heavily on sheet/plate products. Given “China’s iron ore output down 4.2 percent in January-August 2025“, this output dip could also exacerbate production challenges.