From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Downturn: German Production Plummets, Italian Rebar Prices Fall

European steel faces headwinds as German output declines sharply, while Italian rebar prices weaken despite a slight production increase. “Germany reduced steel production by 10.5% y/y in August” and “Italy reduced steel production to an annual low in August,” signalling potential demand weakness. While “Italian crude steel production up 7.3 percent in August 2025,” this was significantly lower than the previous month, and “Rebar prices continue to fall in Italy amid lack of support,” further indicating a negative market sentiment. No direct link between these news items and specific plant activity shifts can be explicitly established based on the provided information alone.

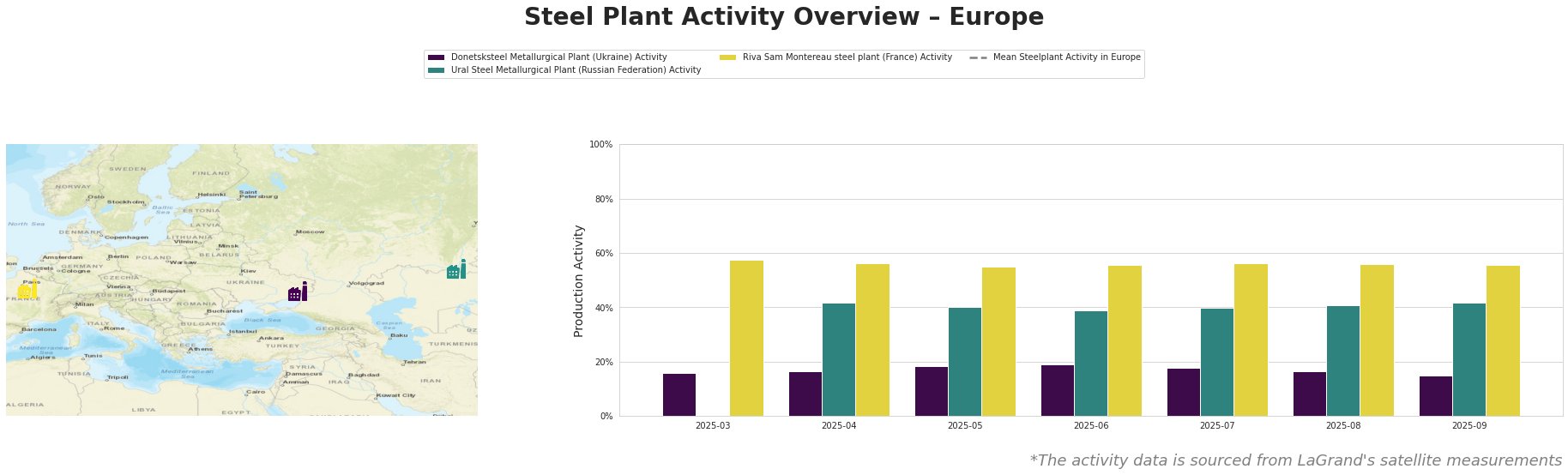

The mean steel plant activity in Europe shows volatility, decreasing significantly in April, increasing again until July, remaining stable for a month, and declining sharply in September. The Donetsksteel Metallurgical Plant shows slight fluctuation, peaking at 19% activity in June and dropping to 15% by September. Ural Steel Metallurgical Plant’s activity shows relative stability around the 40% level. The Riva Sam Montereau steel plant consistently operates at approximately 56% activity throughout the observed period. No explicit connection between these plant activities and the previously named news articles can be established based on the provided information.

Donetsksteel Metallurgical Plant, located in Donetsk, Ukraine, primarily produces pig iron using integrated (BF) processes. Its main equipment includes a BF and EAF, with a crude steel capacity of 0 tons, iron capacity of 1500 tons, and Responsible Steel Certification. Activity decreased from 19% in June to 15% in September, but no direct relationship can be established with any of the provided news articles.

Ural Steel Metallurgical Plant, located in the Orenburg region of the Russian Federation, is an integrated plant producing crude, semi-finished, and finished rolled steel, including pig iron and flat products, mainly for the building/infrastructure and transport sectors. It has a crude steel capacity of 1600 tons via EAF, and an iron capacity of 2700 tons via BF. Its activity has been relatively stable around 40%, but no direct connection can be established with any of the provided news articles.

Riva Sam Montereau steel plant, situated in Île-de-France, is an electric arc furnace (EAF) based plant with a crude steel capacity of 720 tons. It produces semi-finished and finished rolled steel products such as billet, coils, wire, mesh, and rebar. Its activity remained stable at around 56% throughout the observed period, and no direct relationship can be established with any of the provided news articles.

Given the “Germany reduced steel production by 10.5% y/y in August” and the continued decline in Italian rebar prices, steel buyers should carefully monitor inventory levels and potentially delay large-volume purchases of rebar in Italy, anticipating further price declines as suggested by the article “Rebar prices continue to fall in Italy amid lack of support.” Furthermore, closely monitor the situation in Germany and Eastern Europe, since further production cuts are likely. Diversification across European steel producers is recommended to mitigate supply risks should the negative production trends continue. The slight production increase in Italy, as noted in “Italian crude steel production up 7.3 percent in August 2025,” is not sufficient to offset the overall negative market sentiment; therefore, a conservative procurement approach is advisable.