From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Production Cuts Deepen Amidst Weak Demand, Export Pressures

China’s steel sector faces increasing headwinds as production cuts deepened in August. News articles such as “China cut steel production to a 9-month low in August” and “China’s crude steel output fell below 80 million mt again in August” highlight declining output due to factors like production limits and weak demand. While the news articles outline the overall production cuts, the satellite data provides granular insights into individual plant activities and their alignment with these reported trends. The news article “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025” underscores the impact of decreasing exports on the sector.

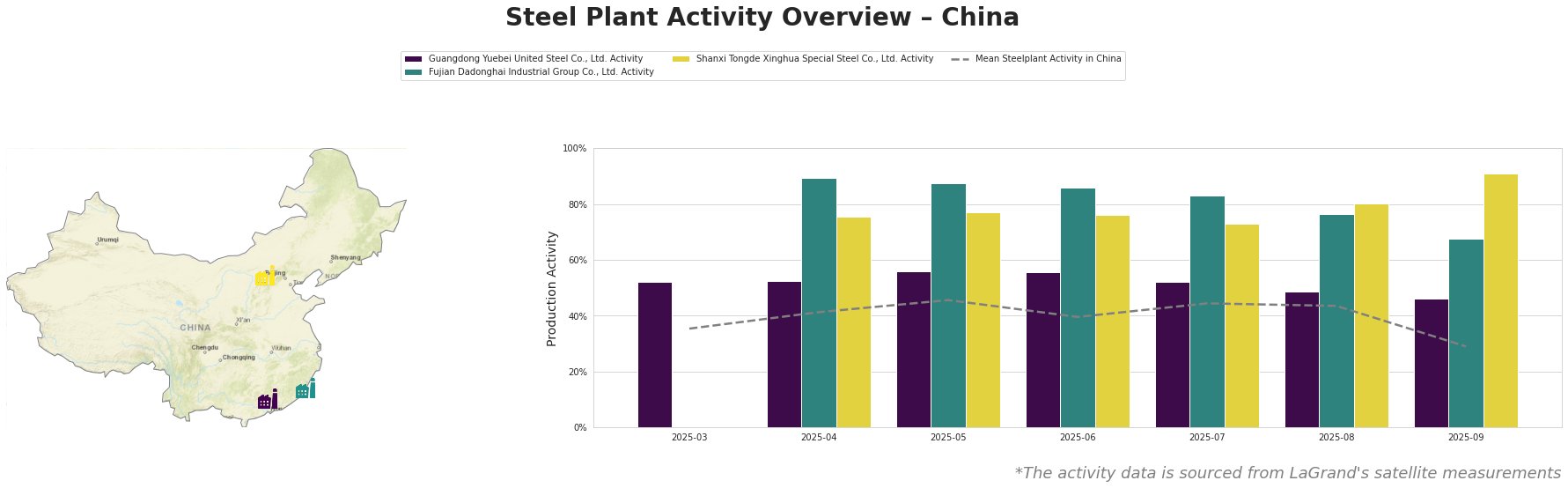

The mean steel plant activity in China peaked in May at 46% and has since declined sharply to 29% by September, indicating a significant downturn.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF steel plant producing rebar for the building and infrastructure sector, experienced a gradual activity decrease from a high of 56% in May and June to 46% in September. This decrease potentially aligns with the broader production cuts reported in “China cut steel production to a 9-month low in August” and the weak demand from the construction sector mentioned in the same article.

Fujian Dadonghai Industrial Group Co., Ltd., another integrated BF steel plant producing rebar, showed a significant drop in activity from 90% in April to 68% in September. This substantial reduction could reflect the declining steel sheet/plate exports reported in “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025,”.

Shanxi Tongde Xinghua Special Steel Co., Ltd., an integrated BF steel plant producing billets and rebar, exhibited a contrasting trend. Its activity increased significantly, reaching 91% in September, up from 73% in July. No direct connection can be established between this plant’s increase and the news articles provided.

The combination of falling production and export reductions presents significant challenges to China’s steel market. The decline in rebar demand is likely linked to the challenges faced in the Chinese Real Estate market. This is reflected by the news articles “China cut steel production to a 9-month low in August” which highlights declining new projects in the construction sector (down 19.5%).

Evaluated Market Implications:

- Potential Supply Disruptions: Based on the observed activity declines at Guangdong Yuebei United Steel and Fujian Dadonghai Industrial Group, buyers sourcing rebar from these specific plants or the Guangdong and Fujian regions should anticipate potential supply chain disruptions.

- Recommended Procurement Actions: Given the news and satellite data, steel buyers should:

- Diversify Suppliers: Actively explore and qualify alternative rebar suppliers, especially those outside of the Guangdong and Fujian regions, to mitigate risks associated with localized production cuts.

- Renegotiate Contracts: Review and renegotiate existing contracts to include clauses that address potential supply disruptions and price volatility, specifically referencing the factors outlined in “China cut steel production to a 9-month low in August.”

- Increase Stock Levels: For critical rebar requirements, consider increasing inventory levels to buffer against potential supply shortages in the short term.

- Monitor Shanxi Tongde Xinghua Special Steel Co., Ltd.: Closely monitor the output and pricing of Shanxi Tongde Xinghua Special Steel Co., Ltd. as their activity increases, potentially making them an alternate source for rebar and billets.

- Closely track export figures: The article titled “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025” notes a sharp decrease in exports in August, but notes almost stable year-to-date numbers. As such analysts and buyers should closely track this to determine future activity, procurement and pricing startegies.